At LegalWills.ca we have provided an online option for preparing estate planning documents since 2001. This gives our company a unique insight into industry trends and allows us to explore the triggers for writing a Will. But in the midst of the COVID-19 pandemic, the last 12 months has been a truly unique experience for us.

Will writing is traditionally one of those tasks that you just don’t get around to. The statistics bear this out, with our own survey showing that around two thirds of Canadian adults do not have their Will in place. Most of these people know that it’s important to write a Will, but it’s a task that is put off until next week, next month, or next year.

However, in 2020 and 2021, something very dramatic happened. LegalWills.ca saw an incredible spike in the number of people writing their Will. There was a lot happening around the world, but the obvious conclusion was that the COVID-19 pandemic nudged people to finally get their Will in place.

At LegalWills.ca we felt that the sudden surge in Will writing was fascinating, and we wanted to take a deep dive into the motivation for writing a Will. We are fortunate to have a large pool of customers who we can ask the simple question, “Why did you decide to write your Will?”

Why do people usually write their Will?

Most of us know the importance of writing a Will, but around two thirds of Canadian adults do not have an up-to-date Will in place. There is a sense that writing a Will can wait until some time in the future: after you have a child, get married, buy a house, or accumulate assets.

Traditionally, writing a Will has been such an expensive and inconvenient process that it’s not a task that you would want to undertake on a regular basis – hopefully just once or twice in a lifetime. So your life must “settle down” before you would consider writing a Will. There is also a sentiment expressed of “I don’t need a Will yet, I’ll write one when I’m older”.

Online services, like the one at LegalWills.ca, are trying to change this approach to Will writing by making it affordable and accessible. A Will can be written when the moment strikes you and the document can be updated throughout your life as your circumstances change.

It is an important distinction because we have found that people come to our service because of a trigger. The most common reasons for preparing a Will at LegalWills.ca include:

- I have been working with an estate for somebody who died without a Will, and I don’t want to put my loved ones through what we are going through.

- I have surgery on Monday. I need a Will now.

- I am going on a trip and I thought it would be a good idea to write a Will.

- We just had our first child, so we thought we should prepare a Will.

- I just read an article on the importance of a Will and it convinced me.

There are many triggers for writing a Will. So what happened over the last 12 months?

Our survey

We invited 10,000 people, who used the services at LegalWills.ca in the last 12 months, to explore their motivation for putting a Will in place. These people all prepared a Will using our service during the last 12 months.

Survey demographics

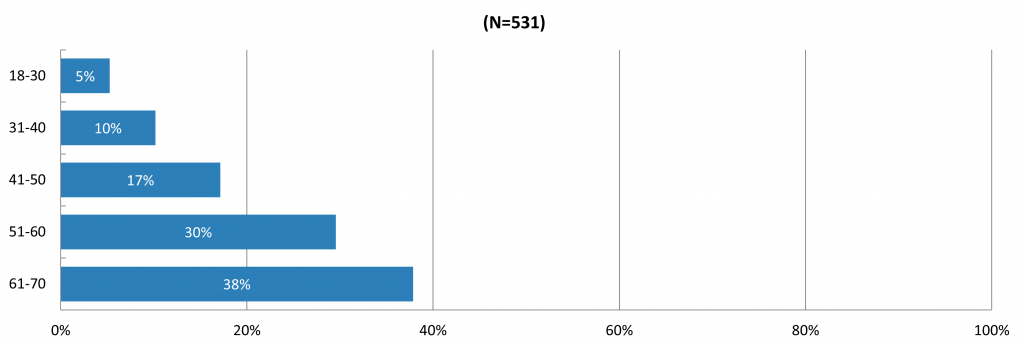

Our survey respondents were from all age categories, but the trend showed higher numbers in older age categories.

This is not typical of the age profile at LegalWills.ca, which traditionally has been concentrated in the 35-50 age group. This means that, over the last 12 months, a disproportionately large number of seniors wrote their Will.

