If you have young children, it is critical to write a Will. The challenge of course is that you are busy. Co-ordinating time with a lawyer, and perhaps your partner, is very difficult. So difficult, that this is a task that is unlikely to make it to the top of the To-Do list for today, or even this week.

Fortunately online services like the Will writing service at LegalWills.ca makes the process much more convenient and significantly more affordable than preparing a Will with a lawyer.

This article gives an overview of why a Will is critical, what you can do within a Will, specifically if you have children, and how you can prepare a Will in a cost effective and convenient way. We also discuss why and how you can update a Will if circumstances change.

Table of Contents

What are the key elements in a Will?

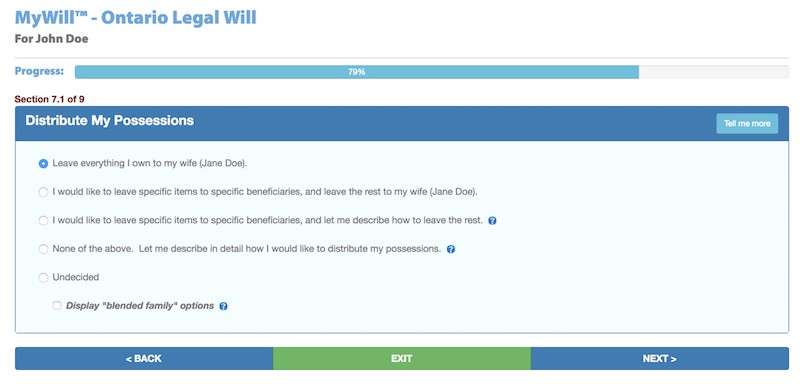

You probably think of a Will as a document that describes the distribution of your assets (possessions) after you have passed away. This is, of course, a significant part of a Will, and one of the most important reasons for preparing one.

But there are at least two other important reasons for preparing a Will.

The Last Will and Testament allows you to name an Executor. This is the person that you are putting in charge of your affairs, to represent you after you are gone. There are a number of responsibilities for your Executor. Essentially, they are responsible for gathering your assets, securing them and then distributing the assets according to the instructions in the Will. They also have to take care of certain administrative tasks like dealing with the Canada Revenue Agency, probating the Will, and even arranging the funeral.

Your Will also allows you to name a guardian for your children. This is the person that you would most like to care for your children if neither parent were available. The appointment in your Will serves as a guide for a judge in a family court who will make the legal appointment.

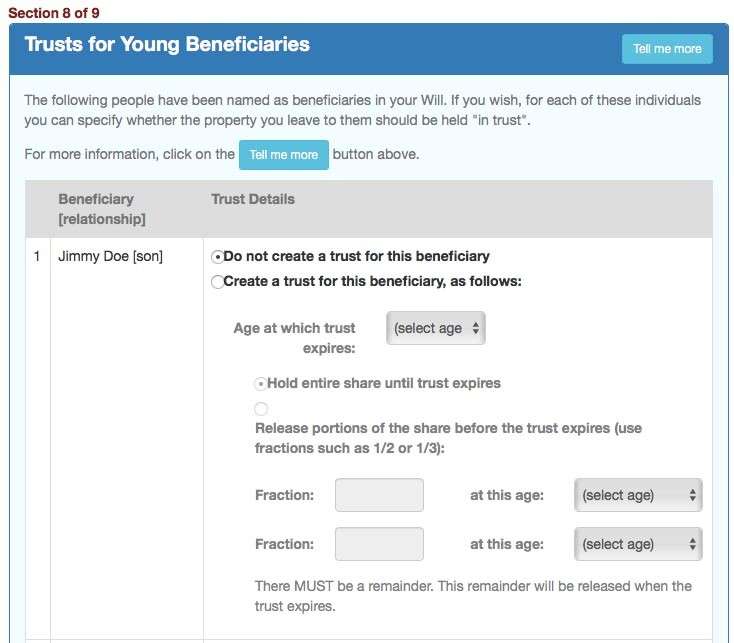

You can also set up a trust for minor beneficiaries in a Will. This allows you to specify the ages at which a child will receive the inheritance or portions of their inheritance. You cannot leave an inheritance directly to a six year old, but you can leave the inheritance to them in trust, where it will be managed by a trustee until they are old enough to receive the inheritance directly.

