wills

Featured Articles

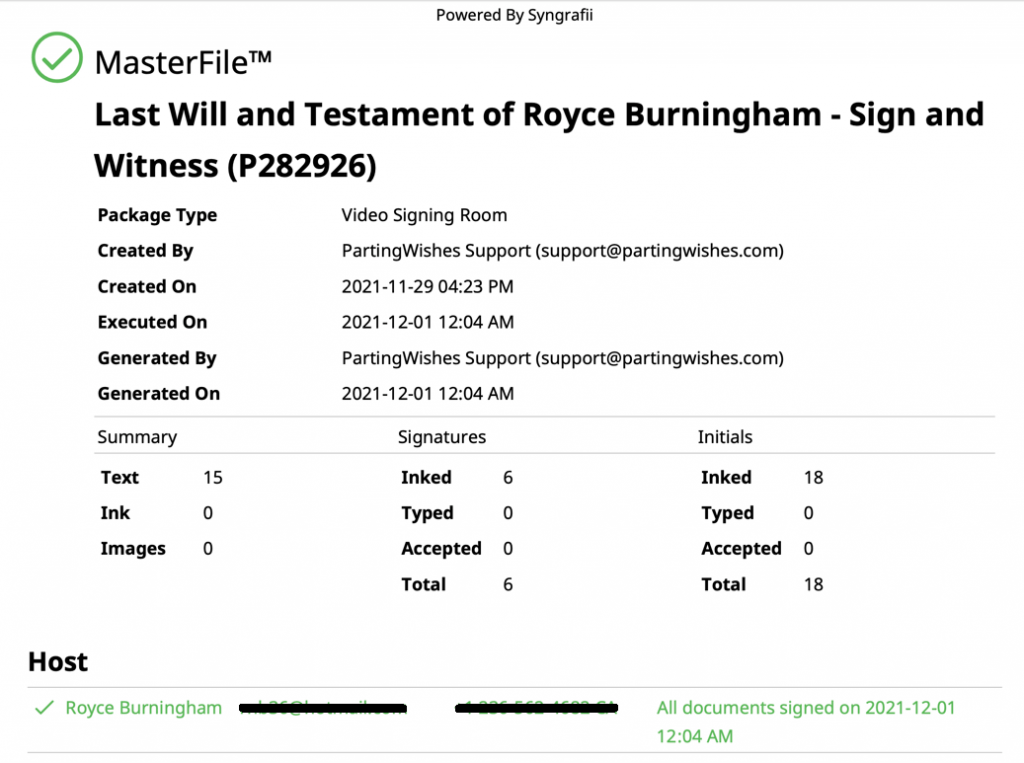

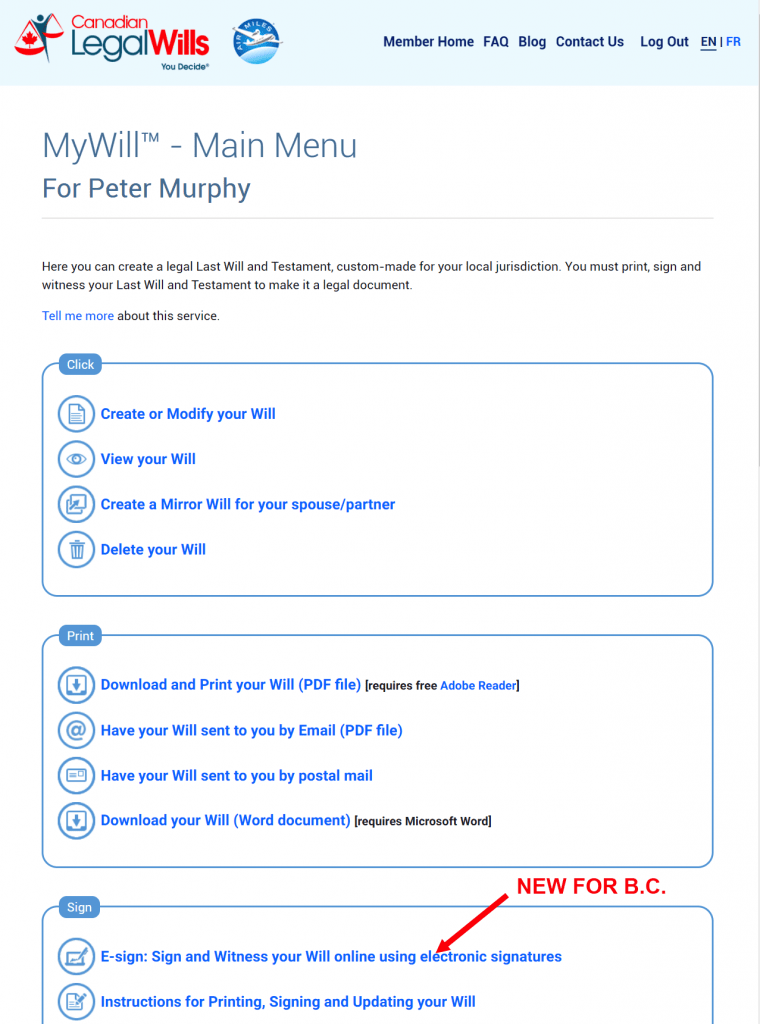

A Guide to Modern Wills: The Digital Will, Electronic Wills, and Online Wills

The law pertaining to Wills has been in place for almost 200 years. Over that time, very little has changed in the requirements to create a legal Last Will and...

Continue reading