There appears to be divided opinion on the importance of Wills. There are a group who believe that a Will is a document to be written on one’s deathbed, as a final statement to explain who will receive the family heirlooms. Fortunately, most of us are wiser, and understand that a Will is something that everybody needs, no matter how old, or how wealthy. A Will is a vital part of your financial plan that is written when you are young, and updated throughout your lifetime.

“Fortunately I don’t need a Will yet”

A caller contacting LegalWills.ca on behalf of their mother

But statistics show that what we know about Wills, and what we actually do about Wills are two very different things. I think most of us were shocked to hear that Prince didn’t have a Will, while silently thinking that it’s something that we really need to get to ourselves.

Recent surveys have been quite consistent in putting the number of Canadians without a Will at just over half. A 2013 CIBC survey put the number at “about half”, while a 2012 LawPRO survey claimed that 56% of Canadians did not have a Will in place. Most recently, in 2014 the BC Notaries reported a number of 55% of British Columbians without a Will.

At LegalWills.ca we were interested in not only the number of people without a Will, but also the number of people with out-of-date Wills. This came from a social discussion on Wills that went something like this;

Dave: I do have a Will, but I wrote it a while ago.

Me: you think it may need to be updated?

Dave: Well, I wrote it just after we got married, but before we had the children.

Me: Are you kidding me? your girls are now 24 and 21 years old !! you don’t have a Will.

Background to the Wills survey

In an online survey we asked the following question; and received responses from 2,000 Canadians;

The responses were targeted across age, gender, income level and geography to ensure that the sample was representative of the Canadian population. The results were weighted by Age, Gender and Region.

The survey was conducted within Canada by Google Consumer Surveys, June 2016, among 2,000 adults aged 18 and older, and has a root square mean error of 4.7%.

For full information on Google Consumer Survey methodology and validity, click here.

Do you have a Last Will and Testament?

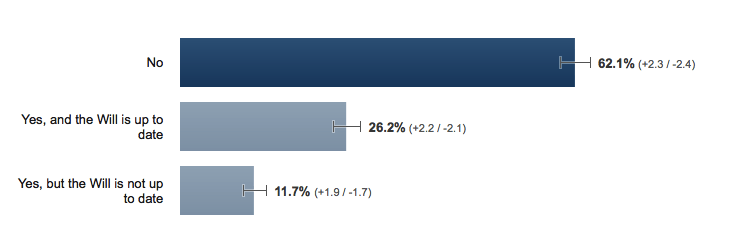

Our survey results show that 62 percent of Canadians do not have a Last Will and Testament. But interestingly, it also shows that nearly 12 percent have an out-of-date Will. So we are left with only a quarter of respondents in possession of a current Will that reflects their personal and financial situation.

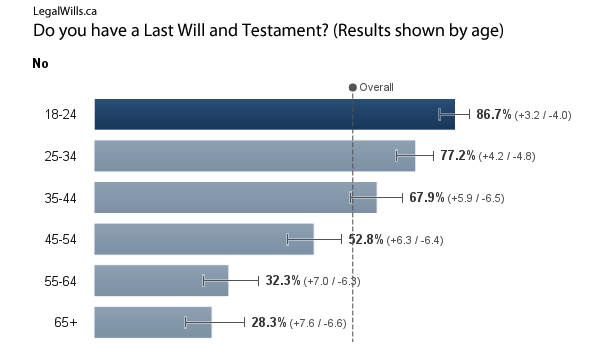

There is an obvious criticism of this rather surprising result. We would expect younger people to not have a Will in place, and if a large number of 18-24 year olds did not have a Will, should we really be concerned?

But if we look at the data for Canadians over the age of 35, the results are still a little concerning. Just over one third had an up-to-date Will in place.

Canadians with Wills by age

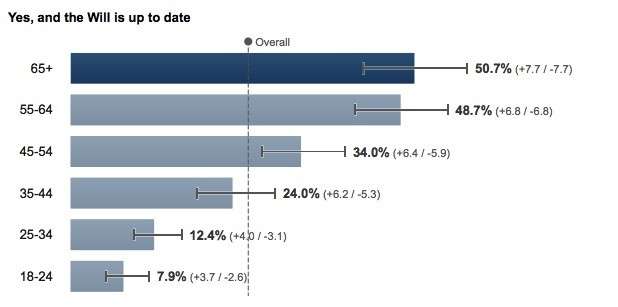

When we dissect the data by age, it is remarkable how few Canadians have an up-to-date Will. In fact, even amongst seniors over the age of 65, only about half have a valid Last Will and Testament in place.

