We live in an increasingly global world. People travel more, settle into new countries, and even share their time between different countries. Traditionally, the idea of owning assets in different countries was reserved for the extremely wealthy. But nearly ten years ago, at LegalWills.ca, we created the Expat Will. The first of its kind available anywhere, and we have been pleasantly surprised at how frequently this service has been used.

The Expat Will solves a problem that cannot be addressed by traditional approaches to Will writing. The service is offered to people with assets in more than one country – a population that continues to increase.

The need for multiple Wills

This solution has been highlighted in two recent articles. This article at Advisor.ca suggested that

While in most cases one will can dispose of all assets regardless of where they’re located, a common planning technique is entering a will in each jurisdiction where property is owned. Multiple wills have several advantages

Keith Masterman Advisor.ca

The author goes on to describe the advantages that include choosing a separate Executor for each jurisdiction, ensuring that the Will complies with the local laws, and the cost effectiveness.

Another article, this time from MoneyControl.com, came to the same conclusion.

First, the different jurisdictions in which you own assets may have different and potentially conflicting succession laws….A single Will may not be aligned with the succession laws of every jurisdiction. Second, keeping in mind the time expended to obtain a probate in each of the jurisdictions, having separate Wills for assets in each jurisdiction instead of a single Will would expedite the process of obtaining probates.

Shantanu Gupta, MoneyControl.com

So it’s not just the team at LegalWills.ca that have arrived at this conclusion, it is a recommended approach by most estate planning attorneys and tax advisors.

Isn’t there an “International Will”?

Since the 1970’s, The Uniform International Wills Act has been in place to allow one Will to dispose of property in multiple jurisdictions. Unfortunately, it requires that all property must be in a jurisdiction supported by the Act. The adoption of this Act has been inconsistent. In Canada and the United States, some states and provinces support it, but others do not. The U.K. does support it, but the vast majority of other EU countries do not (France yes, Spain and Germany no). As a result, it is not practical to prepare Wills in support of The Uniform International Wills Act. It is much more effective to prepare a Will for each country in which the assets are held.

The challenge of preparing multiple Wills

It is highly unlikely that you will be able to find an estate planning attorney who can prepare multiple Wills for you. Attorneys are licensed and trained to work within a specific jurisdiction. If you ask a lawyer based in Toronto to prepare a Will for you that covers your condo in Florida, they usually will not be able to help you.

The best that a Toronto lawyer can do is put you in touch with a lawyer in Florida. But the lawyer in Florida will usually require you to visit their office. Even in this world of Zoom calls and Skype meetings, you may be able to give the lawyer enough information to draft the Will without attending the Florida office, but the document will still need to be signed. Your options for signing would be to either travel to the Florida office, or for the document to be couriered to you for local signing and witnessing.

Do the Wills then work together?

You may have now prepared two Wills, but you have to be certain that the two Will drafting lawyers are skilled in preparing Wills that co-ordinate with each other to cover your assets. For example, it is common for a Will to start with a standard revocation clause that “revokes all former Wills, codicils and other testamentary dispositions made by me”.

So your Florida Will would revoke your previously prepared Canadian Will, unless the document was worded to avoid this from happening.

Updating your Wills

Of course, writing your Wills is an important step. But these documents also have to be kept updated whenever there is a change in circumstance. This need for an update is not only when an asset changes, but also if something happens to somebody named in your Will.

So what would happen if the Executor to your Florida Will is taken seriously ill and is no longer able to take on the role? It would be best to update the Will with a new Executor, but this is logistically as challenging as preparing the Wills in the first instance.

As an aside, if you are naming your Executor for your Florida Will, Florida has unique qualifications for an Executor. They must be either a resident of Florida, or a family member. You cannot name your friend in Alberta as an Executor to a Will in Florida.

The cost of preparing Expat Wills

As you can imagine, the cost for preparing your cross border, complementary Wills is going to be significant. The cost of preparing a simple Will in Canada with a lawyer ranges from $400 to $1,000. The cost of preparing the secondary Will (which demands some specialized knowledge from the US attorney) is going to be significantly over $1,000.

Traditionally, this approach to multi-jurisdictional assets is going to cost you several thousands of dollars.

The requirements for a Legal Will

There is one clue in the above description of preparing a US (or UK) Will that allows us to create an online service for assets held in different countries.

Across every Canadian province, US state, and the UK, the signing requirements to prepare a legally binding Will are the same. The document must be signed in the presence of two adult witnesses.

Once signed and witnessed, you have created a legally binding Last Will and Testament.

Furthermore, there are no residency requirements for a witness. So you can prepare a perfectly legal US Will while sitting in your home in Ontario – provided you use an online service like the Expat Will service at LegalWills.ca.

The Expat Will service at LegalWills.ca

LegalWills.ca has been a leader in online Will writing services since 2001. In 2020 alone, over 100,000 estate planning documents were created using our services. One of the features that makes LegalWills.ca unique is that it also offers full Will writing services for the USA through USLegalWills.com and for the UK through LegalWills.co.uk .

Our familiarity with local laws across all of these jurisdictions has put us in an unrivalled position to be able to adapt our services to offer multi-country estate planning.

Who does the Expat Will service work for?

There are two main scenarios that lend itself to the Expat Will service:

- If you own assets in Canada, the United States, England, or Wales, but live in a different country, or

- If you moved to Canada, the United States, England, or Wales, but already have a Will covering your assets in your home country.

