There are many different varieties of Trust, and this can become confusing to anybody not familiar with the relationship between Trusts and Wills. In this article we will give an overview of Trusts, what they mean, how they work, and which types of trusts can be incorporated into your Will. At LegalWills.ca we support a number of different types of trusts, but certainly not all of them. It is also important to be certain when reading about trusts that you are reading Canadian material. Resources from the United States are very different, and much of the US information is not applicable to Canadians with Canadian assets.

What exactly is a Trust?

A trust is made up of three components. There is a “Grantor” (or “Settlor” or “Trustor”) who describes the parameters of the trust. There is a “Trustee” who manages the trust once it is set up, and then there is a “Beneficiary” of the trust – the person who benefits from the trust being in place. The key point is that by making the Trustee manage the contents of the trust on behalf of the beneficiary, there is more control over the contents of the trust. The beneficiary does not control the trust themselves.

Different types of Trust

On a high level, there are two categories of trust: Living Trusts and Testamentary Trusts. Every type of trust that is set up falls into either one of these two categories: a Living Trust or a Testamentary Trust. A Living Trust (sometimes called an Inter-Vivos Trust) is set up during your lifetime and is often “revocable” meaning that it can be cancelled at any time. A Testamentary trust is set up after you have died, and this is usually described in your Will. It explains to your Executor that you want them to create a trust to manage part of your estate for the benefit of a beneficiary, for a number of possible reasons.

This is where Canada and the US diverge. Revocable and Irrevocable Living Trusts are often used as estate planning tools in the US to reduce estate taxes and avoid probate fees. Because of the different tax structure in Canada, the advantages of Living Trusts are not as obvious, and so in Canada, Living Trusts as an estate planning tool are very rarely used. However, there are countless other eclectic tax saving Living Trusts that are used in Canada, outlined by the CRA, that are beyond the scope of this article.

Types of Testamentary Trust

Testamentary Trusts are set up in your Will, and in a sense, your whole Will is a trust. In fact there is a line in the Will that often trips people up. It essentially says:

“I give all of my property to my Trustee upon the following trusts, namely…”

This doesn’t mean that your Executor is going to receive your entire estate. It means that you are asking your Executor to gather up all of your assets and keep them for distribution to the beneficiaries according to your instructions. At this point, the Executor of your Will becomes your estate Trustee who manages all of your assets for distribution to your beneficiaries. This trust is usually in place for a few months, or up to a year until all of your assets are passed to your beneficiaries.

Trusts for Minor beneficiaries

At LegalWills.ca this is the most common trust set up in a Last Will and Testament. It is a simple premise: An inheritance can be a lot of money, too much money for an 18 year old. By law a young child cannot inherit directly. You cannot give half a million dollars to a four year old, somebody has to manage it for them. In your Will you can set up the parameters for how this will be managed, and the age at which the child will be able to take control of the funds directly.

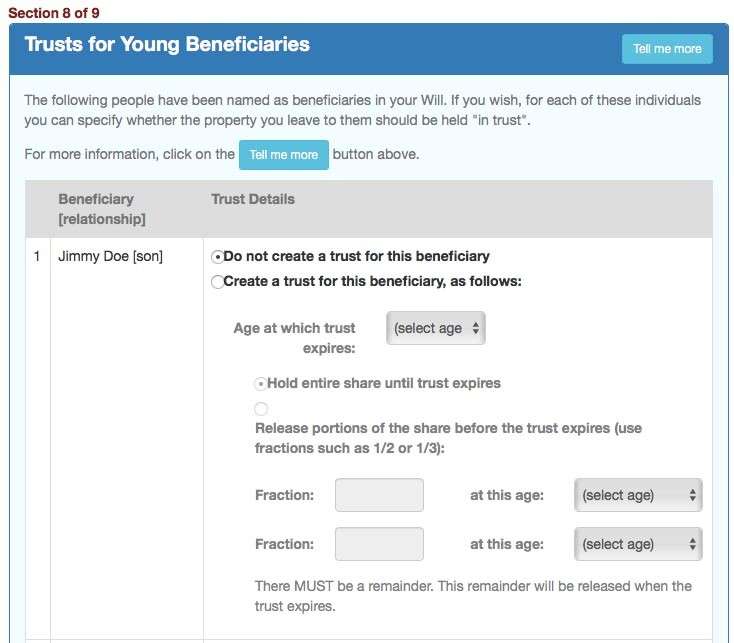

Setting up a Trust for Young Beneficiaries at LegalWills.ca

As you step through the service at LegalWills.ca you will enter the details of your family members and other beneficiaries. When you get to section 8, you will see a list of these family members and beneficiaries, and you are given an opportunity to set up a trust for them.

If you choose not to set up a Trust for a minor, then they will receive their entire inheritance at the age of 18 or 19, depending on your Province. There will also be limits to how the funds within the Trust can be used all the time that they remain a minor.

By creating a Trust within the Will you are able determine the age at which the beneficiary will receive their inheritance, and even to split the inheritance over different ages. For example, the beneficiary could receive 1/3 of their inheritance at 21, half of the remainder at 25, and then the final portion at 28.