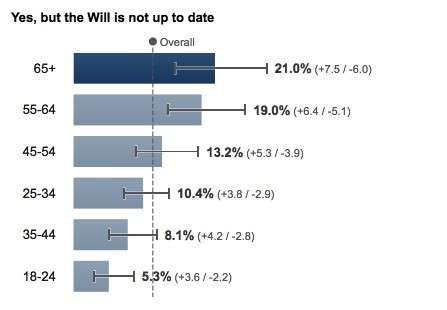

What is of particular concern though, is the number of out-of-date Wills by age

A fifth of all Canadians over the age of 65 have a Will, but it is out of date and doesn’t reflect their current circumstances.

Across all age groups there was no statistical difference in the percentages of male or female respondents who had a Will, or who had an out-of-date Will.

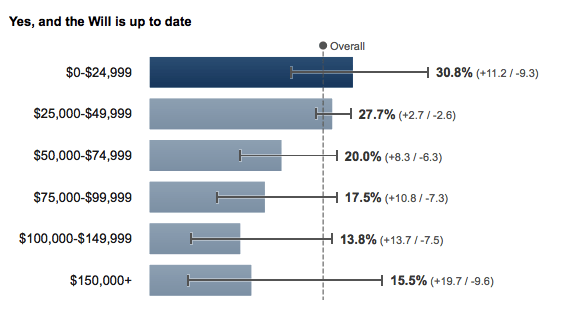

Canadians with Wills by income level

It is commonly asserted that “estate planning”, like financial planning, is a tool for the rich. I have often read reports claiming that people consider writing their Will when they have accumulated significant assets. This is not reflected in our survey results at all and may in fact be a myth.

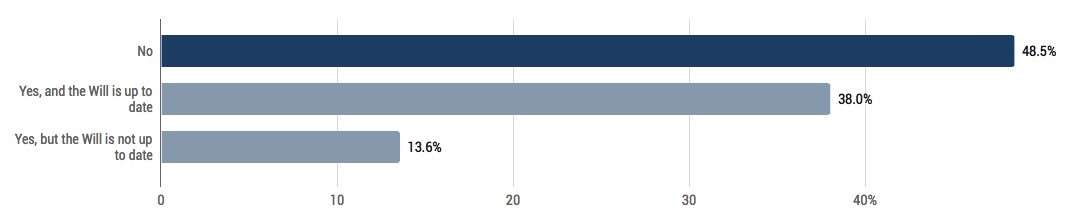

Do you have a Last Will and Testament?

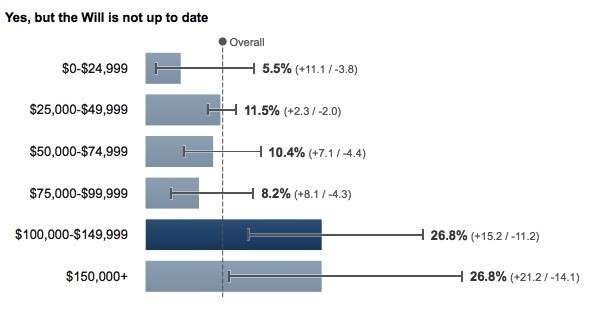

This tells us that it is the lower income groups that appear to have prepared an up-to-date Will. What is particularly interesting is the percentage of higher income individuals who have written a Will, but it is now out-of-date.

So it seems that Canadians making over $100k a year suffer the double whammy of being the least likely to have a current Will, and by far the most likely to have an out-of-date Will.

Some observations from our Wills survey

1. The Will writing system is broken.

Everybody needs a Will; young or old, single or married, affluent, or going through some tough times, you need a Last Will and Testament. Wills not only describe the distribution of your assets and possessions, but they allow you to make key appointments, including an Executor (who takes care of everything on your behalf) and guardians for young children.

Even if you think it’s obvious what will happen to your estate, the process is much simpler with a Will. If you have a named Executor, this person presents your Will to the probate courts, is given court authority to gather your assets, and follows the instructions in your Will. If there is no Will (you die intestate) there is a lot of confusion. You only need to look at the high profile examples of people like Prince to see families fighting in court over something as simple as the Executor appointment.

We know that everybody needs a Will, but even allowing for statistical variation, our survey shows that the vast majority of Canadians don’t have one in place. This suggests that the system for creating and updating Wills isn’t working for most people.

