Online Will writing services have changed the game for Will writing. The traditional barriers of cost and convenience no longer apply. There was a time when a simple Will would cost $600 and take two or three visits to a lawyer. These visits would have to be coordinated with a spouse and other family members. Then if the Will needed to be updated, the whole process would have to be endured again.

It is no surprise then that the vast majority of Canadian adults don’t have a Will.

With online Will writing services, the costs have been brought down dramatically, so a Will can now be written for as little as $39.95. And of course the time consuming appointments are a thing of the past – you can just put the kids to bed, put your feet up, pick up your iPad, and write your Will.

We now expect more people to be writing their Will, simply because the process is so much more convenient and affordable. Most people who use our service wonder why they left it so long

What goes into a Will?

Your Last Will and Testament is an extremely important document because it allows you to make key appointments and describes the distribution of your estate.

You name your Executor

This is critical. In your Will you name your representative who will carry out the instructions in the Will. This person has the responsibility to gather your assets, secure them, and then distribute them according to the instructions in the Will.

Your Executor can be a professional, like a lawyer or a bank, or they can be a friend or family member. If you choose a non-professional, they can always hire professional help as and when they need it. Typically this is the approach we recommend – if you hire a professional Executor, they can take a good chunk of your estate in fees.

If you appoint a friend or family member as your Executor, they may have a better sense of the size and scope of your estate, and it is this critical part of the process that this article explores.

You describe the distribution of your estate

One of the most common misconceptions about a Will is that is lists everything that you own.

We would generally recommend not including a list of assets in the Will itself. You don’t know when your Will is going to come into effect, and your assets are likely to change over time. This would require you to update your Will every time you opened a new bank account, or made a major purchase. Furthermore, once a Will is probated, it becomes a public document that everybody can read. You may not want details of all of your assets made public.

If a particular item has a specific beneficiary that is different to the main beneficiary of your estate, then yes, it must be included. For example, if everything is going to your son, except for a piece of art which is going to your nephew, then the piece of art has to be included in your Will.

Otherwise, your Will refers to your “estate” in general terms.

However, it does make sense to list your assets in order to help your Executor administer the estate. They have to gather your assets, and it is helpful to have the accounts documented so that they can be sure that nothing is forgotten. But not in the Will itself.

This is the key point of this article

Your estate

Let us try an exercise – write down a complete list of your assets.

It’s probably going to take a while. When I say assets I mean your chequing accounts, your savings accounts, any other bank accounts.

Then your investments, your RRSPs, RESPs, LIRAs, GICs.

Your pensions.

Your online accounts, like Roboinvestors, online trading accounts, online banks like Simplii or Tangerine, Paypal. Even cryptocurrency accounts.

Now any online account that generates income for you. Do you have a YouTube channel, Instagram, blog? Maybe you are an “influencer”?

Let’s move onto property and other valuables. Do you own real estate? A car? What about an ATV, snowmobile, or boat?

And now into possessions. Let us start with the high ticket items like jewelry, paintings, antiques. Or even computer equipment, music systems, home theatre, bicycles.

Then your furniture, a piano perhaps, household effects, and the things stored in your garage or in the storage locker.

And you also have more sentimental items. Like your signed Bobby Orr jersey, photos, your first edition signed Harry Potter book.

Finally there are your online accounts or “digital assets”. You need a list of your social media accounts, and you should document your login credentials for your Facebook, Twitter, Gmail, TikTok, Instagram, Pinterest accounts.

It’s a long list and I’ve barely scratched the surface.

But wait. This probably isn’t you who is going to have to write this list down. It’s going to be your Executor. So now imagine that you have been appointed the Executor of your Brother-in-law’s estate.

Now write down all of his assets.

How can you help an Executor gather the assets?

This is the challenge with your Will.

Your Will doesn’t list your assets, but your Executor is responsible for gathering your assets.

So what can you do to help your Executor?

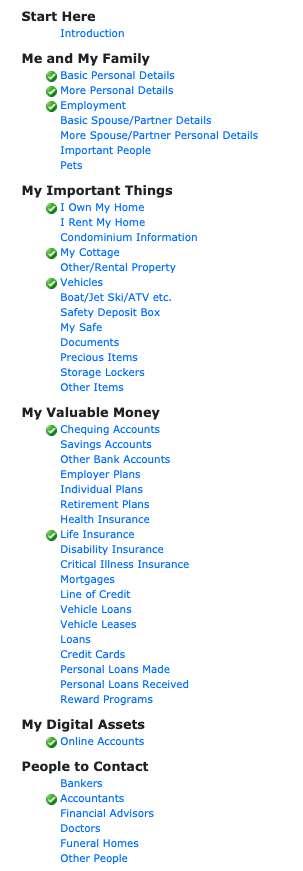

We provide two options for listing assets.

