I’m young – do I need a Will?

You need a Will. In fact, there is never a circumstance where planning to not have a Will is a good idea. Dying without a Will is not a strategy, no matter how old or young you may be, you need a Will.

On a daily basis not many of us like to think about our inevitable death. It’s morbid and a subject that most of us don’t want to pay much attention to. Like going to the dentist for a root canal or having that screening at the hospital, there are some uncomfortable scenarios that we put off for as long as possible. Writing a Will should not be one of them.

But the thought of going over your possessions and paying a lawyer can be too much for some people. However, there comes a time when we need to face the cold hard reality that we won’t live forever and having a Will really isn’t for your benefit, but you write a Will for your loved ones. Granted, creating a Will may not be fun, and when you’re young there are a million and one things you would rather do but it’s actually not such a hard thing to do once you get over the mental hump. And you may actually learn something along the way.

To help you see the benefits of having a Will we have outlined why you’re (almost) never too young, and no matter the age, you need a Will.

There’s no perfect time

Traditionally, the Will writing process has been expensive and time consuming. You would have to book an appointment with a lawyer, and spend several hundreds of dollars. If you are young, you know that you will be going through a number of life changing events. You are likely to form new relationships, buy a house, accumulate assets, maybe have children.The common view is that at each of these life events, you would review and update your Will.

But with a cost of several hundreds of dollars, you would want your Will to have some longevity.

This is why many people think of Will writing as a once in a lifetime activity. And worse, they wait until their life has settled down completely before going through the process of preparing their Will.

I know I need a Will, but I’ll wait until I get married

The problem is; that state never arrives. There is never a point where your assets and personal circumstances never change, particularly when you consider that even a change to somebody named in your Will may prompt an update. Supposing the person you have named as your Executor is taken ill. You need to update your Will.

This is why at LegalWills.ca we encourage people to write your own Will as soon as you are legally able to do so. Then, over time, you maintain your document by just logging into your account, making a change, and then printing out the new Will.

You can update your Will hundreds of times throughout your life, rather than waiting for that perfect single moment in time when you prepare the Will to end all Wills.

Death Ignores Age

It’s a hard truth but death won’t wait for you to have your affairs in order, it also doesn’t care if you’re 21 or a ripe old 98 – and that means you should be prepared. We live in a strange World, and anything can happen.

If you’re under 18, don’t worry about a Will just yet as you must be over the age of majority to write a Will (18 or 19 depending on the Province). Once you are officially an adult you need a Will, it is your responsibility to outline how you would like your assets to be distributed after death or that privilege will be decided for you.

In terms of the right age to have a Will, it depends more on what stage of life you are at and how much you want to protect your assets and family. Most 18 year olds don’t own their own home or have much money to their name but if you inherited assets or happen to be a tech guru that sold an app for millions, you will want to consider legally protecting your assets.

You still might think that you are too young to worry about this issue and you’re not alone. In Canada, 88% of young people in the 27 to 34-year-old range don’t bother to have a Will because they don’t believe that they have any wealth. That is a shockingly large amount of people that have not considered who will obtain their assets but also, who will take care of everything once they are gone?

It’s not just about Money

Having a Will doesn’t declare to the world that you are filthy rich but that you care about declaring your wishes and caring for your family. Even if you don’t have many assets to bequest, your estate plan does some very important things. It makes key appointments like your Executor, or even guardians for your children. It allows you to make charitable bequests, it even allows you to state who should not benefit from your estate. You can also put plans in place for the care of animals.

In reality, you have no idea how much you will be worth after you have died. You are not writing a Will to deal with the assets you see around you now. If you were to die young, there’s a chance that your death was as a result of an accident. Which follows that there is a chance that somebody was held liable, and that some money would be paid to your estate. There are many ways in which you can be worth significantly more after you have died, than you ever were when you were alive.

Peace of Mind

If you die without a Will, your province of residence will decide how to allocate all of your property and assets.

Quick quiz. If you are not married, and have no children. Who will receive your estate?

Answer: your estate will be distributed according to the laws of “Consanguinity.” Everything will be divided between your parents, or if you have no parents, between your brothers and sisters. If a sibling predeceases you, then it would go to their children (your nephews and nieces).

The law does not take into account your individual circumstances and it doesn’t know or care if there are unresolved family dramas. This means that distant relatives, ex-partners and uninvolved parents could financially benefit from your death. Would you not prefer to be the person that determines where your hard-earned money, cherished possessions and beloved children go?

There is also no provision for charitable giving when there is no Will.

Another important factor about not having a Will is that it virtually guarantees that your descendants will face more costs and stress. Your estate will incur extra fees and delays due to the lack of a Will. Your family will also have to deal with the estate being distributed by the province which could result in arguments and expensive legal battles. You need a Will in place to make the process go smoothly with the least amount of family tension.

