Five years ago, LegalWills.ca conducted a unique survey of Will Writing in Canada. We wanted to not only explore the number of Canadians with and without Wills, but also the number of people who had a Will, but felt it had not been kept up-to-date. We broke down these numbers by region, income, and age, and published the numbers on our blog.

In the five years since then, there have been a number of events that we have felt may have influenced these numbers, not the least of which has been the COVID-19 pandemic. As we reported at LegalWills.ca, and the article was picked up in the media, the pandemic caused a massive spike in Will writing.

In the last five years we have also seen a proliferation of new convenient Will writing tools from websites providing some of the services offered by LegalWills.ca. At least five service providers have popped up since our last survey, including Willfora, OM Company, Willowbee, Willful, and Epilogue Wills. The services range from “work in progress” to actually quite good, and range from “absolutely free” to $139 for a simple Will. All of the service providers have one thing in common: they are all claiming significant success in encouraging Canadians to write their Will by offering a convenient alternative to making an appointment with a lawyer. We have also seen companies like Axess Law appear on Canada’s fastest growing businesses with their budget Will writing service for $200. There have also been technical innovations from companies like Notice Connect offering the Canada Will Registry and NotaryPro.ca offering virtual witnessing and notarizing of Wills.

LegalWills.ca has grown by 350% in the last five years, as more people have moved towards an online approach to Will writing. The services are offered through a number of channels, including through a partnership with H&R Block Canada.

The question is: has this made any difference to the number of Canadians with an up-to-date Will in their hands?

Background to the Will Survey

Our previous survey was conducted exactly five years ago, and we asked a simple question.

The survey was targeted across age, gender, income level, and geography to ensure that the sample was representative of the Canadian population. The results were weighted by age, gender and region.

The survey was conducted within Canada by Google Consumer Surveys, in June 2016, among 2,000 adults aged 18 and older, and has a root square mean error of 4.7%.

For full information on Google Consumer Survey methodology and validity, click here.

Will Survey Summary Scores – Do you have a Will?

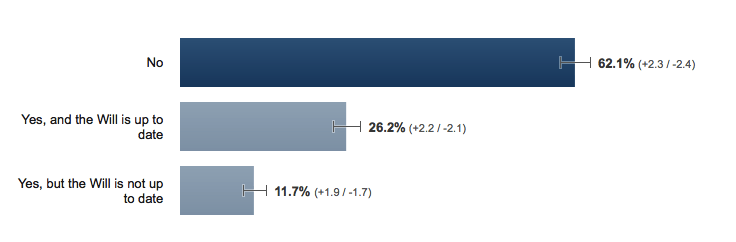

Back in 2016, the results were as follows:

We had seen many, many surveys saying that around 60 percent of Canadians didn’t have a Will in place. We were a little surprised to see that nearly 12 percent of people had a Will in place but it was out of date. I was reminded of a conversation that I had with a friend who admitted “I have a Will, but I haven’t updated it since the girls were born”. His girls were 24 and 21 at the time. He really didn’t have a Will in place.

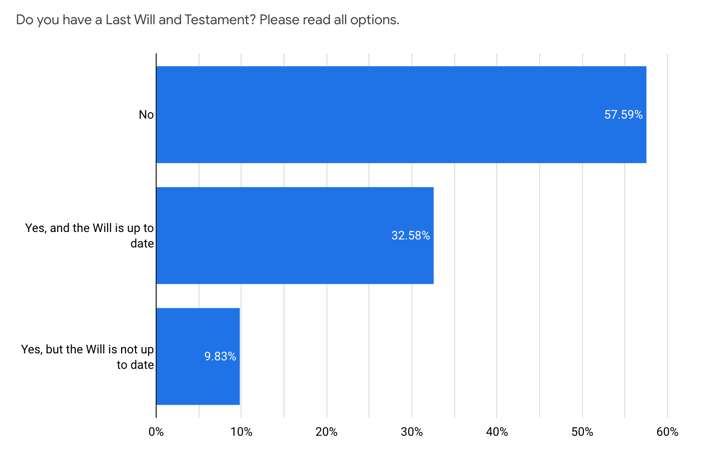

Five years later, the numbers have changed a little. In 2021, the same question generated the following results:

So what does this mean?

Each of these surveys is a snapshot, and the total population of Canadian adults for both surveys was approximately 30 million people.