Under the MyWill service there is a downloadable form labeled “List your Personal Details & Assets (PDF file)”. You can save this to your computer and update it whenever you need to. This is not a legal document, so it does not have to be signed and witnessed. You can download it here.

You can scribble all over this document and update it whenever you need to. You then just store it with your Will.

But we also have our LifeLocker service.

The MyLifeLocker service at LegalWills.ca

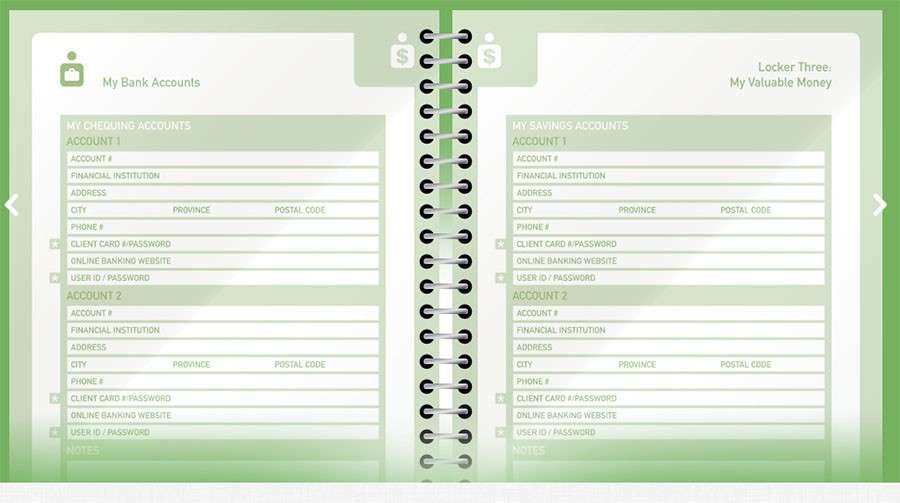

MyLifeLocker is an online service that allows you to keep track of your accounts and personal details. At any point you can login to your account and make updates to it. It is the ultimate Executor Handbook.

The service guides you through the process of thinking about and collating information about your estate.

This image is a subset of the sections within the LifeLocker service

But the key feature of MyLifeLocker is not from the service itself, but from the Keyholder™ service that makes it work.

Your Keyholders™ at LegalWills.ca

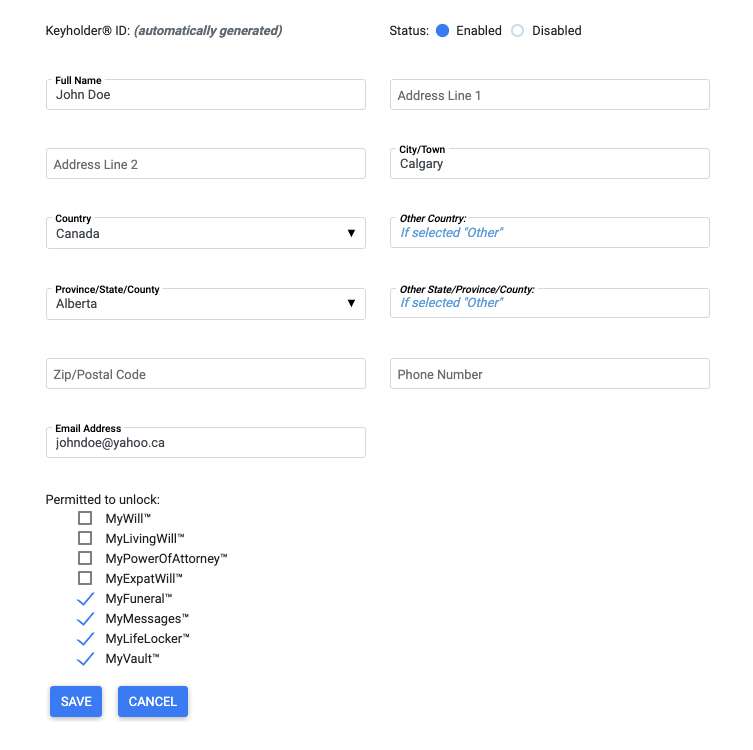

At LegalWills.ca we allow you to set up Keyholders™ . These are trusted individuals who are granted access to some of your services within your account.