The MyExpatWill™ service allows you to create a legal “Expatriate” Last Will and Testament, which works in conjunction with your existing Will, but covers any assets that you own in a foreign country. Your existing Will remains in effect, and covers your assets in your home country.

If you are living in Canada and have Canadian assets, but you also have assets in the U.S., you can use the MyExpatWill™ service to create your U.S. Will for your U.S. assets.

If you are an American citizen living abroad, and need a Will to cover your U.S. assets, you can use the MyExpatWill™ service to create a Will whether or not you have a Will in your country of residence.

If you are new to the U.K., have assets in another country and already have a Will in place for that country, you can use the MyExpatWill™ service to create a Will for your U.K. assets.

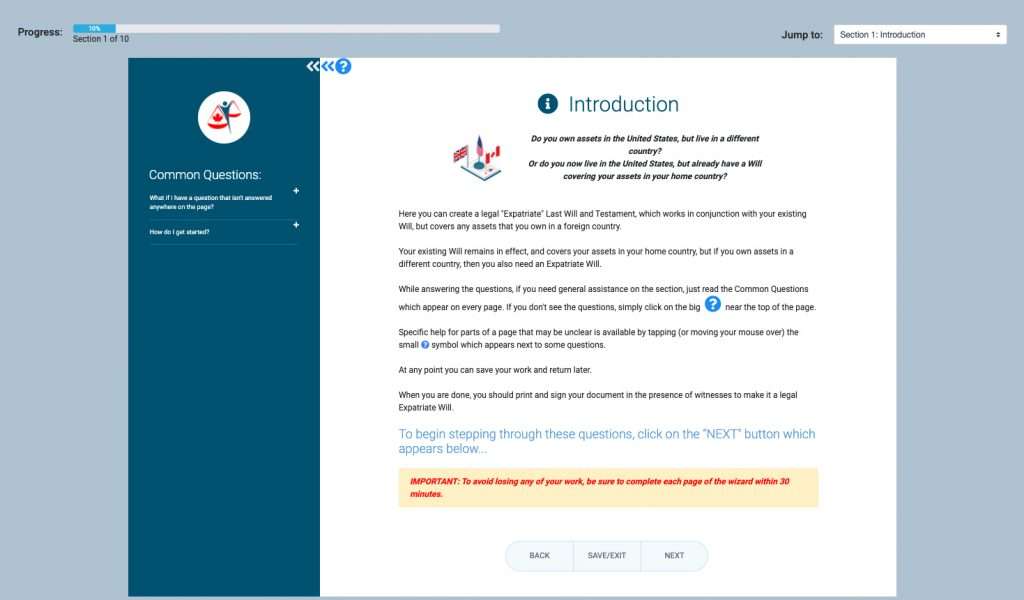

How do I use the Expat Will service?

The Expat Will service works in exactly the same way as our standard MyWill service. You are guided through a series of questions, broken into 9 sections.

The whole process takes about 20 minutes and includes the naming of your Executor and your beneficiaries.

At the end, your document is compiled based on the answers to your questions, which can then be downloaded as a Word or PDF file. It should then be signed in the presence of two witnesses to make it a legal document.

Any time you wish to make a change, you can simply login to your account, edit your answers, and then download a new compiled document for signing.

The cost for the Expat Will service is just $49.95.

This means that you can prepare a Will for your Canadian assets, and a separate legal Will for your US assets, for a total of $99.90.

Do I need more than one Will if I have assets in more than one Province?

Generally no. A Will written under the laws of any province in Canada is accepted by any other province in Canada. However, it is possible that the Will may have to be probated in one province, then “re-sealed” and probated again in the second province. It really depends on the size and complexity of the estate.

What about a Power of Attorney?

A estate planning financial Power of Attorney is a document that is written when you have capacity, to come into effect after you have lost capacity. This allows a named representative to take over your financial affairs on your behalf if you were ever unable to handle your own finances.

The financial Power of Attorney must be accepted by the financial institution holding your assets. For example, if you have a bank account held in the UK, the bank would not accept a financial PoA written under Ontario law. They would want to see an official LPA (Lasting Power of Attorney) written under the strict UK requirements for a registered LPA. In the UK this document also needs to be registered with the government before it is accepted.

This means that if you have assets in Arizona and also bank accounts in Canada, you would need to prepare a separate financial PoA for each juridiction.

We do not offer an “Expat Power of Attorney” service. But you can certainly prepare these documents at LegalWills.ca by simply stepping through our MyPowerofAttorney service, then changing your profile to a US profile using your address in Arizona. You can then recreate your document to be a financial Power of Attorney written under the strict US State requirements (each US State has its own laws for accepting a financial Power of Attorney).

Write your Will and Expat Will today

If you have assets in more than one country and your assets are distributed across Canada, the US, and/or the UK, you can prepare your Expat Wills using our service. Each Will takes about 20 minutes to complete, and costs $49.95.

When you have stepped through our service, simply print the document and sign them in the presence of any two adult witnesses (who have nothing to gain from the contents of the document). You can have peace of mind knowing that you have taken care of your estate in less than an hour, for less than $100. Just go to our Expat Will service to get started.

- Probate in Canada – What it is, what it costs, how to reduce fees. - January 6, 2025

- All about Trusts – how to include a Trust in your Will - June 9, 2022

- The Holographic Will – what is it and when should you use one? - May 18, 2022