Completing your Will is an important step, but it is not the only thing that needs to be done to get your affairs in order. Working through the suggestions below will not only help you organize all of your assets, but will also ensure a smooth process for your surviving loved ones.

Store Your Will and Be Sure That Your Executor Knows Where it is Stored

Once you have signed your Will in the presence of two witnesses, who in turn sign the document, it is a legal Last Will and Testament. At this point, you simply need to store the document in a place that is known and accessible to your Executor.

Your Executor is the only person who needs access to the Will. You do not need to share the document with your beneficiaries or family members. Some people simply give the Will to their Executor (or alternate Executor) for safe keeping in a sealed envelope.

There is no requirement to store the Will with any particular registry, and there is no requirement to register the document with any court or government department (this is done after you have died).

Your Will is a document that can be updated throughout your lifetime. Any time you make a change to your Will, you should sign the new document in the presence of witnesses. Ideally, any older Will should be destroyed, although this is not a requirement. Your most recently signed and dated Will is your “Last” Will and Testament and the only one that is active (assuming that it meets the legal requirements for a Will).

Make an Asset Inventory

Your executor faces the monumental task of reconciling all of your assets after death. When the Executor applies for probate, the estate must account for each item of property and assess its value in a matter of weeks. The time frame for filing a property inventory varies across each province. In most jurisdictions, the court requires an official probate form to be used for the inventory of assets. The estate representative compiles a list of all real estate, personal property, bank accounts, and debts, with a detailed description of each item and its fair market value.

To help your estate representative after death, it is a good idea to compile an inventory of assets now. No one knows better than you what you own. Here are some helpful tips to consider:

- Make a list of all your assets including real property, personal property, bank accounts, retirement, RRSPs and TFSAs. Do not forget to include all debts and non-probate assets (items with named beneficiaries).

- For real estate, include in-province property and out-of-province property. Provide a description of the real estate, with its physical address and the fair market value of the property based on the most recent tax assessment. If possible, obtain copies of the deeds which show that you are the title holder.

- When listing all personal property, create subcategories such as recreational vehicles, entertainment equipment, and expensive jewelry. List each item under the appropriate category, with a complete description and its fair market value. Collections of music, stamps or coins can be listed and valued as a single unit.

- List all bank accounts. Include the name of the bank, bank account number, all names listed on the account and actual cash value. The actual cash value refers to the exact dollar and change amount at the time of death.

- List any retirement accounts, RRSPs or TFSAs. Include the names of the beneficiaries as these are sometimes different from the beneficiaries in your Will. You may also need to obtain divorce settlement documents regarding the division of retirement funds if an ex-spouse is entitled to payouts.

- List all debts, such as credit card debts, past due medical bills, unpaid invoices and personal loans. There is no need to include funeral expenses or debts acquired after death by the estate.

- List all non-probate assets on a separate sheet. Non-probate assets are distributed according to prior contractual agreements. For example, a house owned jointly by both spouses, with rights of survivorship or as joint tenants, transfers to the joint owner without probate. These assets will not be included in the estate, but it is a good idea to clarify what assets will or won’t form part of the estate. If the court enquires about these assets, the executor can easily reference the list of non-probate assets and explain their absence from the probate inventory.

You can keep your inventory of assets with your Will. To ensure its accuracy and to keep it up to date, you may want to retain it and make your executor aware of its existence.

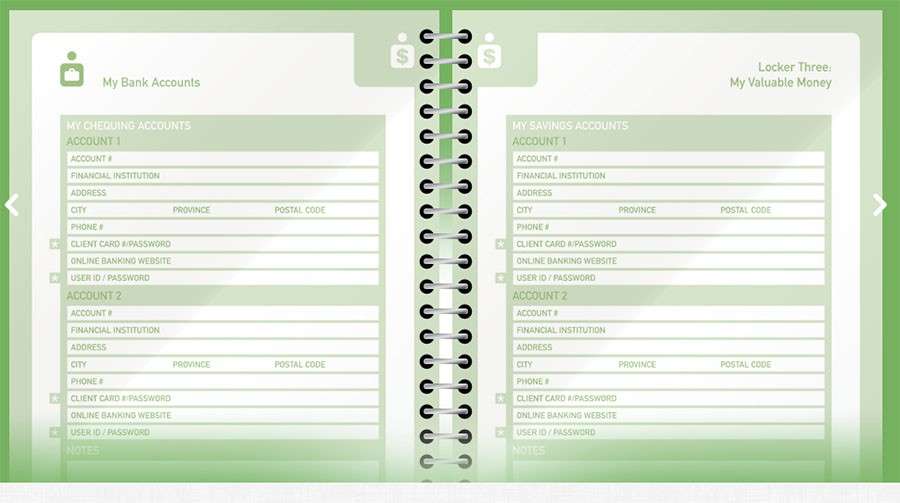

To make this process easier for you, LegalWills.ca has created “MyLifeLocker“. This service allows you to document all of your assets and people to contact. This would allow your Executor, or your representative appointed through a Power of Attorney, to immediately start work on items like working with your utility companies, cancelling your subscriptions and making sure that payments stop for services not being used. In general MyLifeLocker ensures that no assets go undiscovered by your Executor.

Describe your Funeral Wishes

While your Last Will and Testament is the place where you should write down what you want to happen to your property after you die and who should be in charge of making sure that your property goes where you want it to go, your Will should not be the place where you list your funeral wishes. By the time your Will is obtained and read, your loved ones will have most likely already made all of the decisions about your burial or cremation and memorial service.

Therefore, the best way to let your loved ones know about your funeral wishes is to write down a list of specific instructions in a document that is separate from your Will. This separate document should include whether you want a funeral or memorial service; whether you want a gathering of friends and family; whether you want to be cremated, and, if so, where you would like your ashes to be stored or disposed of, etc. In Canada, the average funeral costs around $8,000, with cremation being a quarter of that price.