We have been offering Will writing services through the LegalWills.ca website for 20 years now, and throughout that time, there has been a quite consistent report of around 60-65 percent of Canadian adults not having written their Will (around 20 million people). The survey that we conducted in 2016 was unique in capturing Wills that were not kept up-to-date, so from 2016 we can infer that only 7.8 million Canadians had an up-to-date Will in place.

Fast forward five years and we have seen a significant change, with around 9.8 million Canadians reporting to have an up-to-date Will in place in 2021.

The number of Canadians with “out-of-date” Wills has shrunk from 3.5 million in 2016 to 2.95 million in 2021.

Of course that still leaves us with a very large number of Canadian adults with no Will in place, but that number also appears to be reducing.

Number of Canadians with a Will by Age Category

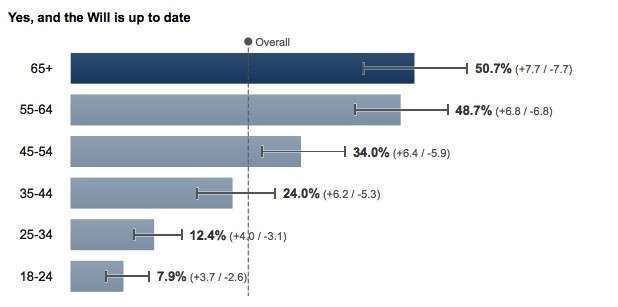

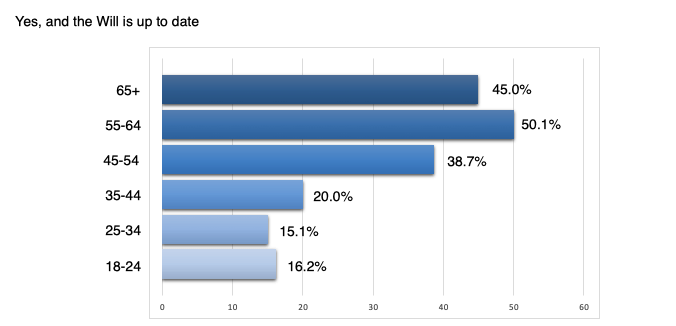

We wondered if there was a particular age group that was taking more care of their estate planning over the last five years. In 2016, we reported the following breakdown:

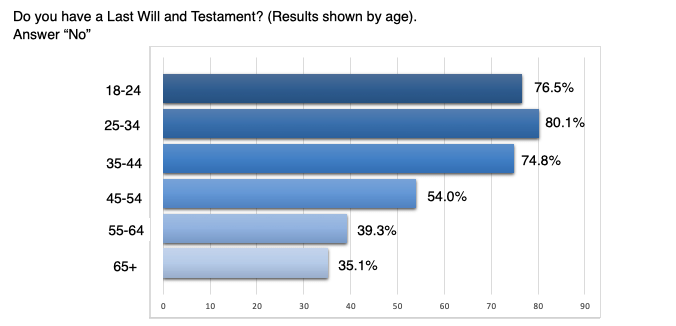

In 2021 there was a significant change to these numbers:

This includes, rather worryingly, the over 65 age category. In 2021, only 45% of Canadians over the age of 65 reported having an up-to-date Will in place. That’s actually down from 50% five years ago.

The most remarkable improvement in percentages comes from the 18-35 age group. Let us delve into this a little bit.

The Traditional Approach to Writing a Will

Will writing in Canada has traditionally been the exclusive domain of estate planning lawyers. In some Provinces (BC and Québec), Notaries are also legally permitted to write Wills. Many years ago, the only other option for writing a Will would have been to prepare it yourself using a blank sheet of paper, or using a blank Will form kit that you could buy from stores like Staples. Generally, the “do-it-yourself” approach to Will writing was frowned upon and it certainly generated a number of substandard Wills.

However, writing a Will with an estate planning lawyer is both expensive and inconvenient. Canadian Lawyer Magazine reports the average cost of a simple Will to be $400-$500, but that is not what we are hearing anecdotally from clients coming to LegalWills.ca. We are hearing quotes of $800 for a simple Will, doubled for couples, and additional costs for creating a Power of Attorney and a Living Will.

Equally important are the time and inconvenience factors. The vast majority of lawyers do not meet you in your home and most Will writing engagements require at least two visits to the lawyer’s office. These visits would also have to be co-ordinated with a spouse if you were married.