How do I name a guardian for young children?

In reality what happens is that a judge at the family courts will appoint a guardian. Hopefully people will come forward and offer themselves as the guardian and the judge will grant guardianship to the person or family that he/she considers to be the most appropriate. As a parent, the stated appointment in your Will would be the over-riding factor in making that appointment. If this person is still willing and able to serve as the guardian, then the judge would most likely grant guardianship to this person.

Of course, circumstances can change between the writing of the Will and the guardianship appointment being made. For example, your guardian may have personal struggles of their own and are no longer be fit to look after your children. This is why your guardianship appointment in your Will is not a legally binding appointment.

When a judge makes an appointment, they do not know anything about your family. They do not know which prospective guardians share your values, your parenting philosophies, or have the best relationship with the children. The judge can only look at financial means, their own family situation, and where the prospective guardian lives.

When people step through the service at LegalWills.ca, many stop at the question of guardianship. They find it too hard to choose between two close family members.

However, the decision is always better in your hands, rather than left to a courtroom.

Does a guardian for children have to live in Canada?

No, absolutely not. You must name the most appropriate guardian for your child. You can weigh the relative disruption of your child moving to another country, with the benefit of being with the best person to raise them. Again, this would be a very difficult trade-off for a judge to make. But you may feel that your child would be much better off with your sister in Sweden, than your Aunt in Toronto.

Your appointment of guardian is not limited to people living in Canada.

Can I name more than one person to be the guardian for my child?

You can certainly name a couple, but you have to consider what happens in a breakdown in their relationship. It is more common to name a single person as the guardian, with an alternate (backup) appointment, just in case circumstances change and your first choice is unable or unwilling to serve.

Can I name somebody other than the child’s parent to be a guardian?

It is quite common for biological parents of a child to no longer be living together. Occasionally, we are asked if it is possible to prevent the child’s other biological parent from serving as “guardian”.

“I am no longer with my spouse (the biological parent of my child), I want to make sure that if something were to happen to me, that my spouse does not gain custody of my child. I want my mother to care for my child instead”

It is worth reviewing how the guardianship appointment is made. Prospective guardians will put themselves forward and a judge will make the appointment. The judge will be faced with a decision between the biological parent of the child and an appointment made in your Will.

The judge will take into account many factors, and it is not possible to speculate on the final appointment.

Can the guardian be a witness to the signing of a Will?

Yes. You may be aware that a beneficiary in a Will cannot serve as a witness to the signing. But this is the only restriction for witnesses. In fact, even if a beneficiary does serve as a witness, in most Provinces, they simply default on their bequest. It doesn’t invalidate the Will.

There is no restriction on a guardian serving as a witness.

Having said that, we generally recommend that your witnesses have absolutely nothing to do with your Will. So it would be better to have witnesses who are not named in the Will in any capacity. This ensures that there will not be any disputes.

Can the guardian be the Executor of the Will?

Yes. There is no restriction on your appointed guardian serving as a witness. You may have a friend or family member who is perfectly qualified to serve in both roles, and simply being appointed to one position does not preclude them from serving in the other position.

Should my partner and I both name the same guardian for our children?

At LegalWills.ca we do not support Joint Wills. This is a single document that serves the needs of two people. Instead, we recommend the use of a Mirror Will. This is two separate documents, each of which typically names the partner as the main beneficiary, with a plan in case both are involved in a common accident. But the Wills do require some co-ordination.

Remember, a judge is going to appoint the guardian based on any guidance made in a parent’s Will. It helps enormously if both parents have named the same guardian. If you do not name the same guardian and you are both involved in a common accident, you are potentially creating a custody battle between friends and family members.

How do I leave a set of instructions for the guardian?