If you have a specific wish or plan in mind that you would like carried out after your death, you will have to provide clear instructions. It is also important to let your loved ones know that you have created this plan and where it is being stored so that they can access it at the appropriate time.

This also protects your family from any fall-outs over the funeral arrangements. It is quite common for families to disagree over the amount to be spent on a funeral, and even the disposition of the body (buried or cremated). By writing your wishes ahead of time, you are saving your family from making these decisions at a time when they may be grieving your loss.

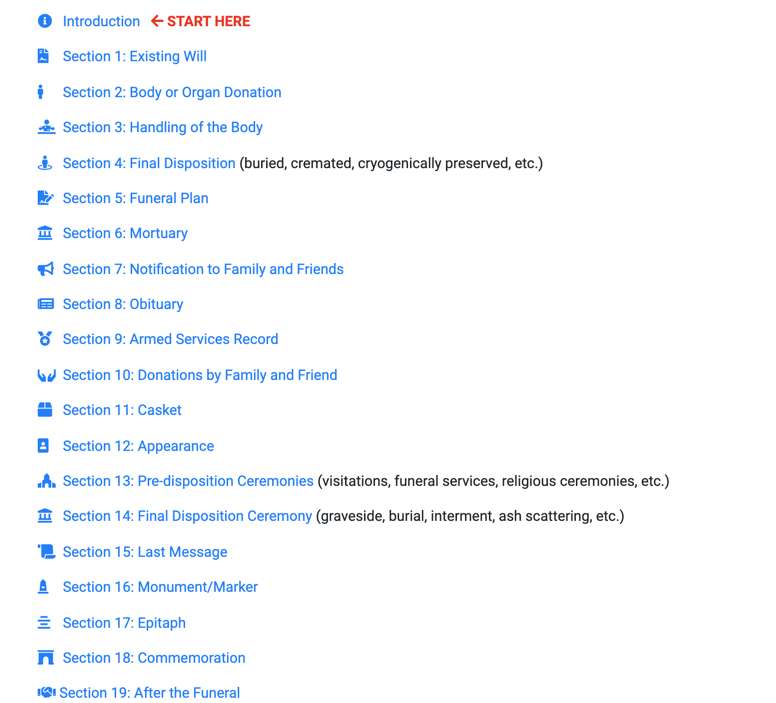

At LegalWills.ca we have helped with this part of the process by creating the MyFuneral service, which is a part of our Premium Will service. This guides you through all of the decisions related to describing your funeral wishes.

Prepare a Financial Power of Attorney and Living Will

There are typically three documents considered to be a complete estate planning package. These are the Last Will and Testament, the Financial Power of Attorney and the “Living Will” (made up of a Healthcare Proxy or “Substitute Decision Maker” as well as an “Advance Medical Directive”).

The Financial Power of Attorney

This document is in effect while you are alive. For an estate planning Power of Attorney, it is written when you are capable, and typically comes into effect only after you have lost capacity. It usually gives general access to all of your financial assets, so that your representative can pay your bills on your behalf, manage your investments, and cancel any ongoing subscriptions. This is a General Financial Power of Attorney and is often described as “Enduring” (meaning that it is in effect after you have lost capacity) or “Springing” (meaning that it only comes into effect after you have lost capacity).

The Living Will

The term “Living Will” is not a legally recognized term in Canada, but we use it to describe the service that we offer at LegalWills.ca (simply because it is the most commonly used search term for this type of document). Your Living Will is made up of two documents: You can name somebody to make medical decisions on your behalf if you are ever unable to speak for yourself. This is called a “Healthcare Proxy”, “Medical Power of Attorney”, “Substitute Decision Maker”, or other names depending on where you are located.

Your Living Will also allows you to describe the type of medical treatment that you wish to receive if you are ever in an irreversible terminal condition – like a coma. This is known as your “Advance Medical Directive”.

Your Power of Attorney and Living Will are important documents to have in place to set alongside your Will. Your Will only comes into effect after you have died; the other documents are in effect while you are alive and are immediately cancelled as soon as you pass away.

Create a Plan for Your Digital Assets

Digital devices, local servers, and the cloud store billions of pieces of valuable, confidential, and proprietary information. In 2014, 48% of Canadians paid the majority of their bills online and more and more people use financial sites such as Mint, Buxfer and tax software to store information. Given the importance of people’s “virtual lives”, estate attorneys and their clients need to consider digital assets as part of the estate plan.

Digital assets can include anything from a PayPal account to a blog, email, or social networking account like Facebook and Twitter. It has also become increasingly popular to store purchased music and personal, copyrighted photographs online. Even online game accounts are potential assets.

Digital estate planning relates both to the assets themselves and to the method for accessing the assets. Without a plan, surviving loved ones may not be aware of the online asset or have any access to it without the testator leaving usernames, passwords and any other security required information. The same issues regarding access to passwords and accounts apply in the case of a testator that becomes incapacitated Therefore, you should leave clear instructions granting digital authority to either your executor, power of attorney, or other trusted person.

At LegalWills.ca you can describe your digital assets and the management of these assets using our MyLifeLocker service.

Complete Everything That You Need at LegalWills.ca

LegalWills.ca offers one of the most cost effective approaches to writing your Will. In addition, through our MyLifeLocker, MyVault, MyPowerofAttorney, MyLivingWill, and MyFuneral services, we have everything you need to protect your loved ones.

We encourage you to get started today!

- Probate in Canada – What it is, what it costs, how to reduce fees. - January 6, 2025

- All about Trusts – how to include a Trust in your Will - June 9, 2022

- The Holographic Will – what is it and when should you use one? - May 18, 2022