I recently happened upon a Facebook ad promoting an online Will writing service. There are a few different services in Canada, and because Facebook knows that I have an interest in Will writing, I seem to be targeted for every ad from all of our competitors. This particular ad has been running for many months, and garnered nearly 200 comments.

I feel a little sorry for this service provider though, because the comments are riddled with myths, misconceptions, or could we even go as far as to call it “fake news”. The comments section has a surprising level of misunderstanding. I thought it would be interesting to dissect some of these comments, and put the record straight.

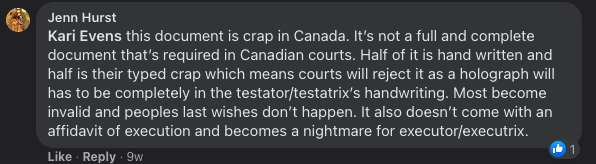

The Holographic Will

“Half of it is handwritten and half is typed, which means courts will reject it as a holograph Will”.

The holographic Will causes so much confusion, but it’s really very simple. A Will must be signed in the presence of two witnesses to make it legal, but some provinces make an exception to this rule. Sometimes it is simply not possible to gather two witnesses (for example, if you are stuck under a rock), and you may need a Will in a hurry. So some provinces allow you to prepare a Will without witnesses if it is entirely written in your own handwriting. This is called a holographic Will.

Here’s the catch: not all provinces accept a non-witnessed holographic Will (notably British Columbia), so it makes sense to prepare a Will and sign it in the presence of two witnesses.

However, all provinces will accept a document that is signed in the presence of two witnesses whether it is all handwritten, all typed, or a mixture of the two.

So in answer to Jenn Hurst’s point, an online service is not helping you to prepare a holographic Will. If half of the document is typed, it is not a holographic Will, so it must be signed in the presence of two witnesses. A document that is signed in the presence of two witnesses will be accepted in all Canadian provinces, regardless of if it is typed, handwritten, or a mixture of the two.

One postscript to BC not accepting holographic Wills: all provinces now try to interpret the intentions of the person preparing the Will. Recently in BC a completely unsigned, typed Will was accepted by the courts because the courts decided that the Will represented “the fixed and final intentions” of the person preparing the Will, even though they messed it up.

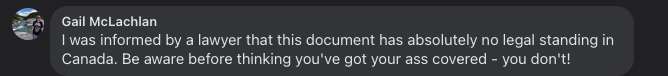

An online Will service is not legal

We get this a lot, and can either be “my friend told me this isn’t legal” or “my lawyer told me this isn’t legal”.

There are two ways to address this concern: we can firstly look to the law. Each province has its own statutes describing the legal requirements for a Will. For example, in Ontario, it is the Succession Law Reform Act that states:

Will to be in writing

3 A will is valid only when it is in writing.Execution

Valid execution of will

(2) A will is not valid unless,(a) at its end it is signed by the testator or by some other person in his or her presence and by his or her direction;

(b) the testator makes or acknowledges the signature in the presence of two or more attesting witnesses present at the same time; and

(c) two or more of the attesting witnesses subscribe the will in the presence of the testator.

In British Columbia, the law is quite similar, except it is called the BC Wills, Estates and Succession Act.

37 (1)To be valid, a will must be

(a)in writing,

(b)signed at its end by the will-maker, or the signature at the end must be acknowledged by the will-maker as his or hers, in the presence of 2 or more witnesses present at the same time, and

(c)signed by 2 or more of the witnesses in the presence of the will-maker.

There are no other requirements in any other Canadian Province. The document must be in writing (not necessarily in your handwriting, but it must be written – it cannot be an audio or video recording, or a verbal promise).

Then it must be signed in the presence of two witnesses.

You could literally write your Will on the back of a napkin and it would be legal. People have done it, but we wouldn’t recommend it.

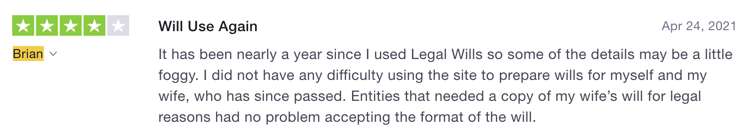

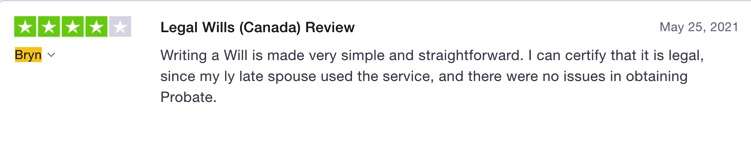

There is of course another way to answer this question, and that is to explore the hundreds of thousands of Wills that have been prepared using our service.

There is comfort in using a service provider that has been around for 20 years, as many of our Wills have been through the probate process. We have thousands of reviews, and many of these are from people who took our Wills through the probate and estate administration process.