Do not leave these instructions in the Will itself. Your Last Will and Testament is a legal document that describes key appointments and the distribution of your estate. It’s not a place for general commentary. If you have particular parenting philosophies to pass on, or instructions for handling certain behaviours, or even messages of support, these can be included in a letter to accompany the Will.

The letter can then be stored with the Will.

Remember, after your Will is probated, it becomes a public document that anybody can read. Instructions for parenting do not belong in a Last Will and Testament.

What is a trust for a minor and how do I set one up?

In Canada, you cannot leave an inheritance directly to a minor. You can leave a bequest of $100,000 to a six year old, but they cannot receive the money directly until they are an adult, or until they reach the age that you specify in your Will.

A trust is a legal arrangement that has somebody (a Trustee) take care of a property or assets on behalf of somebody else who is not able to take care of the asset themselves. Trusts can be used in a number of different scenarios, for example, a child with special needs can have a particular type of trust set up called a “Henson Trust” whereby they don’t receive money directly, but somebody looks after it for them.

In your Will you can leave money to a young child, but it will be kept in trust. If you use a service like the Will writing service at LegalWills.ca you can define different ages at which the child can receive their inheritance.

You are able to specify that parts of the trust are released before the trust expires. For example, you could decide that 1/3 of the total value of the trust is released when the child is 21. You can then have a second milestone, and specify a fraction of the remaining trust that will be released to the minor.

For example, if the value of the trust was $90,000 you could specify that 1/3 of this would be released when the child turned 21 ($30,000). You can then specify that at 25 the child will receive 1/3 of what remains ($20,000 assuming there was no change in the overall value of the trust through investments and money spent for the maintenance of the minor). Then at 28, the trust expires giving the minor the remaining $40,000.

How do I leave money for the guardian to care for my child?

You cannot leave something to one person for the benefit of another person. You cannot leave a sum of money to a legal guardian to fund the upbringing of the child. You either leave the sum to the guardian or you leave it to the child. Otherwise, somebody else would have to police the spending of that inheritance to ensure that it was only used for the child, and there are some grey areas like family vacations or home renovations that could be paid out of the child’s inheritance “for the benefit of the child”.

The correct approach is to leave the inheritance to the child. It would then be kept in trust and managed by a trustee (the Executor of your Will). The guardian can work with the trustee to release funds for the benefit of the child. With this approach, the needs of the child are addressed, but there is also accountability between the guardian and trustee. The funds can be used to help the child when they are still minors, but with a view to protecting the assets in the trust so there is something left for them when they become old enough to receive the trust outright.

The Executor of your Will would serve as the trustee, but there are two important clauses in your Will. The trust clause itself states that the Trustee

“may from time to time until he/she becomes absolutely entitled to all the capital of her share pay to or apply for the benefit of him/her the whole or such part of the net income derived from such share or the part thereof from time to time remaining in trust and such part or parts of the capital thereof as my Trustee in his or her absolute discretion deem advisable”

So the funds within the trust can be used for the benefit of the child as they are growing up. In addition there is a clause

“I authorize my Trustee to make any payments for any person under the age of majority or who is otherwise under a legal disability to a parent, guardian or committee of such person”

So the trustee can pass the funds onto the guardian if they determine that this is an appropriate thing to do.

If you tried to set a fixed amount ahead of time, you would have to predict the situations that may arise. You don’t know when the Will is going to come into effect and what needs the children may have. For example, the children may need to pay for advanced medical treatments that are unavailable in Canada, or legal fees, or tuition fees at a particular school, or sports, or music activities. These could be paid for out of the trust if the trustee feels that they are in the best interests of the child. They can also release funds for the general maintenance of the children in consultation with the guardian, but there would be records of payments made and accounting that can be shared with the children.

What happens to a young child’s inheritance if I die without a Will?

The child will still receive their inheritance, but they will receive everything when they reach the age of majority in your Province (either 18 or 19). Most people feel that this is a young age to receive a large sum of money.