2. What do we mean by an out-of-date Will?

When we asked this question in our survey, it was to try and understand how many people had Wills that no longer made sense. For example a Will that was written before having children, and wasn’t updated to reflect the new family status.

My own personal admission is that after the birth of our second daughter, I worked every day at LegalWills.ca for over a year before I updated my Will. We procrastinate, we forget, it just never makes it to the top of the To-Do list, and many of us are left with Wills that no longer work.

But updating a Will can be more subtle. Supposing your alternate Executor is suffering through an illness, would you update your Will? You should. What if you wanted to include a new charitable bequest? You probably wouldn’t go through the hassle of preparing a new Will would you?

There are countless reasons why you would want to update your Will, but making an appointment with a lawyer and paying the substantial fees would be enough to put most people off.

3. People wait for the perfect time.

So why do so many people not have a Will if they know that they need one?

Most of you are under the impression that writing a Will is a costly and inconvenient process, and if it is has to be done, it should only be done once in a lifetime. So if you are single, you would probably hold off until you get married, or buy the house, or have the first child, or the second, or you have received your inheritance. The fact is, that there is never a time when your circumstances have stopped changing. You become one of the 62% of Canadians without a Will.

4. Being without a Will has nothing to do with affordability

Many people turn to LegalWills.ca because they have been quoted $800 for a simple Will. By this, I mean that a person is married with two children, they want everything to go to their spouse, and if something were to happen to both of them, the estate would be divided between the children. The professional legal charges for this type of Will are indeed egregious, but as we’ve seen from our survey it is actually the highest income groups who are most likely to not have a Will.

It is commonly stated that do-it-yourself Will services don’t work for high income individuals, and that these people really need legal advice to prepare a Will. But just 15 percent of people earning over $150k have prepared a Will. The only conclusion to draw is that cost is not the main barrier, but rather the process of writing a Will with a lawyer is too inconvenient and time consuming.

5. People really don’t understand the impact of dying without a Will.

Too many people are like Snoop Dogg. Forbes reported that Snoop Dogg doesn’t have a Will because “I don’t give a ****, I’ll be dead”.

Unfortunately, what Mr Dogg doesn’t realize is that writing a Will was never about you. It’s about taking care of your loved ones – the people that you care for through your life, I’m not sure that many people would deliberately inflict trauma on their own family at a time when they can least handle it, but not writing a Will is setting your family up for heartache and emotional turmoil. It all too often leads to acrimonious fallouts between family members who seemed to get along just fine until they had to work together to administer an estate without a Will.

6. Not having a Will is a huge missed opportunity

There is more to a Will than just covering your bases. You can do wonderful things in a Will, for example:

- Leave a few thousand dollars to a charity

- Give your favourite niece some funds to travel the World

- Set up an event in your memory

- Create a scholarship fund

- Organize and pay for some social events for your best friends

- Leave a cherished item to somebody who will really appreciate it

- Make sure your digital accounts are all taken care of appropriately

- Make sure that your pets are taken care of

The list goes on. Of course without a Will, the courts will just split up your assets according to the Provincial laws of intestate succession. It will almost certainly not reflect how you would have chosen to distribute your assets.

7. Most people don’t understand how easy it is to prepare a Will.

You have to make some important decisions in your Will and these can take time. Appointing your Executor and the guardians for your children are not decisions to be taken lightly and you may need to consult with family and loved ones. But once you have a solid idea of the contents of your Will, the process for writing a Will is actually very simple. It takes much less time than filing your taxes.