We simply know that our documents work and in our 20 years we have never once heard from a loved one of a customer who has experienced any difficulties with one of our Wills.

There are so many things to consider, a lawyer will explain this in detail

This comment is packed with interesting observations. To start with, there is often a scare tactic used like “You wouldn’t attempt your own brain surgery would you? So why would you write your own Will?”. This tries to convey a belief that a Will is just too complicated for you to understand.

This simply isn’t true. Yes, estate planning and tax planning can certainly be complicated, but your Will doesn’t need to be. We provide detailed explanations every step of the way with our service to answer any questions, such as: who would make a good choice as an Executor? how you can make provision for your pet? how to include a charitable bequest? how to name guardians for your children? This is exactly what our software does.

Most people who use our software are amazed at how easy it is to use, but also how comprehensive the sections are. They feel educated on the process and have a better understanding of their final document.

The last comment is about the financial Power of Attorney, and Power of Attorney for personal care. We couldn’t agree more. Both of these documents are very important, and both are available from our website with our complete estate plan package.

In Canada it is different from Province to Province

This is to some extent true, but probably not as much as you think. There are certainly differences in things like signing requirements for a financial Power of Attorney (Manitoba has very strict requirements for a witness), and there are some variations in what you can and cannot do in a Will (BC has particular protections for adult children). Certainly Québec is a completely different legal system.

But any reputable online Will writing service takes this into account in the same way that tax software takes provincial differences into account. In fact, LegalWills.ca only started to support the Province of Québec, a full 20 years after supporting the rest of Canada.

So yes, there are some differences in provincial laws, but this doesn’t mean that an online Will writing service doesn’t work.

Wills cannot be written this way

I’m not entirely sure what this comment means, but there is often confusion about an “online Will” and what that really means. It is correct to say that a Will cannot be written, signed, and stored online – the law still requires the document to be printed on a piece of paper and signed in the presence of two witnesses (although there does appear to be some progress in this area).

When you use an online Will writing service, you are not preparing an “online Will”. You step through the service, your document is compiled, and you then print it, and sign it in the presence of witnesses. The end result is a signed piece of paper – exactly the same as if you worked with a lawyer.

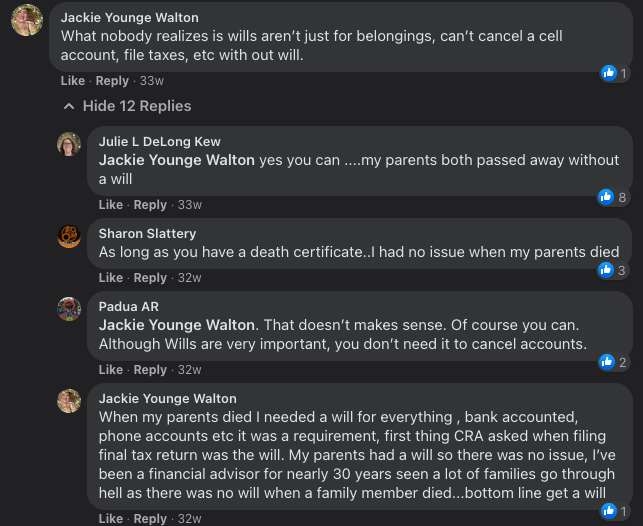

You don’t need a Will

In this comment Jackie was making an important point. A Will does much more that describe the distribution of your estate – it also appoints an Executor, and this person must be given the authority to act by the courts before they can “administer the estate”. This includes closing accounts, cancelling subscriptions, filing taxes, that type of thing.

Of course, people die without a Will, and different accounts require different things. But you will certainly not get very far with only a death certificate. You may for example be able to cancel a cable account, but banks will require a “grant of probate” (if you die with a Will) or a “grant of administration” (if you die without a Will).

The confusion with this particular thread is with the definition of “accounts”. But the banks, vehicle licensing department, land titles, and CRA will need to know that they are dealing with the official estate administrator, and this person is only appointed through probate.

But you can still probate an estate without a Will. It’s just much easier to do it with a Will, and the estate administrator will be appointed by you, in your Will, rather than by the courts.

