At LegalWills.ca we have made a decision to not allow you to set Executor fees in your Will. There is a good reason for this, and it does require some understanding of Executor fees and how they are calculated.

What are Executor Fees?

Within your Will you name an Executor. This person has the responsibility to gather your assets, secure them, and then distribute your assets to the beneficiaries according to the instructions in your Will. Together with these broad tasks, the Executor also has to arrange your funeral, file your final year taxes, apply to probate, and work with every business that you have interacted with to close down your accounts. In addition, there is now the concept of a Digital Executor. This person is responsible for working with all of your online accounts and digital assets to make sure that they are either closed down, memorialized, or transferred to a beneficiary.

It is a big task that can take many hours of work, over weeks and months, and even occasionally years. It is therefore only reasonable that an Executor should receive some compensation for all of this work that must be done to administer your estate.

What are the different types of Executor?

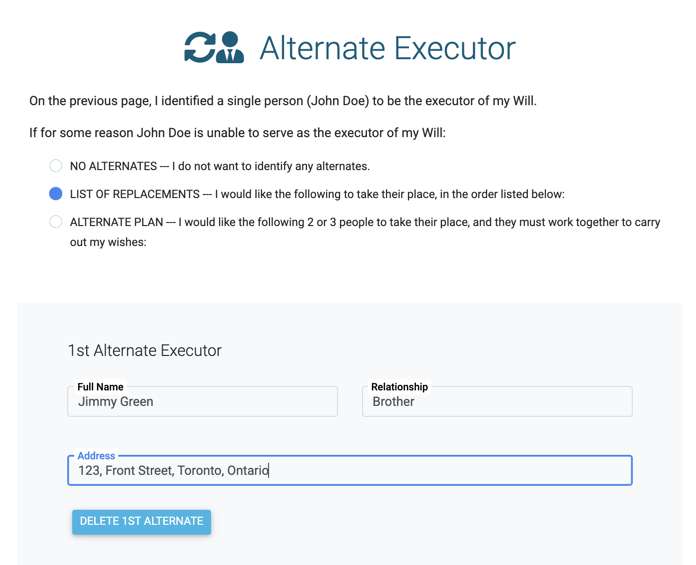

If you have a Will, then your Executor is appointed by you, in your Will. You can name a single person to take on the role or “joint Executors”. Within the Will you usually also name at least one backup or “alternate Executor”. Most of the people who prepare their Will at LegalWills.ca appoint a friend or family member as their Executor. There is absolutely no problem with your chosen Executor being a beneficiary.

In fact, it is very common for the Executor to be the main beneficiary, particularly when this person is your spouse. It can make things go quite smoothly when your spouse is transferring assets to their own name, when they are named as Executor of your Will. It is also common to then name children as a backup Executor (sometimes appointed as joint alternate Executors). Not all services allow joint Executors, but at LegalWills.ca you can name up to three first choice joint Executors, and up to three alternates who can either step into the role one by one, or who can work jointly when the first choice is unable or unwilling to serve.

When naming a friend or family member as an Executor, they must be an adult in your Province, but there are no other particular qualifications. They can have a criminal record, and they can have filed for bankruptcy. Just make sure that you are choosing an appropriate person.

Another option for your Executor is a professional Executor. This can be a bank, law firm, or trust company. Every major bank offers Executor fees, not all lawyers do, but some lawyers specialize in this part of the process and may even prepare a Will for a very low fee if they can be named as Executor. The catch with this is that some professional Executors set their own fees that are over and above the Executor fees set by the courts.

How are Executor fees calculated?

Executor fees are generally established on a Provincial level by the courts. They are calculated as a percentage of the estate according to a range based on the “size and complexity” of the estate. Keep in mind that these fees are over and above any costs that may be incurred through the process of estate administration.

In Ontario, Executor fees are usually calculated as 2.5% of all assets gathered, plus 2.5% of all assets disbursed to beneficiaries. In other words about 5 percent of the estate.

In BC, the level of Executor compensation is a little more vague, but is “up to” five percent depending on a variety of factors including:

- the magnitude of the estate;

- the care and responsibility involved;

- the time occupied;

- the skill and ability displayed; and

- the success achieved in the final results.

In Alberta, the Executor compensation rates are subject to a more complicated calculation. Firstly, a calculation is made based on the size of the estate:

On the first $250,000.00 of capital: 3% – 5%

On the next $250,000.00 of capital: 2% – 4%

On the balance: 0.5% – 3%

There are further Executor fees based on revenues coming into the estate while the estate is being managed, as well as additional fees based on the assets being managed. So in general, it is a range that the Executor must pick from, and the level of compensation must then be validated by the courts.

Can you set your own level of Executor fees?

The fees quoted above are usually applicable only if the Will “is silent regarding Executor compensation”. In other words, you are legally permitted to set your own level of Executor compensation in your Will.

Of course, this will likely only happen if you have named a friend or family member as the Executor. If you name Royal Bank of Canada (RBC Royal Trust) as the Executor in your Will, they will likely require certain clauses to be inserted into the Will. You will not be able to name a professional Executor and set your own fees. Often, the fees charged by professional Executors may include additional administrative fees over and above the court approved levels of compensation.

Why doesn’t LegalWills.ca allow users to set Executor compensation?

In general the courts establish the level of Executor compensation based on the size and complexity of the estate. You have absolutely no idea what the size and complexity of your own estate will be.

You may feel that today, you have a good sense of the size of your estate, but keep in mind that your Will is not coming into effect today. It is some time in the hopefully distant future. You also have no idea how complicated your estate administration will be.

Supposing you are hit by a bus, and the bus company are held liable. But the bus company is holding off on paying any settlement. Your estate is going to get both larger in size, and significantly more complicated. There may be claims made against your estate that you are currently unaware of, because usually you have no idea how you are going to die.

You want to avoid a situation where you have stated in your Will that your Executor will receive $10,000 for their work, and your Executor realizes that this is going to be much more work than $10,000 worth. So they simply refuse to take on the role. You could end up with a situation where nobody wants the job because the level of compensation is too low for the work involved, particularly if the Will comes into effect 30 years from now when $10,000 is worth $1,000 in today’s money!

Can an Executor choose not to receive fees?

The flip side to this is naming a friend or family member who works through the Executor tasks and simply chooses not to be compensated. This is actually quite common, and in many countries, expected. Some family members may feel that it is unreasonable for the Executor to receive 5% of the value of a home simply for selling it through a real estate agent (who also receives a percentage of the home). In this case, the Executor will not need to do much work at all to earn $100,000 as a percentage of the sale of a home in downtown Toronto or Vancouver.

Can you leave a bequest to an Executor?

The Executor of your Will can be a beneficiary of the Will. This is very common when a spouse is named as both the Executor of the Will and also the main beneficiary. There are pros and cons to naming your spouse as the Executor of your Will, and we have covered this in a separate post.

However, don’t muddle the two. If you have left $10,000 to your brother, and also appointed your brother as the Executor, you should not assume that this bequest is in lieu of the Executor compensation. The two things should be kept quite separate. Your brother has every right to choose not to serve as Executor, but this should not mean forgoing any bequest given to them in the Will.

- Probate in Canada – What it is, what it costs, how to reduce fees. - January 6, 2025

- All about Trusts – how to include a Trust in your Will - June 9, 2022

- The Holographic Will – what is it and when should you use one? - May 18, 2022