As a result, writing a Will has traditionally been thought of as a once in a lifetime task, maybe with one update toward the end of life. If you are young and you know that there are many life changing events ahead of you, possibly including marriage, house buying, having children, as well as influences of organizations that you may want to include in your Will, then it makes sense to hold-off on the creation of your Will. Most young people would not want to waste time and money on preparing a Will that would only stay valid for a short time.

There has traditionally been a sentiment amongst young people of “I don’t need a Will…yet”.

This is reflected in our data that shows that older people are much more likely to have a Will in place than younger people.

However, the number of young people (under 35) preparing their Will is changing significantly, and it is not a leap to put this down to the number of convenient, affordable tools that are now proliferating across the Internet.

Online Will Writing Tools

As mentioned earlier, there are at least five new online Will writing services that have appeared since our 2016 survey and some of these have achieved some good traction in the marketplace. A look at the advertising of these services shows clearly that they are targeting a younger demographic, and transforming the topic of Will writing into something almost “cool”. In the US and UK, this is seen even more so with companies like Beyond, Trust & Will, FreeWill, FareWill, Fabric Wills, and so on. Some of these services offer Android and iPhone apps to help you prepare and update your Will. The market is there and it is receiving hundreds of millions of dollars of venture funding. There are also a number of complementary service providers handling “digital estate planning” like Clocr, GoodTrust, Legado, ReadyWhen, Biscuit Tin, FutureVault, and others.

The Will writing services in Canada range from $49.95 (at LegalWills.ca) through to about $150 at the top end. More importantly, they allow you to prepare your own Will in about 20 minutes, without moving from your sofa. These benefits are being reflected in the advertising:

Clearly the online Will writing approach is very appealing to a younger demographic. Many of the new online Will writing services are claiming to have prepared tens of thousands of documents, so it would seem reasonable to attribute the rise in young people preparing their estate planning documents to these new tools.

Canadians Without Wills

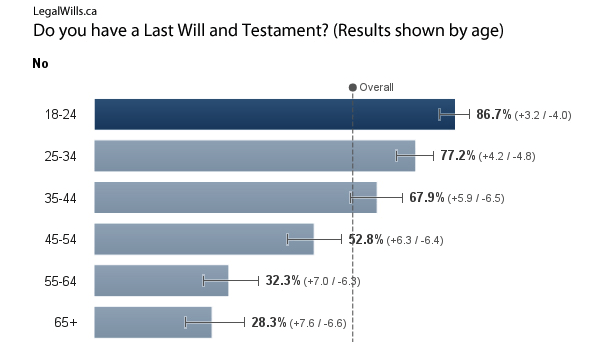

The other side to this good news story is the number of Canadians who do not have a Will in place, and this is still a dismal story. Back in 2016, the number of Canadian adults who reported that they did not have a Will in place at all (whether up-to-date or not) was as follows:

In 2021 the numbers had shifted to:

It is a little surprising to see higher percentages in every age group other than the youngest adults. The percentages of Canadians in other age categories reporting that they do not have a Will has actually increased over the last five years.