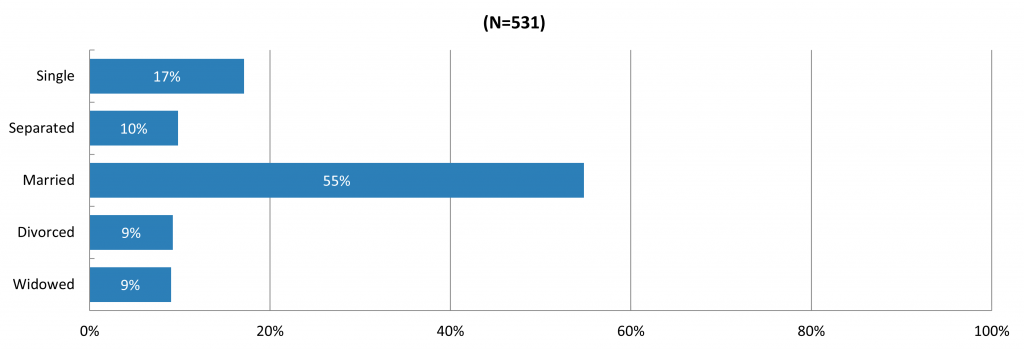

All marital status groups were represented, and were consistent with the typical patterns of users at LegalWills.ca. The genders were quite evenly split, with slightly more men than women writing their Will. Typically at LegalWills.ca, there are slightly more women using the service than men.

Was COVID a reason for writing your Will in 2020/2021?

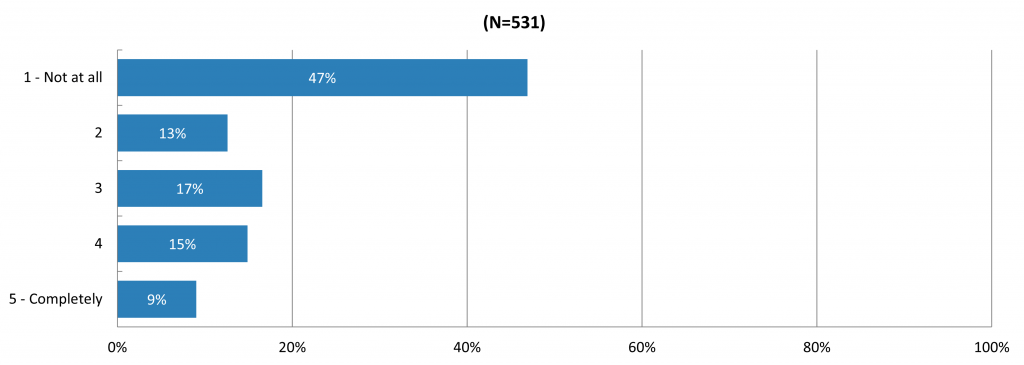

We wanted to ask the obvious question: You wrote/updated your Will in 2020. How much of a role did the presence of COVID-19 play in your decision to write/update your Will?

There are two ways to interpret this data. For over 20 years, we have offered a service to write your Will at LegalWills.ca. Hundreds of thousands of people have done this, before COVID; and when COVID has abated, we expect that people will still be writing their Wills with us. About half the people who wrote their Will using our service in 2020 (47%) said that COVID-19 had no bearing on that decision.

However, the data is also showing that over half of respondents (53%) absolutely were influenced by the COVID pandemic when deciding to write their Will. In fact, nearly one quarter of people (24%) indicated that it was a major factor.

We wanted to explore some of those other reasons for writing a Will.

