Must my Will go through probate?

To understand whether or not your Will needs to go through the probate process, you have to understand what happens after you have died.

Hopefully you have written a Last Will and Testament.

In your Will you name an Executor. This is the person that you entrust to gather and secure your assets. Your Executor then has to distribute the assets according to the instructions in your Will.

The Executor must collect up everything you own, keep it safe and secure until everything has been collected, and then pass these possessions and financial assets to your beneficiaries.

Let us imagine a scenario.

Imagine your Executor going to your bank and presenting them with the Will. They explain to the bank that you have died and they show your Will to the cashier. The Will names your Executor. The person you have named shows their ID and they request the contents of the bank account. This person could even be one of your own children.

Imagine that the bank is happy that the Will seems legitimate, and the person standing in front of them has proven their identity. They are clearly the Executor in the Will. So the bank gives the contents of the bank account to the Executor.

Now imagine the next day another person shows up at the bank with a different Will, dated after the previous Will. The new document has a different person named as the Executor, and this person is standing in front of the cashier demanding the contents of the bank account.

How could a bank have possibly known that there was another Will? And that this new document cancelled the previous one?

What is Probate?

It is not possible for individual banks and financial institutions to verify and validate Wills. They simply don’t know whether a document has been challenged, or revoked, or superseded by another document. Banks do not have the processes in place to do this, and they certainly do not want to run the risk of emptying a bank account and passing the contents to the wrong person.

A Will is validated through the process called probate.

What exactly happens when a Will is probated?

Your Executor would take your Will to a probate court and submit that document for probate. It is at this point that the courts can establish the true Last Will and Testament. They can resolve possible confusion between multiple documents, and deal with any concerns regarding the legitimacy of a document.

It is also during the probate process that a Will can be challenged.

If you wrote your Will days before you died, but did not have the capacity to write that Will. And your most recent Will disinherited your entire family and left your estate to your caregiver, then there’s a good chance that your Will is going to be contested or challenged. If that Will is overruled by the courts, your previous Will may be recognized as your most recent Last Will and Testament.

Once your Will has been accepted, the courts will determine if your Executor is still willing and able to serve in this role. Sometimes the person that you have appointed is no longer the best choice. For example, if they are now serving time in prison, or they have lost capacity to take on the responsibility, or they simply don’t want to do it, then the courts may turn to your alternate appointment in your Will.

Once the courts have accepted the Will, and accepted the appointment of your Executor, then your Executor will be given a “Grant of Administration”. This is also called a “Grant of Letters Probate”, or a “Certificate of Appointment of Estate Trust With or Without a Will”. But it is a court issued document that officially appoints your Executor as the estate administrator.

Let us now revisit the bank. Your Executor can now appear at your bank with their Grant of Administration issued by the probate courts, and the bank will feel assured that they can release the assets of the bank account to the court appointed estate administrator.

Does every Will in Canada have to go through probate?

In practice, given this scenario with the bank, almost all Canadian Wills are probated. The only exceptions are those when the entire estate is held jointly, and the assets are passing to the joint asset holder. Traditionally husbands and wives held one or two joint bank accounts, and a jointly owned house. If the first partner died and left the entire estate to the surviving partner, then probate can be avoided.

In situations like this, the banks and financial institutions have no risk exposure when transferring jointly held assets to the surviving partner of a deceased joint account holder.

But isn’t probate expensive in Canada?

It varies quite significantly from Province to Province, but it may not be as much as you think. Certainly, in the United States there is a significant industry creating advanced estate plans, simply to lower the exposure to probate fees. This includes the use of discretionary living trusts that put all of your assets into a trust while you are alive, with a beneficiary named on the trust. This allows the assets to bypass the estate and to not be included in the probate fee calculation.

But in Canada, this hardly seems worthwhile.

Probate fees are generally charged on a sliding scale, some Provinces charge based on bands of estate value, others on a sliding percentage.

We have created our own probate fee calculator that you can use to estimate the estate administration tax that will be paid out from your estate depending on where you are located in Canada.

But as an example, let us take your estate to be worth $250,000. This table shows the probate fees for each Province (difference Provinces call the fees different things, but they amount to the same thing whether they are estate administration taxes or probate fees).

| Province | Probate Fees on $250,000 estate |

| Alberta | $400 |

| British Columbia | $3,150 |

| Manitoba | $0 |

| New Brunswick | $1,250 |

| Newfoundland and Lab | $1,554 |

| Northwest Territories | $300 |

| Nova Scotia | $3,545.15 |

| Nunavut | $300 |

| Ontario | $3,250 |

| PEI | $1,000 |

| Quebec | $65 |

| Saskatchewan | $1,750 |

| Yukon | $140 |

As you can see, there is a very wide range of fees charged by each Province for probating a Will.

I thought there was no inheritance tax in Canada

In Canada a beneficiary generally receives their inheritance tax free, and an estate is not taxed. However, your Executor will still have to file your final income tax return (and also possibly pay capital gains taxes on some assets). There will also be “estate administration tax” – more commonly called “probate fees”.

How can I avoid probate? Or at least reduce my probate fees?

Probate fees are calculated based on the size of your “estate”. It is therefore important to understand what is part of your estate, and what is not.

Your “estate” consists of all the things that you own by yourself when you have died. Your car, bank accounts, clothes, jewelry. If you own it, it is part of your estate.