It works like this:

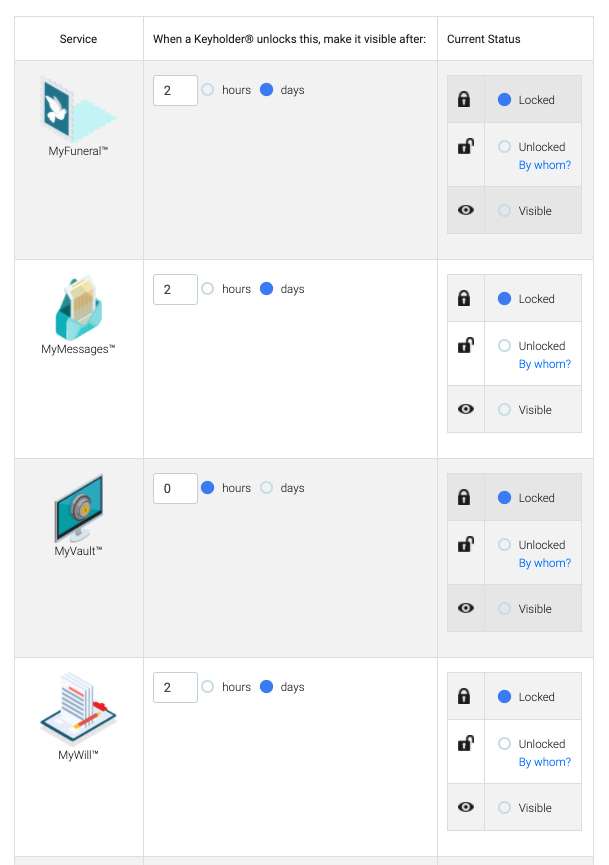

You enter information into each service. For example, MyFuneral, MyMessages, MyLifeLocker. You then name a series of Keyholders who each have access to different services (you can have more than one Keyholder with access to the same service as well).

You can then set up the grace period for each service between the Keyholder requesting access and the information being made available to them.

This means that any information that you have entered into the MyLifeLocker service can be made available to your Executor when they need it. And not before.

You notify your Keyholder by email that they have been assigned the responsibility.

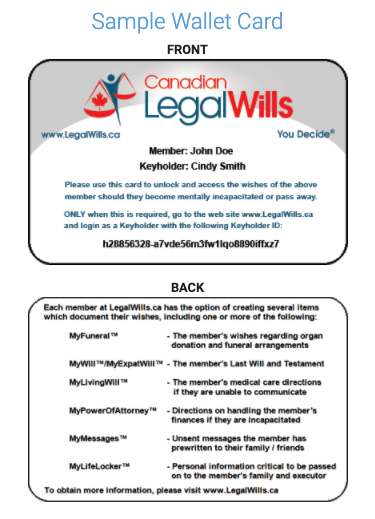

You can even order them a wallet card for safekeeping with instructions for logging into their account.

Securely store documents at LegalWills.ca

MyLifeLocker allows you to document your information, and this is a tremendous help for your Executor. But what if you need to pass on files to your loves ones?

Enter MyVault.

You may have some photos, audio files, maybe a recipe book, or an unfinished novel.

Perhaps you want to leave recordings of some messages for your loved ones and descendants.

You can even upload a spreadsheet of the login credentials for your online accounts.

The MyVault service also allows you to name keyholders who can access the contents of your Vault at the appropriate time. And of course, the MySecurity service ensures that information doesn’t reach the right people, but at the wrong time.

It’s the modern day equivalent of the sealed envelope “to be opened on my death”.

Is the information secure?

Yes.

No documents are ever stored at LegalWills.ca. We don’t even store your Will.

We store the answers to the questions in an encrypted file. Your information is only compiled into a readable format when you or your Keyholders login and click to compile the document. This is why any time you view your document, it takes a few seconds for the document to be generated.

Detailed information on how we protect your privacy is contained within our Privacy statement.

