Disclaimer: This article is using the Duke and Duchess of Sussex as an illustration of a widely experienced situation. We are not suggesting that Prince Harry and Meghan Markle use our service; it would be up to them to decide whether the Expat Will service at LegalWills.ca is a good fit for them. We have certainly seen people with wealth, surrounded by a legal team, write their own Will, or even die without a Will. But each individual would need to decide the best approach for themselves. We refer to them as “Harry and Meghan” in the article, but it could be anybody.

Disclaimer 2: This article is not legal advice. It is presented as general information which may or may not apply to your own personal situation.

You have probably heard by now, the Duke and Duchess of Sussex are moving from the UK to Canada. There is a chance that they may buy property in Canada. Prince Harry is a UK citizen. Meghan Markle is an American citizen. Their son, Archie, is probably dual citizen UK and US, now being raised in Canada.

What does this all mean for their estate planning?

Do they need a Will?

The answer of course is yes, every adult needs a Last Will and Testament. They are married, and they have a son.

Prince Harry turns 36 in September. His mother, Princess Diana, died when she was 36. Diana had a Will, and the distribution of her estate was well documented.

Most people think of a Will as describing the distribution of your possessions. This is indeed a key part of the document, but there are at least two other critical elements. The Will allows you to name an Executor; the person who will take responsibility for gathering your assets, securing them, and then distributing them to the beneficiaries. The Executor submits your Will to the probate courts where it is accepted as your official Last Will and Testament.

In addition, your Will allows you to name a guardian for any young children (and also to set up a trust for a minor beneficiary). If anything were to happen to both Harry and Meghan, who would be responsible for raising Archie? Would it be William and Kate? Meghan’s mother? A family friend? Harry and Meghan should make that decision and document it in their Will.

An International Will?

It is quite difficult to prepare a well drafted Will that complies with the laws of all countries. You cannot, for example, write a Will in China and submit it to a probate court in Ontario.

So what should you do if you are a citizen of one country, have assets in another country, reside in a third country, and your beneficiaries are in a fourth country? This is now Meghan’s predicament.

It turns out that your citizenship and the location of your beneficiaries is not particularly relevant.

We generally recommend that you prepare a Will for each country in which you hold assets. So at a minimum, Meghan and Harry will be needing a Will written under the laws of British Columbia (if they buy a house on Vancouver Island) and one written under the laws of the UK (assuming that they continue to own property there). If Meghan also owns property in the US, then she should prepare a third Will under the State laws of that property.

Multiple Wills

However, there are a couple of challenges with preparing multiple Wills. Firstly, any standard Will starts with the clause

“I HEREBY REVOKE all former wills, codicils and other testamentary dispositions made by me.”

This means that if you prepare your UK Will, and then a week later sign your Canadian Will, you will be revoking your UK Will. This was not your intention.

If you choose to prepare your Will with a lawyer or solicitor, they will be licensed to practice in a specific jurisdiction. This means that a Canadian lawyer cannot prepare a UK Will for you.

If you walk into a lawyer’s office in Victoria, BC and tell them that you also have a property in Florida, they will likely Google lawyers in Miami and refer you to them. The cost for getting these Wills written is going to be about $5,000.

You would also have to travel to each country in which you have property, to meet with a lawyer and prepare the Will. Of course if you needed to update the Will, for example if Harry and Meghan had a second child, they would have to go globetrotting again to update all of their Wills.

This might not be a huge issue for Harry and Meghan, but it can be a real pain for the rest of us.

Online Will writing services

Fortunately, there is actually one online Will writing service that can accommodate the needs of Harry and Meghan – LegalWills. We are actually the only online Will writing service in the World that can do this because of a few unique features.

Our services are offered through LegalWills.ca (for Canada), LegalWills.co.uk (for the UK) and USLegalWills.com (for the US).

This means that by using an online Will writing service, you can prepare a Canadian Will while sitting in Thailand, Dubai, or anywhere else in the world.

However, this isn’t what makes us unique (there is one other service provider that offers a service across these three countries).