But joint accounts with a right of survivorship, and financial accounts that already have beneficiary designations are not part of your estate. So life insurance policies, or registered savings vehicles like RRSP’s or TFSA are not part of your estate, if they have beneficiaries named.

If you have not named a beneficiary on your life insurance policy, or you have simply named your “estate” as the beneficiary, then it becomes part of your estate and is subject to probate fees.

Probate is the process that grants the legal authority for your Executor to act. So if you have assets that are to be passed onto another person, then your estate must be probated in Canada. This is the same whether or not you have a Will.

If you choose not to have a Will, your estate must still be probated

But you can reduce the size of your probate fees, by reducing the size of your estate. This can be done by putting your assets into registered accounts like RRSP’s, holding accounts jointly with a right to survivorship, or simply gifting your assets to beneficiaries while you are alive.

If you have not named a beneficiary on your life insurance policy, or you have simply named your “estate” as the beneficiary, then it becomes part of your estate and is subject to probate fees.

You may have read about “Transfer on Death” or “Pay on Death” bank accounts. These are available in the US, but they are not offered in Canada.

Are probate fees charged on both a husband and wife’s estates?

At LegalWills.ca our Wills include a very important “survivorship” clause. It states that no beneficiary will receive their bequest until they survive you by 30 days. This is important.

Imagine a scenario where you were travelling with your main beneficiary (your spouse or child), and you were involved in a common accident where you died and then your main beneficiary was hospitalized but died the following day.

Without the survivorship clause, your entire estate would pass to your main beneficiary, and incur probate fees, then the estate would be distributed according to their Will, and incur a second set of probate fees.

Fortunately, our Wills take account of this situation, but sadly, some do not.

How long does the probate process take?

It typically takes about 3 months for an application for probate to be seen by the courts, the whole probate process can take anything up to a year. Even longer if there are challenges to the Will.

Be aware that in Ontario, the Executor must submit an “Estate Information Return” within 90 days of them officially being appointed Executor. This return must include a detailed inventory of everything owned by the deceased and the complete breakdown of the value of the estate.

Is it a requirement to hire a lawyer to probate an estate?

No, absolutely not. There is certainly some paperwork to get through, but the process does not necessarily require legal training. Legal fees would be paid for out of the estate, and the Will would usually give the Executor the powers to hire professional help if needed, but it can still be expensive. For example, lawyers typically charge about $3,500 to obtain a grant of administration (or certificate of appointment).

Probated Wills are public documents

Once a Will has been probated it is a public document, and anybody can apply to the probate courts to view it. This is important for two reasons;

If you think you should have been included in somebody’s Will, the person has died, but you didn’t hear anything from anybody about your inheritance, then you can apply to the probate courts to view the Will. You should look up the contact information for the Registrar at the Superior Court of Justice in the jurisdiction where the person died and for a fee you would be able to receive a photocopy of the Will.

But this also has implications for your own Will. Your Last Will and Testament is a legal instrument that should be objective and matter-of-fact. You shouldn’t include a list of every asset that you own, you certainly should not include User ID’s and passwords for online accounts, and you should avoid any personal commentary or colourful language in your Will.

Write your Will today

Choosing to not write a Will is not a strategy for avoiding probate. Your estate will be probated whether or not you have a Will, and probate fees will be incurred either way. But writing a Will does make the process easier.

If there is no Will, then immediately after you have died, there is nobody appointed to take charge, to secure assets and to initiate the probate process. Of course, writing a Will also allows you to distribute everything according to your wishes. If you die without a Will, your estate is distributed according to the sometimes-bizarre distribution plan that the Provincial courts have for people who die intestate (without a Will).

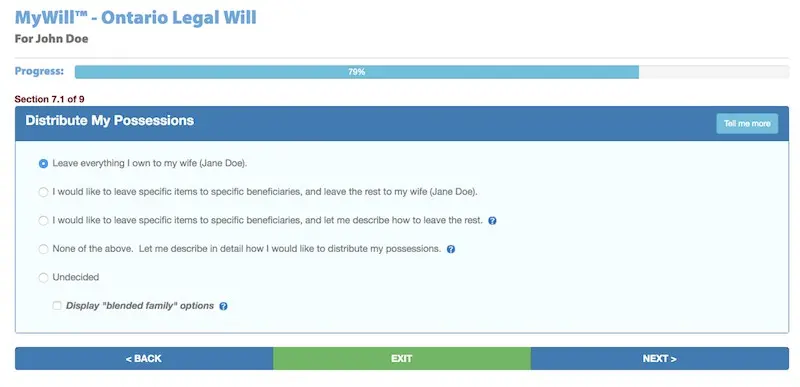

Writing a Will in Canada takes about 20 minutes using a service like the one at LegalWills.ca and costs just $39.95. You simply step through the 10 sections in our online service, and then download and print your final document. This document should then be signed in the presence of any two adult witnesses to create a legal Last Will and Testament.

Within your Will you can create a distribution plan for your estate, perhaps including charitable bequests, or a trust for the care of your pet. You can set up trusts for minor beneficiaries and guardians for your children.

You can also appoint an Executor. The person that you are entrusting with your estate, to go through the probate process and administer your estate according to the instructions in your Will.

- Probate in Canada – What it is, what it costs, how to reduce fees. - January 6, 2025

- All about Trusts – how to include a Trust in your Will - June 9, 2022

- The Holographic Will – what is it and when should you use one? - May 18, 2022