You may have more than one young beneficiary with different levels of financial responsibility, and so you may choose to have one child receive their inheritance at 21, and the other at 25. Or perhaps one is 4 years older than the other, and you would like them to receive their inheritances at the same time.

All of this flexibility is built into the section on “Trusts for Minor Beneficiaries” at LegalWills.ca.

How is the Trust for Young Beneficiaries managed?

If you set up a trust within the service, new clauses appear in the final Will. The clauses instruct your Executor to set up the Trust, and critically, the clauses give the Executor (who becomes the Trustee) the power to release portions of the Trust for the benefit of the child as they are growing up. For example, if there are healthcare expenses, or educational expenses for the child, then portions of their inheritance can be released by the Trustee to pay for this.

Is the Trustee the same as the Child’s Guardian?

The person who manages the child’s Trust can be the Guardian, but it doesn’t have to be. In fact there is a clause in the Will that allows the Trustee to hand over the management of the trust to the Guardian of the child if the Trustee feels that this is in the best interest of the child. Sometimes it makes sense for the Trustee to be a different person than the Guardian so that there is accountability for how the assets in the Trust are spent.

There are a number of grey areas, for example, house renovations or family vacations which could be regarded as beneficial to the child. But the Trustee must always balance the needs of the child growing up, while protecting the assets in the Trust so that there is something remaining when the child is old enough to receive the assets directly. This is why it is often best to have one person serve as Trustee and another person serve as Guardian. The Trustee can release portions of the Trust to the Guardian to cover expenses while the child is under the care of the Guardian.

Lifetime Interest Trusts

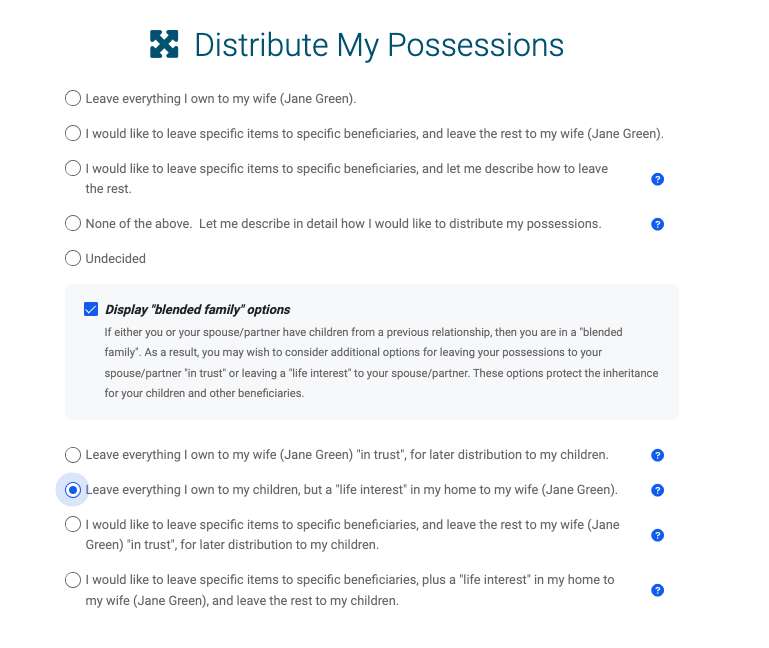

The next most common Trust created using the service at LegalWills.ca is the Lifetime Interest Trust. This is particularly critical for blended families (currently 12.6 percent of Canadian families), which is when your spouse is not the biological parent of your children.

In most Wills for married couples the entire estate is left to the spouse, with an alternate plan in case the spouse does not survive the Testator (person making the Will), perhaps with the estate then going to the children.

But it is important to note that this does not mean that everything goes to the spouse, and then, when the spouse dies, everything goes to the children. If the spouse survives the testator, and then subsequently dies, then everything is then distributed according to the instructions in the spouse’s Will.

Imagine that Alan is widowed and has two adult children; Brian and Betty. Alan then gets married to Cathy who also has two children from a previous relationship: Debbie and David. The four of them live happily and Alan has written his Will leaving everything to Cathy.

Sadly Alan dies, and everything now goes to Cathy. Ten years pass, and Cathy has moved on with her life, she rarely has anything to do with Brian and Betty. She doesn’t even exchange Christmas cards. She updates her Will to leave everything to her children Debbie and David. When Cathy dies, her entire estate goes to her children, but this entire estate also includes everything that Alan left to her.

Brian and Betty have been completely frozen out and they have received nothing of their father’s estate.

There is a way to avoid this and it is supported through the service at LegalWills.ca – The Lifetime Interest Trust.

Using this option, the inheritance is left to the children, but the spouse is able to benefit from the trust for the rest of their life. For example, it can be set up to allow the spouse to remain in the family home, but the spouse never owns the family home. When they die (or move out, or start a new relationship), then the house becomes the property of the children outright. This clause in the Will also dictates who is responsible for maintaining the property in the meantime.