Comparing Men and Women

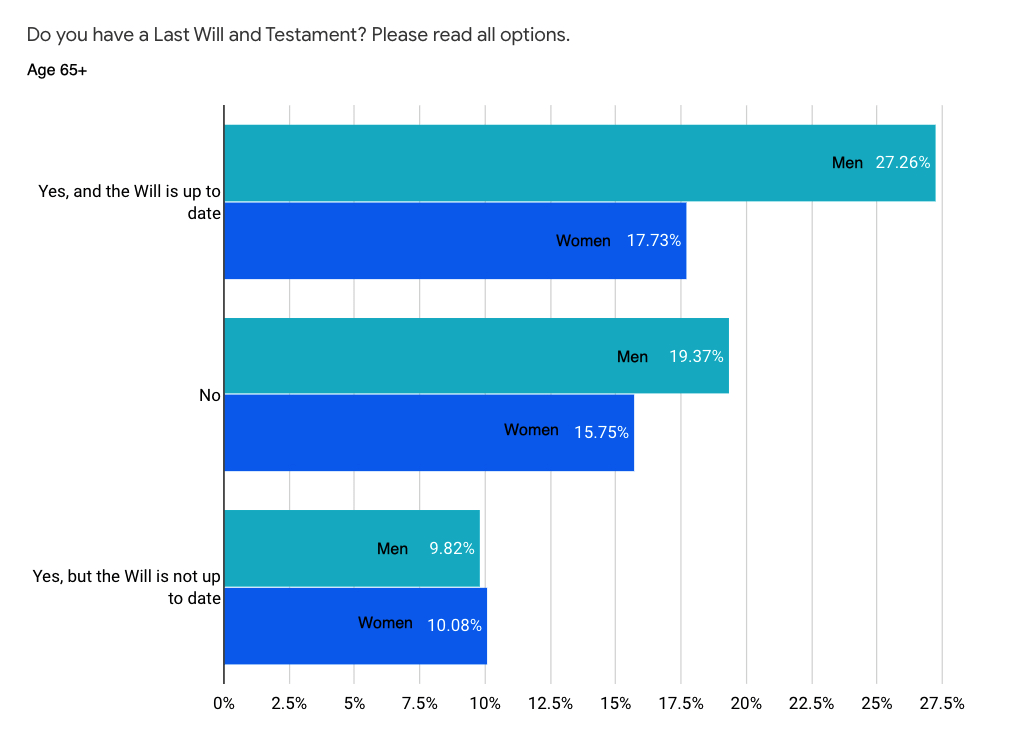

If we drill down to the 65+ age category, there are some interesting differences between men and women, as follows:

We can see that many more men over the age of 65 have a Will in place compared to women in the same age category.

Some Regional Differences

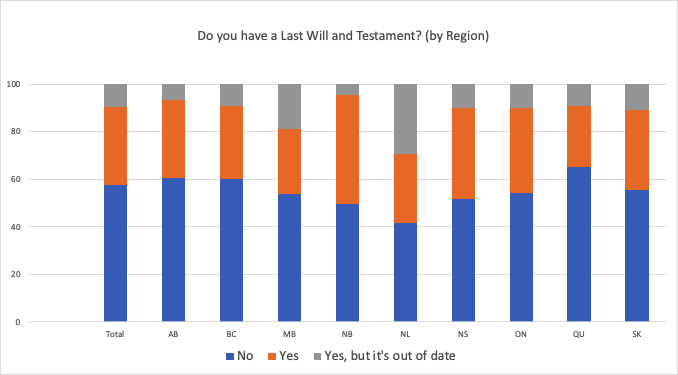

Finally, we wanted to explore any regional differences, as follows:

There is something immediately striking in the number of people without Wills across the different regions of Canada.

The two Provinces in which the most people do not have a Will in place are British Columbia (60.3%) and Québec (65.3%). These two Provinces are notably different from the rest of Canada because they are the only two Provinces in which Notaries are permitted (alongside Lawyers) to prepare a Will. At first, this would seem counter-intuitive; why would Provinces that offer an additional Will writing option have the lowest take-up of Will writing? The answer is in the perception that in these Provinces you MUST write your Will with a Notary or lawyer.

LegalWills.ca launched their service in Québec in 2020 – the first of its kind in Canada. The reaction to the launch was quite misinformed. It seems that Notaries in both BC and Québec have given the impression that a Notarial Will is really the only available option, and that preparing your Will using an online service and signing this in the presence of two witnesses is somehow inferior (which it definitely is not).

The result is, that although the number of Canadians reporting that they have an up-to-date Will in place is a worrying 32.6%, in Québec that number drops to just 25.6%.

Further Observations from our Will Survey

There is still a long way to go.

There is no circumstance whatsoever that benefits from not having a Will in place. The distribution of your estate will be determined by intestate laws, that vary from Province to Province, and rarely match anybody’s true intentions. Furthermore, your Executor appointment will be made by the courts, instead of by yourself. In addition, your assets will be frozen and you will put your family through a lengthy administrative process.

Most people understand that writing a Will benefits their family and loved ones, but we are still in a situation where the MAJORITY (55 percent) of Canadians over 65 years of age do not have an up-to-date Will in place. The numbers are worse for younger age groups.

Although there is a proliferation of simple, affordable, interactive tools now available online, there is still a very large number of Canadians who need to bump this to the top of their ToDo list.

Most people do not understand how easy it is.

