As we spend more time online, our social, sentimental, and financial assets have begun to migrate online as well. Collectively, we have come to call these items, your digital assets.

Unfortunately, people all too frequently neglect the digital component when they write a Will. You probably haven’t considered creating a plan for your Facebook, LinkedIn or Twitter accounts. Maybe you have recently experienced the loss of a friend and seen first hand the mis-management of online accounts for people who are no longer alive, I know I have. Sadly, three of my ex-colleagues have died, and every year, LinkedIn still prompts me to congratulate them on their work anniversary.

But there is much more to digital assets than your social accounts. Some of these assets simply need to be managed, some need named beneficiaries, and some have real monetary value and should be included as part of your estate.

Copyright: fgnopporn / 123RF Stock Photo

Your Digital Assets – what are they?

You can divide the three most common forms of digital assets into three categories: social, sentimental, and financial digital assets. You may have a plan for your social assets, but having a comprehensive plan for your sentimental and financial assets is probably more important.

Social assets:

These include social media accounts and other public online presences.

- You may want to prevent your social media accounts from remaining active after you pass.

- Some social media services (like Facebook) allow your profile to become a digital memorial of sorts. Depending on what you and your family decide, this may be an appropriate middle ground between closing the account entirely and allowing it to remain active.

- Each social media service has its own procedures for dealing with the account of a deceased person.

Sentimental assets:

These include things like cloud storage for family photos, music collections, and so on.

- Vinyl records and film photographs may be a thing of the past, but leaving loved ones curated digital collections of media including family photos, e-books, or digital music may be a great way to pass along memories.

- Digital services are also taking the place of traditional pen and paper archives. Geneology services like ancestry.com or health data services like 23andme are worth preserving as sentimental assets if you feel like the information may be interesting or useful after your passing.

- Your family could still end up fighting over these accounts and sentimental digital assets, so it is worth having a plan for them in your Will.

Financial assets:

These include anything with tangible real-world financial value.

- These can include things like domain names, online presences that have a balance of funds or credit including online temp working sites like UpWork, Fiverr, or Freelancer, gambling sites like PartyPoker, accounts or blogs that earn affiliate revenue through Adsense, and increasingly, Bitcoin and other digital cryptocurrencies.

Convenience and security: it really is possible?

We often hear that convenience and security are inherently opposite goals. The legal minefield around digital assets are an excellent example of this phrase in action. James Howells’ case several years ago illustrates this perfectly.

James Howells made the news several years ago after he discovered that he had inadvertently thrown out hard drives containing millions of dollars worth of Bitcoin. When this was reported, the amount numbered $7.5 million. In today’s valuation, the amount is a barely-less-significant $3.4 million. Regardless, imagine a departed relative was in possession of millions of dollars of digital assets that you were unable to access; it is difficult to imagine anything that could compound the grieving process as much as knowing that not only could these assets have paid for legal and other final expenses in the wake of a loved one’s passing, but that these assets will remain unclaimed, indefinitely. Good foresight and proper planning can prevent this headache from ever occurring.

But it is not only those who, knowingly or otherwise, hold a great deal of cryptocurrency that should worry about their valuable digital assets. Even something as everyday as an iPhone or iPad might be off-limits after a loved one passes. The CBC recently wrote about Victoria widow Peggy Bush, who was unable to retrieve the data on her late husband’s iPad because his Apple ID had gone missing. Even if you share the passcodes that will unlock the devices themselves, that something like a missing Apple ID might prevent you from accessing a deceased loved one’s data is a real potential, if preventable, heartache.

Peggy Bush’s case was only a month after the tragic attacks in San Bernardino, California, and will perhaps make more sense in light of this. The San Bernardino attack raised eyebrows in digital security circles as well as public security ones. In spite of obvious public security concerns, Apple refused to allow the FBI access to the attackers’ iPhone, causing authorities to pay almost a million dollars for a private hack instead. Although there is an obvious argument of public good to be made in favour of Apple giving police and loved ones access to Apple devices and accounts when it is appropriate to do so, it is important to remember that companies like Apple have millions of customers who rely on the security of their data, and it goes without saying that a million-dollar hack is probably out of the question for most budgets. Because it will be in the best interests of such a company to keep everything locked behind proprietary security, having a plan for your digital devices is extremely important.