A Trustee will have to be appointed by the courts (not necessarily the person that you would have appointed). And the Trustee’s hands will be tied. They will not be able to release portions of the trust for the benefit of the child while they are growing up. The guardian (appointed by the courts, and not by you) will also have difficulty accessing funds within the trust to pay for the raising of the children.

Do I have to include adult children in a Will?

The answer to this question varies by Province. Across Canada there is no legal obligation to include an adult child in your Will unless they are a dependent that is either still living with you, or dependent on money from you.

In British Columbia things are a bit different. BC has the “Wills Variation Act” that opens the door for an adult child who feels that they have been treated unfairly to make a claim against an estate. There is an excellent overview of the Wills Variation Act on the “Disinherited” blog. But BC is unique in allowing an adult child who has been treated “unfairly” to challenge a Will. It would be up to the courts to determine if the claim has merit.

How do I write a Will if I have young children?

There are three options for writing a Will in Canada:

- Using a blank form kit, or a blank sheet of paper

- Using a lawyer (or a Notary in BC, or Notaire in Québec)

- Using will writing software; now usually online.

The cost for a Will varies significantly depending on which approach you take.

A growing number of people are moving to online Will writing services like the one at LegalWills.ca because of the convenience and affordability. You can simply go to our Will service and write your Will in about 20 minutes for $39.95 from the comfort of your own home. No appointment necessary.

You don’t have to complete the service in one sitting. If you get stuck on your guardianship appointment, or charitable bequests, or pet trusts, simply save your work, and return at a later date.

Once you have stepped through the service, your document is compiled, you then print the document, sign it in the presence of two witnesses, and you have your legal Last Will and Testament.

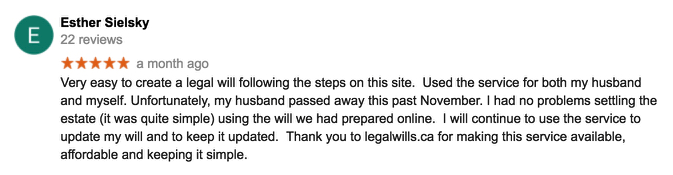

We have been in business since 2001, and have helped hundreds of thousands of Canadians prepare their Will. We have never once heard of there being an issue with one of our Wills.

When should I update my Will?

There are obvious life events that should prompt an update to your Will. For example, a change in your marital status, or the birth of a child.

Your child becoming an adult should also trigger a review of your Will. As well as your child having children of their own.

In fact, if there is a change of circumstance to anybody named in your Will, you should review your document to see if it still reflects your wishes. For example, your Guardian may have moved to the other side of the world, or had triplets of their own. Your Trustee may have been taken ill, it would therefore be important to appoint a new trustee, even if temporarily.

You may also have had a change of heart about your distribution plan. For example, a charity may become an important part of your life, and you want to acknowledge their work with a charitable bequest in your Will.

How do I update my Will?

If you wrote your Will yourself with a blank form kit, or blank piece of paper, you may be tempted to handwrite a change. This is not recommended, since it can lead to confusion – this is the strategy used by Aretha Franklin that resulted in millions of dollars in wasted legal fees.

If you wrote your Will with a lawyer, then you should return to that lawyer and ask for them to prepare an update. Unfortunately, this can be time consuming and as expensive as preparing the original Will ($400-$800).

If you use an online service like the one at LegalWills.ca you can simply login to your account, modify your Will, print out the new version and then sign the new document in the presence of two witnesses. There probably will be no charge to do this.

You may be wondering about a codicil. We regard this as an outdated approach and explained the pitfalls of codicils in a recent article.

If you have children, write a Will.

Hopefully this article gives you an overview of the important of writing a Will, particularly if you have children. Dying without a Will places a tremendous burden on the family that you leave behind.

The process only takes 20 minutes, and costs $39.95. Your Will is not something to be written once in your lifetime, but should be written today, and updated throughout your life.

Write your Will today.

- Probate in Canada – What it is, what it costs, how to reduce fees. - January 6, 2025

- All about Trusts – how to include a Trust in your Will - June 9, 2022

- The Holographic Will – what is it and when should you use one? - May 18, 2022