Trusts to Care for Pets

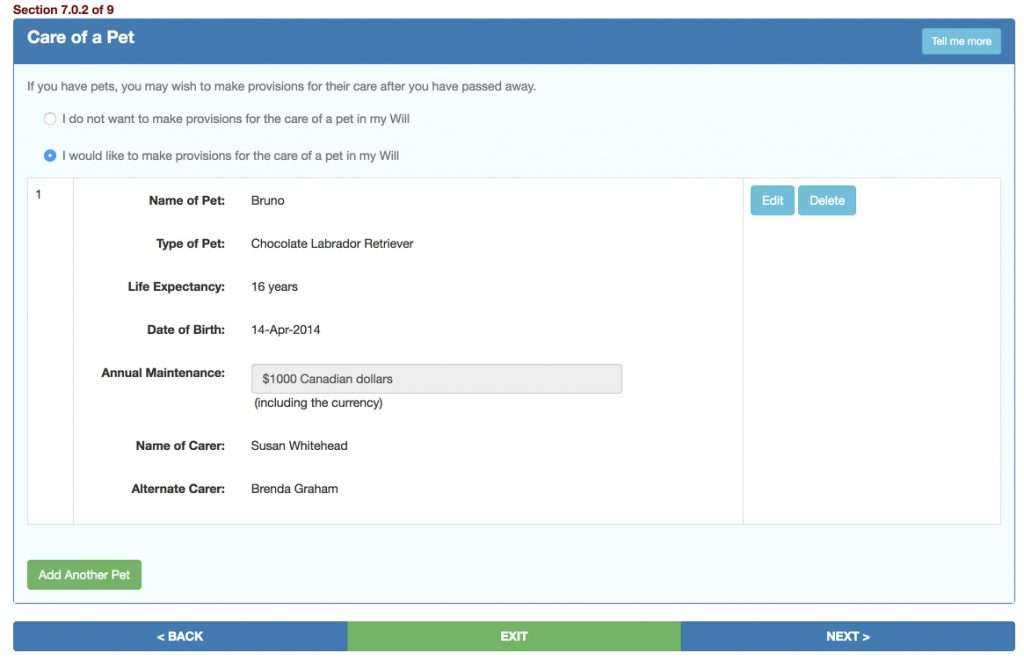

Pet Trusts are “kind of” Trusts, which allow you to leave a bequest to a person for the care of your pet. In a sense, the pet is the beneficiary of the trust, which makes it not strictly speaking a legal Trust because in Canada, a pet is a possession, it cannot be a beneficiary. In Canadian law, it would be the equivalent of leaving a bequest to your car.

However, at LegalWills.ca you can leave a sum of money to a beneficiary expressly for the care of a particular animal.

In fact, at LegalWills.ca you can make the total sum a calculation based on the life expectancy of the pet. The costs associated with taking on a two year old dog, are significantly different to the cost of taking on a 14 year old dog, and our pet trusts page takes this into account.

Testamentary Trusts not supported at LegalWills.ca

There are two particular types of trust that are not currently supported at LegalWills.ca.

Trust for a child with special needs – Henson Trust

There are very particular requirements when leaving an inheritance to a child who needs care, or is in receipt of government benefits. This is often referred to as a Henson Trust.

People with disabilities can often apply for government benefits, but can become ineligible if they have assets over a certain size. A direct inheritance can suddenly disqualify the beneficiary from these benefits. One estate planning technique is to put the inheritance into a Trust so that it is managed on the behalf of the beneficiary, and the beneficiary doesn’t suddenly become wealthy enough to disqualify them from receiving benefits.

Because these situations are so variable and wide ranging, we recommend that the Trust is tailored to the individual circumstances, and any special needs Trust should be prepared by an estate planning lawyer.

Spendthrift Trusts

Spendthrift Trusts (sometimes called “asset protection Trusts”) are in place to put controls over the spending habits of the beneficiary. Sometimes a parent may have concerns about an adult child’s ability to manage their money – some people are simply not very good with handling a large inheritance. In this case, you always want somebody to manage the inheritance on behalf of the beneficiary, potentially for the rest of the beneficiary’s lifetime.

This type of Trust is not supported at LegalWills.ca, because it is potentially open ended and could be in place for decades. It requires somebody (or a Trust company) to manage the Trust, and it must set out clear parameters for how the Trust is to be managed. It is legally possible to say for example that your reckless adult son will receive $1,000 a week for the rest of their life rather than a $500,000 lump sum. But somebody has to manage that for the rest of your son’s life.

At LegalWills.ca you can set up a Trust for a young beneficiary that is in place up to a maximum age of 35.

Write your Will today

We do believe that every Canadian adult should have a Will in place. There is never a situation where you benefit from not having a Will. At LegalWills.ca we are on a mission to make Will writing as affordable and accessible as possible so that every Canadian can prepare their Will. At just $49.95 you can prepare your own Will from the comfort of your home, and today we have helped over half a million Canadians prepare their own Will. Get started today.

- Probate in Canada – What it is, what it costs, how to reduce fees. - January 6, 2025

- All about Trusts – how to include a Trust in your Will - June 9, 2022

- The Holographic Will – what is it and when should you use one? - May 18, 2022