What about a Digital Executor?

In theory, it makes sense to name a person who has the final say on how your accounts should be managed and distributed, and in the US, there has been some movement in law to recognize the position of a “Digital Executor”. But most accounts are bound by the service providers terms of use, which are compliant with the laws of the service provider’s home. For many online financial accounts, the head office of the service provider ends up being in places like the Isle of Man, and British Virgin Islands, and so any Canadian and US legislation would be difficult to enforce.

Creating a plan At LegalWills.ca

There are two steps to creating a plan for your digital assets; documenting the assets and describing your intentions for the asset.

At LegalWills.ca we have partnered with MyLifeLocker to take care of the ambiguity involved with these sorts of issues.

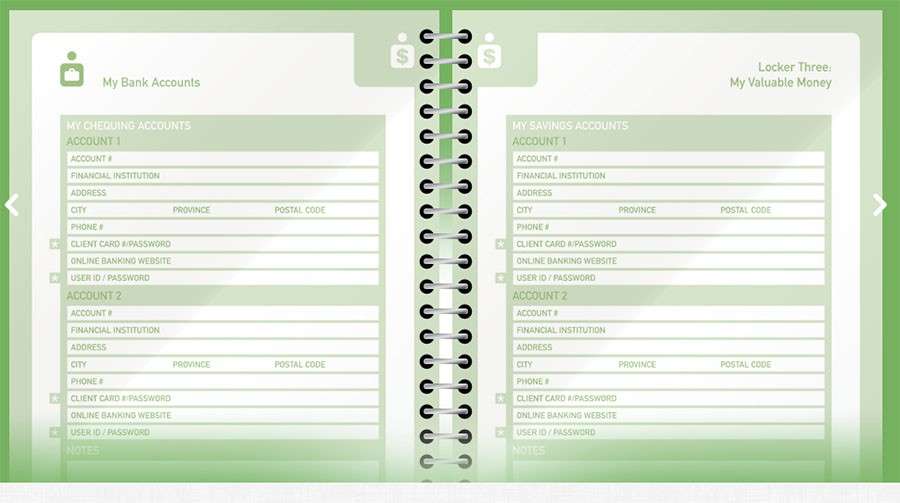

Using the Executor handbook at MyLifeLocker you can document all of your assets including your digital assets, and update these by simply logging into your account. The LifeLocker itself, does not exist on our servers, but simply an encrypted set of bits and bytes, so nobody can access your information except you, and your named, trusted keyholders.

You create keyholders, one of which is likely to be your Executor. At the appropriate time, they can login using their custom generated keyholder ID and access the services that you have given them access to. These services could include your funeral wishes, any messages that you have written, any documents that you have uploaded and of course, your LifeLocker.

For each digital asset, you can include the User ID and password, and then describe how you want that digital asset to be handled.

Without a LifeLocker, your Executor will need to guess how many online assets you have, presumably by going through your email accounts. If you have your LifeLocker in place, you can control which digital assets you would like your Executor to know about, and they only need to know about them at the appropriate time.

Regardless of what your ultimate plan of action is, probably the most important thing around digital assets is making sure that your loved ones understand the value of your financial assets. Most people are unfamiliar with the value of something like Bitcoin, domain names, prestigious account handles, ad revenues from videos, electronic downloads on blogs, the list goes on. To avoid a situation like James Howells’, you want to make sure that no matter what happens, your executor and beneficiaries understand what it is that they are inheriting.

- Probate in Canada – What it is, what it costs, how to reduce fees. - January 6, 2025

- All about Trusts – how to include a Trust in your Will - June 9, 2022

- The Holographic Will – what is it and when should you use one? - May 18, 2022