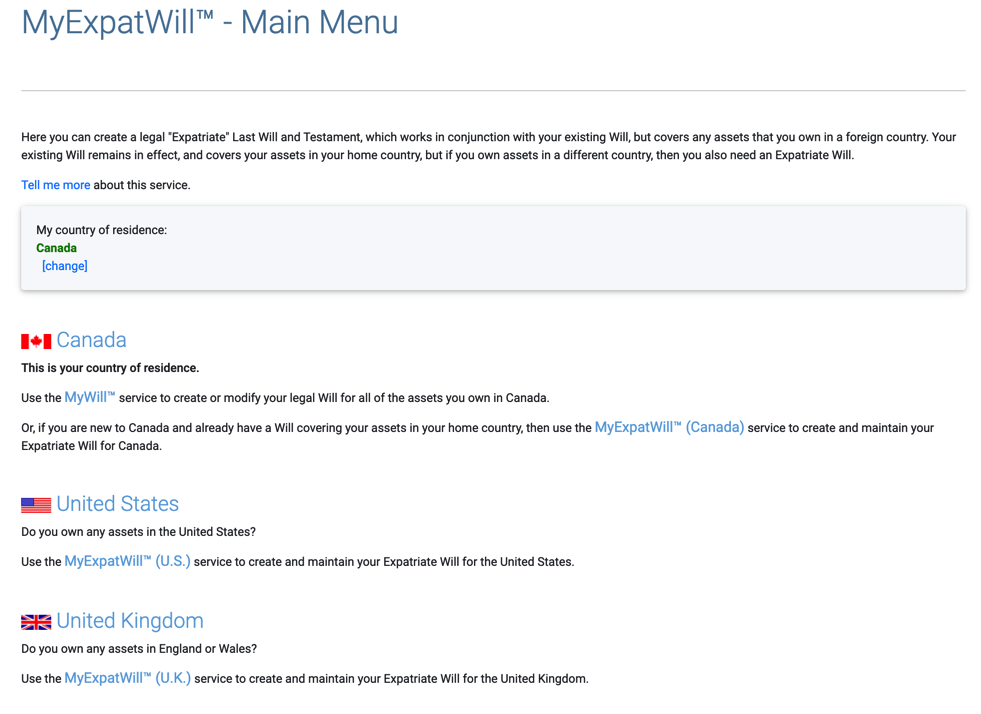

The Expat Will service

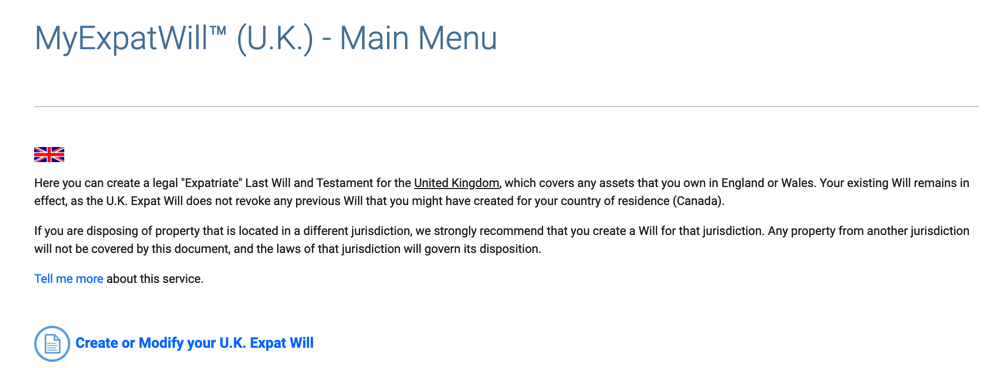

LegalWills is the only service provider to offer an Expat Will service. This is a document that is written to cover assets in another country to work alongside any Will you have written for any other country.

Let us take Meghan as an example. Imagine that in a few years she has settled in Canada. Let us assume that she now regards Canada as her permanent home, but she still has a home in the UK, and assets in the US.

She can log on to www.legalwills.ca and prepare her Will using our standard MyWill service. This will give her a Last Will and Testament, written under BC law, which will appoint an Executor, name a guardian for Archie, and describe the distribution of her estate. Of course, in BC, if she didn’t have a Will, Harry would receive the first $300,000 of her estate, and the rest would be divided between Harry and the children. Contrary to popular belief, Harry would not simply receive her entire estate. She definitely needs to write a Will.

Then Meghan can prepare a UK Will using the MyExpatWill service for the UK. This will state that it deals exclusively with her UK assets and works alongside her Canadian Will.

If she also has assets in the US, she can use the MyExpatWill service for the US, to prepare a third Will to cover these assets; all from her comfortable home in Victoria. The process would take about an hour to complete all three documents, and would cost 3 x $39.95, or about $120.

What about a Power of Attorney?

A financial Power of Attorney allows you to name somebody to take care of your finances. It is usually set up ahead of time to come into effect if you were ever to lose capacity. This means that if you were ever hospitalized, in a coma, or somehow lost capacity to handle your own financial affairs, your representative could step in and do this for you.