We use an industry standard high security streaming-encryption algorithm known as “RSA” to encrypt all sensitive personal information before it is stored online. RSA is a public-key cryptosystem developed by MIT professors Ronald Rivest, Adi Shamir, and Leonard Adleman. (To give you a feeling for the level of security provided by this encryption, it has been estimated that with the most efficient algorithms known to date, it would take a computer operating at 1 million instructions per second over 300 quintillion years to break the encryption.) Also, the encryption method used ensures that the only way possible to access and view the sensitive personal information stored here by a LegalWills.ca member is by using a private internal encryption key which is unique for every member. Our software algorithms ensure that the encryption and decryption of a member’s sensitive personal information can only be performed by the member themselves, or by those designates to which the member has provided a separate unique key known as a “Keyholder® ID”. It is not even possible for the operators of this web site to decrypt a member’s sensitive personal information without knowledge of this encryption key.

What happens if I don’t document my assets?

For your financial assets, you run the risk of the asset not being discovered. Your Executor will think that they’ve completed the estate administration and gathered up all of your assets, but something was missed.

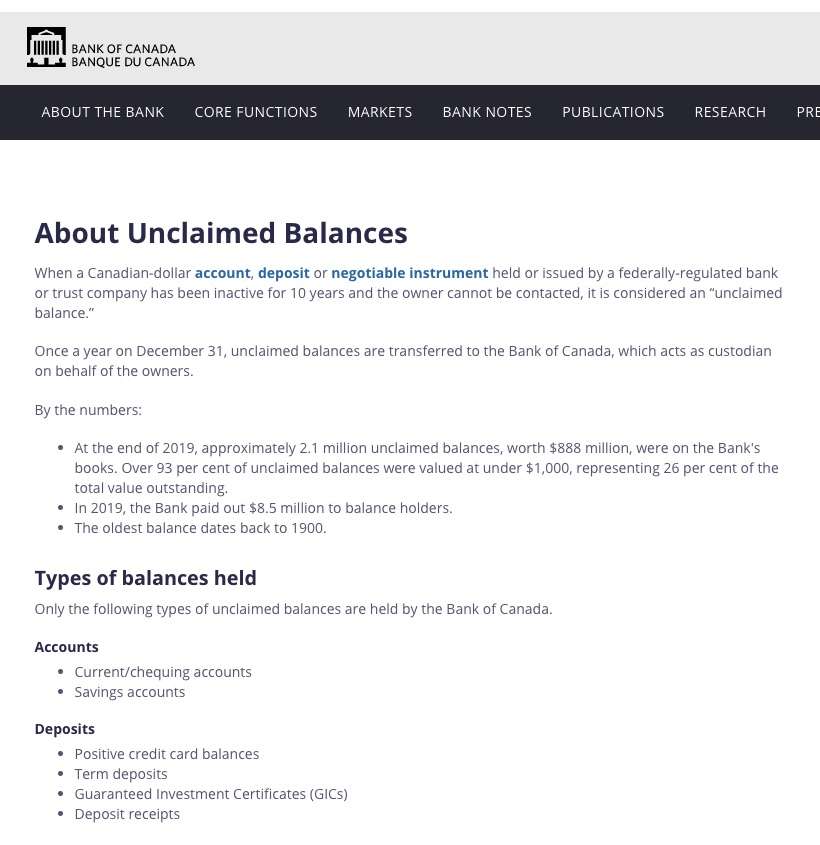

If this happens, then it becomes one of the 2.1 Million unclaimed accounts currently registered with the Bank of Canada.

If it is a possession, then it runs the risk of ending up the wrong hands. Your prized Stratocaster guitar could just simply go missing. Somebody could have sworn that it was in the house just last week, but somebody else thinks that it was sold years ago.

Keeping an inventory of your assets is a key part of estate planning. As important as preparing the Will itself.

Write your Will today

If you haven’t written your Will yet. You really should. It takes about 20 minutes and only costs $39.95.

Nobody who has written their Will regrets getting it done.

It gives you such a feeling of satisfaction and peace of mind.

You can get started on your Will now by going to the home page and clicking on “Start your Will“

When you are choosing a Will writing service provider though, look for one who can help your Executor. A service provider like LegalWills.ca that offers tools like MyLifeLocker, MyKeyholders, MySecurity and MyVault.

It is a powerful suite of services.

- Probate in Canada – What it is, what it costs, how to reduce fees. - January 6, 2025

- All about Trusts – how to include a Trust in your Will - June 9, 2022

- The Holographic Will – what is it and when should you use one? - May 18, 2022