What about your stuff?

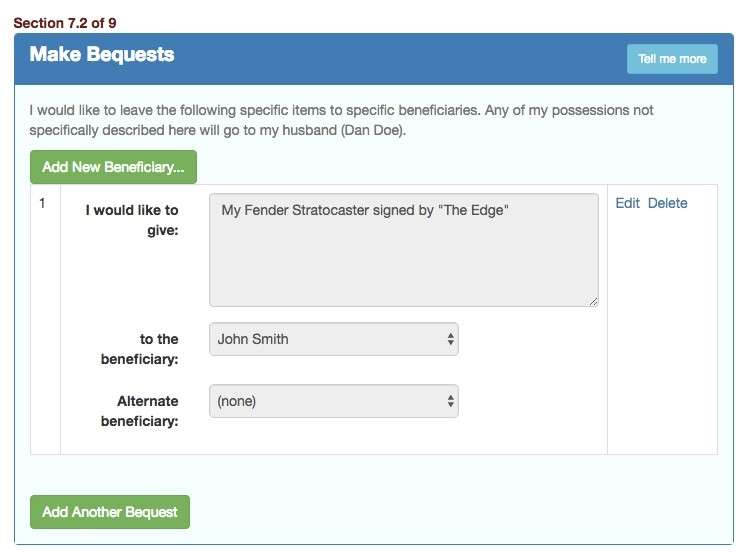

One of the coolest things about Wills is that you can decide who will receive your cherished items. It can be distressing to think about your vinyl collection going to your sister who has not appreciation for the monetary and emotional value. Or your Fender Stratocaster signed by The Edge going to your unappreciative father.

Your Will is an opportunity to recognize the people and organizations who have impacted your life.

The cost factor

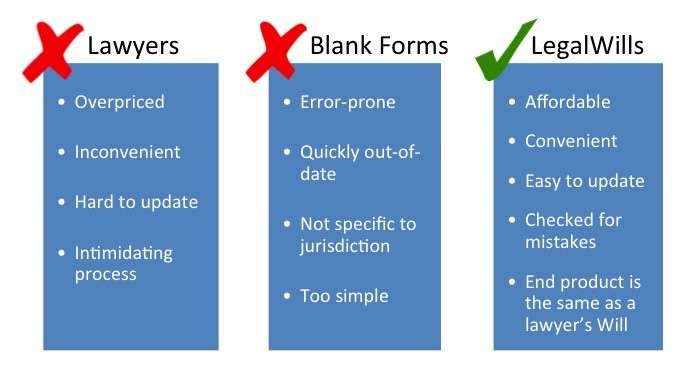

Many young people decide that they don’t need a Will because they simply don’t want to have to pay the legal fees. And traditionally, the eye watering $800 fees are certainly a barrier. Particularly when an estate planning attorney typically charges several hundreds of dollars for every update to the Will.

Fortunately, Will services have evolved with the Internet age, and a gap has been filled between the overly simply blank form Will kits, and the outrageously expensive estate planning lawyer.

As an aside, also be aware of the lawyer offering discount Will writing services. They usually do this by writing themselves in as the estate Executor, which is a far more lucrative revenue stream for them in the long run. They not only make an hourly rate for estate administration, but also charge a percentage of the total value of the estate. This means that they can potentially make tens of thousands of dollars for a few hours of work.

The modern approach to Will writing

LegalWills.ca is one of the companies that have moved into that gap between blank form Will kits and expensive lawyers. We not only give you direct access to the software used by lawyers, at a fraction of the cost, but also harness the power of the Internet to offer advances value added features.

At LegalWills.ca you can not only create your Will, your financial Power of Attorney and your Living Will. But you can also document your assets in our Executor assistance tool called MyLifeLocker, you can upload important files to our Digital vault service, you can write messages to be distributed after you have passed away, describe your funeral wishes, name keyholders to access your services at the appropriate time, and countless other services that give new meaning to the idea of complete estate planning tools.

We have offered the service for over 16 years now, and continually evolve our products and services. Over 200 five star reviews on Google suggest that we are addressing a need.

Don’t Wait – you need a Will.

Life events happen unexpectedly and so does death. Don’t put of making a decision today because you would rather spend the money on something which will not help your family in the event of your death. Having a Will in place is the best use of both your time and money. No matter what age you are, we all have treasured possessions and assets that we want to see in the hands of our loved ones – make sure that happens with a Will!

Writing a Will is not about you. You do it for your loved ones.

- Probate in Canada – What it is, what it costs, how to reduce fees. - January 6, 2025

- All about Trusts – how to include a Trust in your Will - June 9, 2022

- The Holographic Will – what is it and when should you use one? - May 18, 2022