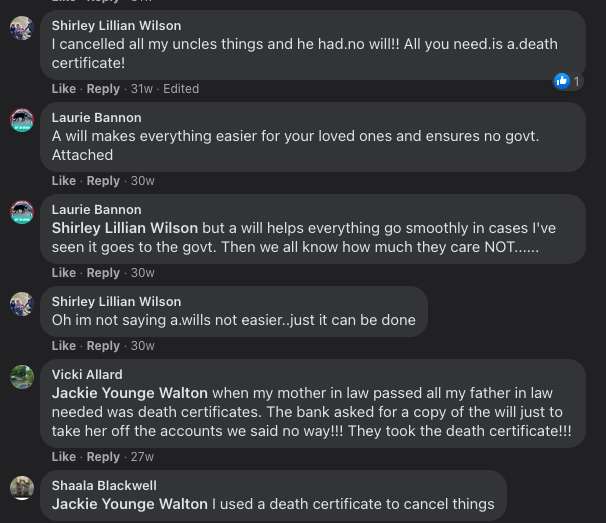

If you have a death certificate you are fine

This is an extension of the previous comment, and some people are trying to say that things are just easier with a Will. Vicki Allard notes that when her mother-in-law died, the father-in-law only needed a death certificate. But this is a very specific example. If everything is passing to a joint asset holder, then the bank is assuming no risk. But I can assure you that when Vicki’s father-in-law dies, the bank will not release anything without a grant of probate or letters of administration issued by the probate court.

However, some of the other comments are incorrect. If you do not have a Will, your assets do not go to the government. This only happens in exceptional cases where there are absolutely no living relatives.

I don’t believe in Wills

This is an interesting comment. You have to understand what happens when you die with a Will compared to when you die without a Will. It doesn’t make any difference to you at all, since you have died, but it makes a massive difference to your family and the loved ones that you have left behind.

By not preparing a Will, you have not appointed an Executor, so the courts will do this for you. If you have children, you have not appointed a guardian, so the courts will do this for you. You have also not described the distribution of your assets, so the courts will do this for you. This means that you will not have made any charitable donations, passed on a treasured heirloom, or given recognition to anybody who has touched your life in a meaningful way. You have missed a golden opportunity to do something great with your legacy.

Without a Will, your assets are frozen until your loved ones get their time in court. All of your assets will likely be sold at auction and distributed according to the intestate succession rules of your province (which are different in every province).

Many celebrities have died without proper Wills: Aretha Franklin, Prince, Chadwick Boseman, Michael Jackson, and Amy Winehouse, to name a few. In most cases their estates were whittled away with legal fees and the opportunity to leave a lasting legacy was lost.

Just get a free Will you don’t need to pay

We’ve written previously about the perils of a Free Will Kit. There are only a few ways in which a Will can be offered for free:

- It’s just not very good. It has been created by somebody with no legal background, it is not supported by anybody, it is not kept up to date, and/or it does not take into account Provincial laws. Anybody can offer a free kit, but you should investigate exactly who created it, and how it can be offered for free. At LegalWills.ca we have legal costs, insurance cost, support costs, and development costs. It would be impossible to offer it free of charge unless we did either of the next two points.

- The service claims to be free, but you are required to enter your credit card number and then “cancel within 30 days”. But charges continue to automatically appear on your credit card statement each month even though you have cancelled.

- The service itself is free, but your information is sold to third parties like insurance companies or funeral homes who try to sell funeral plans.

The example highlighted in this post falls into category number 1. It is a blank form Will kit, and these have generally been exposed as an inadequate approach to writing your Will.

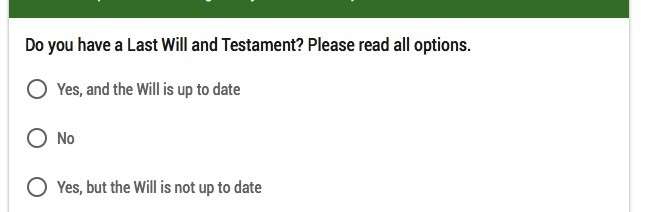

Now let’s discuss some advantages of an online Will service.

After discussing the viability of an online Will service, I think we need to explain why these services are in many ways BETTER than going to a lawyer. Obviously, they are much more affordable – the service at LegalWills.ca is just $49.95 compared to $500-$1,000 for a lawyer. But beyond that, LegalWills.ca offers a number of advantages:

- The ability to update your document as often as you wish to reflect any changes in your personal or financial situation, or the situation of somebody named in your Will. If your alternate Executor has taken ill, simply login to your account, change the appointment, print a new Will, and sign it. If you had written your Will with a lawyer, you probably wouldn’t bother.

- Take your time. You can complete your Will in 20 minutes, but you don’t have to. If you get to the section on charitable bequests and want to leave $500 to each of 25 charities, you can do this, and take as long as you like to get it exactly right.

- Document your assets using unique services like MyLifeLocker, where you can keep an ongoing inventory of your assets, and then appoint trusted keyholders to access this information at the appropriate time (and not before).

- Store critical information in your digital vault including digital assets that you would like to pass onto loved ones.

With a service like LegalWills.ca you don’t just get 5 sheets of paper. You become part of a system of services that help you get everything organized for your family and loved ones.

Get started on your Will right now.

- Probate in Canada – What it is, what it costs, how to reduce fees. - January 6, 2025

- All about Trusts – how to include a Trust in your Will - June 9, 2022

- The Holographic Will – what is it and when should you use one? - May 18, 2022