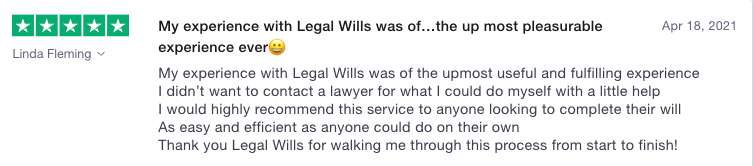

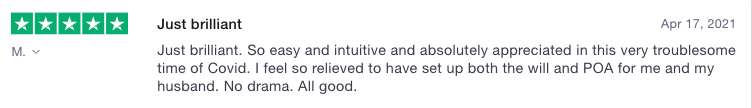

Recently LegalWills.ca started working with Trustpilot to gather feedback on the service. The comments and reviews were heartwarming to the team. In just a week, 200 people had shared their experiences.

Most reviewers shared the sentiment that if they had known how easy it was, they would have completed their Wills years ago.

The service at LegalWills.ca takes as little as 20 minutes (although you can take as long as you need), and costs just $49.95. So now, more than ever, there is no excuse for not having a Will in place.

Online Interactive Will Services – Are they for everybody?

The final observation is on the applicability of online interactive Will services like the one at LegalWills.ca. How well do they work for the average Canadian?

Of all Will writing service providers in Canada, LegalWills.ca is one of the pioneers, or perhaps even visionaries. We have been developing and expanding the service every year for twenty years. Over that time, we have listened to customers, particularly to those who found a shortcoming. In some respects, we may have been overly accommodating. Whenever somebody asked for a feature, we would try to incorporate that feature where possible.

Some of the enhancements we have created in our service over the years have included a section on charitable bequests, pet trusts, lifetime interest trusts, joint executors and joint alternate executors, simple specific bequests and complex specific bequests, a “precatory memorandum”, and assets outside of Canada. We have even developed innovative services like LifeLocker and the Digital Vault. Of course, we have also extended our services into Québec and now offer a fully bilingual service in all provinces and territories of Canada.

We definitely feel that the vast majority of Canadians can and should use the array of services at LegalWills.ca.

There are some things that our service cannot do. Primarily of course, we do not offer legal advice or enter into a client/attorney relationship with any of our customers. We do not offer estate planning or tax optimization advice which needs to come from an estate planning lawyer. There are also some more complicated estate documents like a Henson Trust, or a secondary Corporate Will, that we do not cover.

As much as we do believe that our service suits many people, it is not for every single Canadian. Having a combination of online interactive services and trusted legal professionals is the best way to cover the needs of all Canadians.

Conclusion to our Will Survey

At LegalWills.ca our Mission is to demystify estate planning by educating the public about Wills and other estate planning documents, while making the process fully accessible to everyone through the most affordable and straightforward online platform available. We had the vision to do this twenty years ago, at a time when interacting with an online platform was in its infancy. LegalWills.ca came online just two years after Google.

The number of people writing their Wills with us has grown every single year for twenty years. During the last five years we have seen significant growth, with extraordinary growth in the last year during the COVID-19 pandemic.

The pandemic appears to have provided yet another springboard needed for people to consider their estate planning needs. There has been an unprecedented interest amongst the under 35’s, who are now giving serious thought to their estate planning needs and putting their Wills in place. Clearly, online platforms provide a very affordable and convenient platform for under 35’s to write their Wills, even from an iPad or Smartphone.

But clearly, there is still a long way to go. The majority of Canadian adults still do not have a Will in place. LegalWills.ca intends to continue with not only developing our services to make them more accessible and more affordable, but also into educating the public. Common misconceptions still abound like “I don’t need a Will; everything will go to my spouse” or “If you don’t have a Will, the government gets everything” or “If I write a Will, everything has to be probated”.

We still hear comments like “A Will isn’t legal unless it’s written by a lawyer” or “Online Will services aren’t legal”. As it turns out, the proliferation on new entrants to the online Will writing market actually helps LegalWills.ca in spreading the word that services like ours are legal, convenient, and affordable. It is our mission to continue to be the most extensive and most affordable option on the market.

There is still a problem in Canada with people not writing their Wills (the numbers are very similar in the US and UK). At LegalWills.ca we are offering a comprehensive, online alternative. After 20 years in business, we have helped hundreds of thousands of Canadians prepare their Wills. We will continue to educate and to encourage all Canadians to embrace modern Will writing options like the service at LegalWills.ca.

- Probate in Canada – What it is, what it costs, how to reduce fees. - January 6, 2025

- All about Trusts – how to include a Trust in your Will - June 9, 2022

- The Holographic Will – what is it and when should you use one? - May 18, 2022