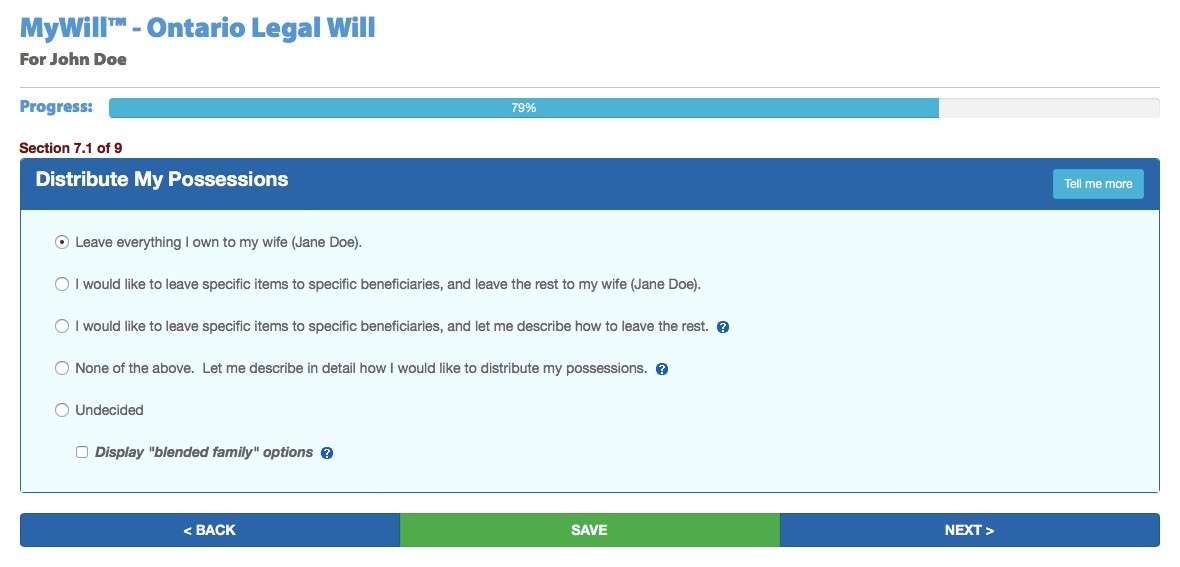

Stepping through the process at LegalWills.ca takes about 20-30 minutes. We guide you through 9 sections related to your family situation and then prompt you through the distribution of your estate, making sure that every eventuality is taken care of. If you are involved in a common accident for example with your main beneficiary, there has to be a backup plan, and our service makes sure that this is included in your Will.

After stepping through the service, you simply download and print your Will as a PDF file and then sign it in the presence of two witnesses. These can be any two adults who have nothing to gain from the contents of the Will. Once signed and witnessed, you have a fully legal Will.

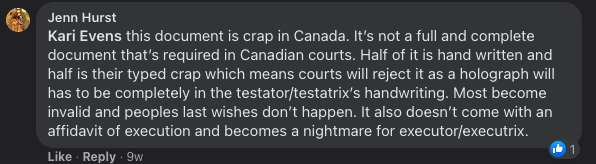

8. The myths surrounding do-it-yourself Will services endure.

Back in the 1990’s there were widely advertised Will kits that quite rightly came under a lot of criticism. There were too many blank spaces in these kits, and it was too easy to make a mistake, but the mistake wouldn’t come to light until after you had died.

Online interactive Will services are nothing like Will kits.

Some of the criticisms of “do-it-yourself” will writing apply to blank form kits, but do not apply to online services.

For example, our service is entirely Province specific. The first question you answer is your location, and from that point the service prepares documents specific to your Provincial laws.

The services are continually updated. Just today, there was a ruling over assisted suicide that has made its way into the help text of our Living Will and Advance Directive service. We continually update our services to reflect the changes in estate planning laws.

Finally, our service won’t let you create a Will without naming an Executor, creating an alternate plan, having a residual beneficiary, and naming a guardian if you have minor children. The service checks for errors in much the same way as tax preparation software. Then we allow you to update the document as many times as you need to, so that you can be sure it reflects your wishes.

9. The appropriateness of online Will services is underestimated.

We often hear it said that a “do-it-yourself Will service” is only appropriate for the most simple situations. It’s a tired narrative that seems to get repeated over and over. The fact is that online services like the one at LegalWills.ca now include more advanced provisions including trusts for minors, guardians for children, and blended family situations including lifetime interests in property.

Blank form kits can only cater for very, very simple situations (and even then, they can be dangerous), but online interactive services can address the needs of the vast majority of Canadians.

The service at LegalWills.ca uses the exact same software used by estate planning lawyers across Canada. So the final product is usually word-for-word identical to a Will produced by a law office.

Conclusion

There is still a problem in Canada with people not writing their Wills. At LegalWills.ca we are offering an alternative, and after 15 years in business we have helped hundreds of thousands of Canadians prepare their Will. But the numbers are still dismal, and we either need to improve education or encourage people to embrace modern Will writing options like the service at LegalWills.ca.

- Probate in Canada – What it is, what it costs, how to reduce fees. - January 6, 2025

- All about Trusts – how to include a Trust in your Will - June 9, 2022

- The Holographic Will – what is it and when should you use one? - May 18, 2022