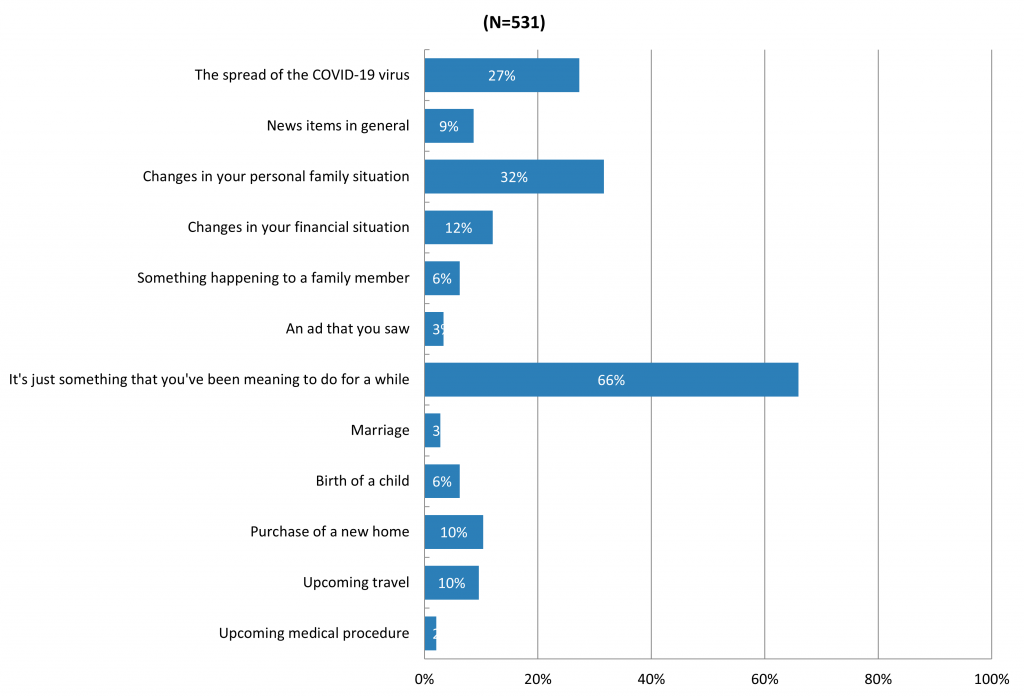

From this chart you can see that yes, COVID-19 was definitely a factor for more than a quarter of respondents, but there are still a number of other reasons that may prompt somebody to finally put their Will in place. The vast majority of people aren’t even certain of the precise trigger, but it was simply something that they had been meaning to do for a while.

Other factors, like changes in your personal family situation, are evergreen reasons for writing a Will that were no more of an influence in 2020 than any other year.

Approaches to Will writing

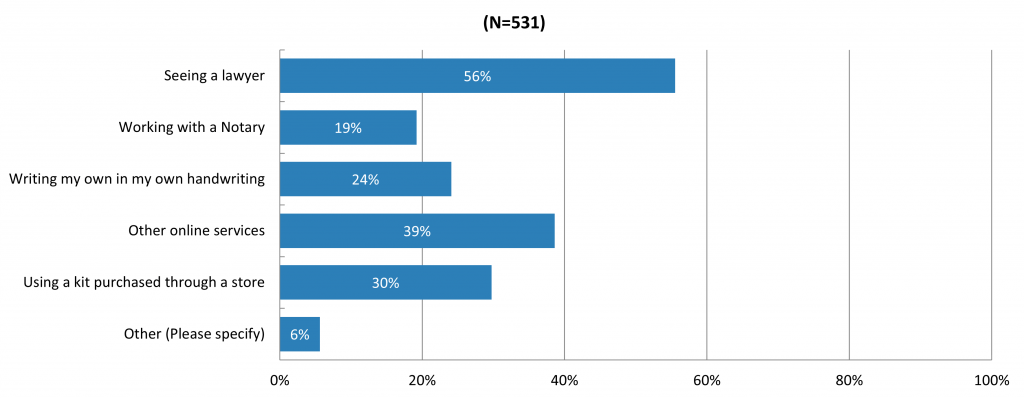

We invited 10,000 of our customers to offer some insights into the different approaches to writing a Will. We asked “There are many different ways to write a Will. Which approaches did you consider before choosing LegalWills.ca?”

It was interesting to us that around half the respondents stated that they didn’t even consider writing their Will with a lawyer.

Perhaps there is a perception that writing a Will with a lawyer is expensive and inconvenient. It does show that, over the years, using one of the different approaches to “writing your own Will” is becoming more mainstream.

We feel that at LegalWills.ca, our Will service has been improved year over year with more capabilities, complementary services, and improved design. It has taken a long time to get the service to the level of capability that it has today, and over time we have been able to meet the needs of more and more people. By incorporating features like minor trusts, lifetime interest trusts, pet trusts, joint Executors and alternate Executors, and even allowing people to cover assets outside of Canada, our service can address the vast majority of situations.

It is also gratifying to us to see that 40 percent of the people who used our services also explored other online options, and chose LegalWills.ca.

What is included in your Will?

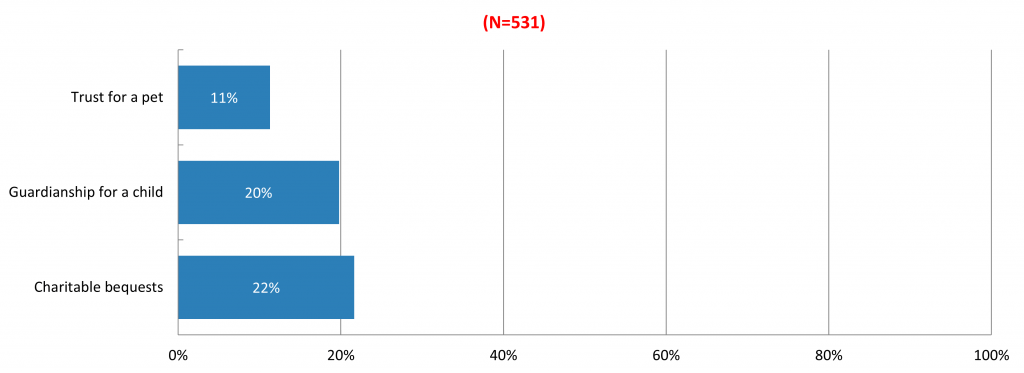

We also wanted to explore the features within the Will service that were used by our customers. We asked the question: In your Will, did you include any of the following?