In Meghan’s case, she would need a Power of Attorney written under the laws of each jurisdiction that she would want her representative (or “Agent”) to work in. This means that if her Agent would want to access her bank account held at the Royal Bank in Victoria, the Agent would need to present a financial Power of Attorney that complies with the laws of BC.

Likewise, if they were working with LLoyds Bank in London, the representative would need to use a “Lasting Power of Attorney (LPA) for property and financial affairs” written under UK law. Of course, a bank in the US would need a Financial Power of Attorney written under State laws there.

The US and Canadian Power of Attorney can be created at LegalWills.ca using the MyPowerOfAttorney service. In the UK, the LPA needs to be prepared using the government’s own tool. The UK requires the document to be registered with the government before it comes into effect.

The Living Will

The Living Will is typically made up of two documents; an appointment of a Healthcare Proxy (or Decision Maker) and an expression of your end-of-life care through an “Advance Directive”. A Living Will varies quite significantly from country to country and even between States and Provinces.

For a Living Will to be recognized by the attending medical team, it must comply with local laws. So, in this case, Meghan and Harry should at least have a Representation Agreement written under the laws of British Columbia. This could be created at LegalWills.ca through our “Living Will” service.

They may also want to consider preparing a Lasting Power of Attorney for health and welfare in the UK. This could be created directly on the government’s website.

Funeral wishes and other documents

LegalWills.ca sets itself apart from other online services by the number of additional tools that we offer.

For example, you are able to document in detail the kind of funeral service that you would like. This can be critical in order to relieve the decision making burden from your grieving loved ones. Funeral homes have been known to pressure loved ones into buying unnecessarily lavish caskets and accessories, with money from the estate that could have gone to family members. You can express your funeral wishes using our MyFuneral service.

After you have passed away, your Executor is required to gather your assets before distributing them to your beneficiaries. How does the Executor know the extent of your assets? How will they know that they have found everything?

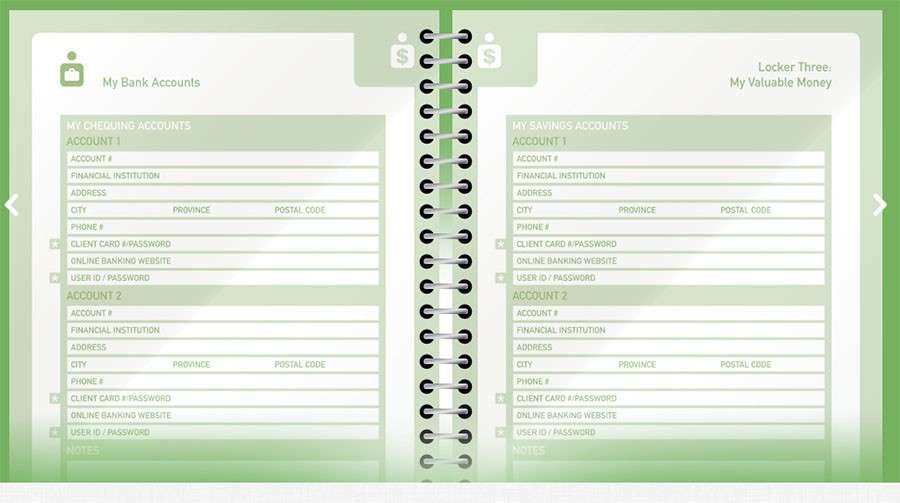

We provide a service called MyLifeLocker that works as an Executor handbook. Immediately, your Executor will be able to deal with your utility companies, cancel subscriptions, handle your online accounts and know exactly where your assets are.

We also provide a service to upload important documents that can then be passed on to loved ones through a Digital Vault. This can be used to securely share a spreadsheet, unpublished novel, recipe book, audio files, or any other important file for your loved ones.

Writing your Expat Will at LegalWills.ca

The whole process for preparing a Will for a different jurisdiction is surprisingly simple at LegalWills.ca.

The first step is to determine which service to use, based on the location of your assets.

You then step through the ten sections, describing the distribution of your assets in that jurisdiction.

At the end of this process, which usually takes about 20 minutes, your Will is compiled, and can then be downloaded as a PDF file.

You then simply sign the document in the presence of two witnesses to create your Will. Your witnesses can be local to you wherever you are.

Maybe Meghan and Harry have different ideas for their estate planning needs. Hopefully they have some excellent cross-border legal advice. If you also have property across different jurisdictions, take a look at the Expat Legal Will service from LegalWills.ca. It might solve some very tricky problems for you.

- Probate in Canada – What it is, what it costs, how to reduce fees. - January 6, 2025

- All about Trusts – how to include a Trust in your Will - June 9, 2022

- The Holographic Will – what is it and when should you use one? - May 18, 2022