The numbers surprised us. Around one in ten of all respondents indicated that they had created a pet trust, and around one in five included guardianship for children and charitable bequests.

Historically, we have seen around 12% of our users include a charitable bequest in our Will, so it speaks to a statistical anomaly when people are asked whether they included a charitable bequest (22 percent) compared to whether they actually include one. The discrepancy could be because many people include charitable bequests as part of their alternate distribution plan. For example, “Everything to my spouse, but if we are both involved in an accident at the same time, then everything to charity”. In our previous studies this would not have been included as a charitable bequest, but when self-reported, people tend to count these alternate distribution plans.

Other estate planning services

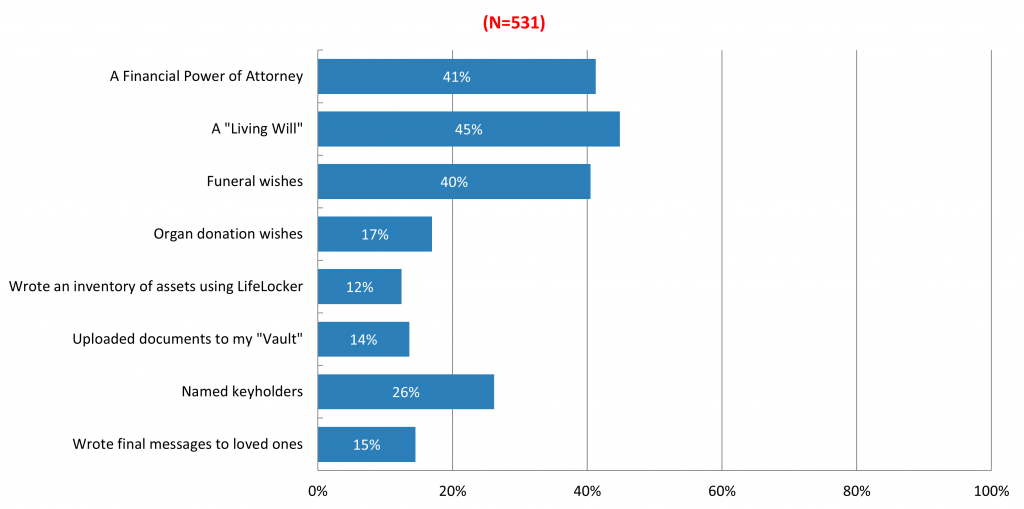

Finally, we wanted to see which other estate planning services had been used by our Will writing customers.

It was wonderful to see that almost half of our customers who had prepared a Will had chosen to complete their estate planning documents by also preparing a Financial Power of Attorney and “Living Will” (Advance Directive and Medical PoA). We also provide a free “MyFuneral” service and almost half of respondents had also used this service.

LegalWills.ca also has an industry leading suite of complementary services to work alongside the core estate planning documents.

One of the great challenges for an appointee in a Power of Attorney, or the Executor in the Will, is locating your assets. We provide an important tool to help with this called MyLifeLocker. This allows you to document an inventory of your assets to ensure that nothing goes undiscovered and that all of your assets manage to get to your beneficiaries. It is encouraging to see that one in eight of our users took advantage of this service, and also uploaded files to the MyVault service.

Around the same proportion of respondents used the MyMessages service to create messages to be distributed posthumously.

All of these services rely on our proprietary Keyholder mechanism so that the information can be stored securely, and are only made available to the right people at the right time, not before. 26% of the people who created a Will, set up Keyholders. Again, this Keyholder mechanism is absolutely unique in the online Will writing market.

Beyond COVID – writing your Will.

We are proud to be Canada’s only online Will writing service that supports all provinces and territories in both official languages. We offer the most comprehensive Will writing service, with a truly unique portfolio of complementary services.

LegalWills.ca also happens to be the most affordable online Will writing service of its type in Canada, at just $49.95.

If you are considering writing your Will, whether this is because of changes in your family situation, your financial situation, or even world events, we encourage you to take a look at our service and join the hundreds of thousands of Canadians who have their estate plans in order with LegalWills.ca.

If you have any questions about this survey, or about our service in general, please don’t hesitate to contact us.

- Probate in Canada – What it is, what it costs, how to reduce fees. - January 6, 2025

- All about Trusts – how to include a Trust in your Will - June 9, 2022

- The Holographic Will – what is it and when should you use one? - May 18, 2022