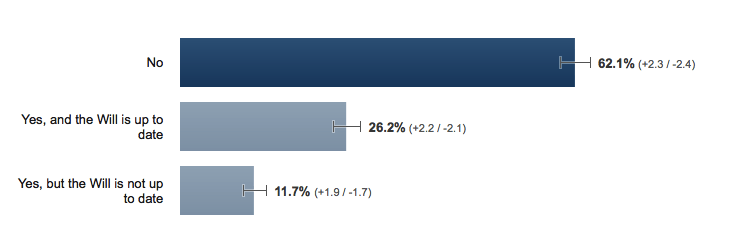

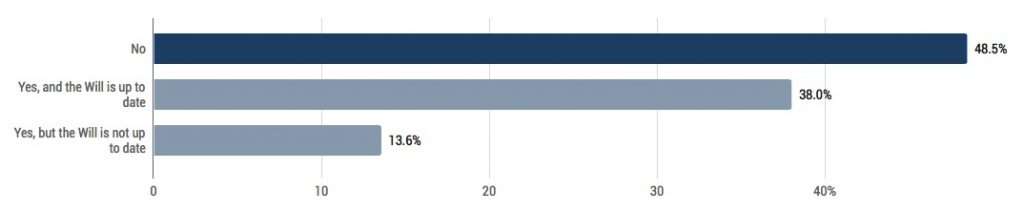

There have probably been a number of situations in your life when you have thought, “I should be preparing a Last Will and Testament.” And for some reason or another you have never actually taken the steps needed to update or create your Will. Don’t feel too embarrassed, because you are certainly not alone. In 2016 only 38 per cent of Canadian adults had signed a legally valid Will. Of those that did, one third were out of date.

Even if the data was restricted to Canadians over the age of 35, only 38 percent of those polled had a legal, up-to-date Will.

This leaves a lot of people legally unprepared and their families unprotected or provided for.

Although the idea of having to take legal measures in the event of your death may seem morbid, a Will is simply an instruction manual for your survivors which outlines how your estate will be distributed, makes key appointments and expresses any final wishes. A relatively simple Will can provide instructions on who will take care of your kids, who will be your estate administrator and how your hard earned money and assets will be distributed among your survivors. Quite simply, having a Will is arguably one of the most important things you can do for yourself and your family. Both you and your family will be able to have peace of mind knowing that your spouse, children, relatives and charitable bequests are all legally protected.

If you die without preparing a Last Will and Testament, your estate may not be distributed in the way you would have wished and the costs of administering your estate could also be higher. If all of these reasons aren’t enough to convince you to get started, then read through our helpful list of top ten reasons why all Canadians should have a Will.

You control the distribution of your estate

As explained, a Will is a legally-binding document that outlines your wishes regarding your property. Whether it be money, houses, stocks or jewelry, you determine how you would like your estate to be distributed upon your death. Therefore, if you desire family heirlooms to be passed on to specific individuals, you must legally clarify your intentions in order to minimize any family fights about your estate that may arise. This applies to your whole estate and if there is no Will for survivors to act on then it could result in unnecessary arguments, expensive legal action and the failure of your wishes being followed.

You name the person responsible for managing your estate

Once you die your Executor becomes responsible for carrying out your requests in the Will. They make sure that all of your affairs are in order, including paying bills, canceling credit cards, notifying the bank of your death and distributing all assets. This can be a large and overwhelming task for any individual therefore, it is important that you select this person carefully. Executors can be family members but they don’t have to be and more importantly, they should be honest, trustworthy, and organized.

You name your children’s guardian

In the absence of a Will, the courts will take it upon themselves to choose a family member(s) or state-appointed guardian to take care of any minor children. No matter how unlikely it is that your children would be left without a parent, the cost or effort required to make a Will is nothing compared to the peace you will have knowing that your children will be cared for by those you selected. By writing a Will you will be able to appoint the person that you want to raise your children rather than have the courts make this decision for you.

You may be fortunate and have more than one person willing to take on the responsibility of caring for your children, but sometimes this can be worse. If your sister and your in-laws both want to be appointed guardian, then the bitter fight between them can caused irreparable family tensions. By simply preparing a Last Will and Testament and making the appointment yourself, you protect your family against unnecessary anguish.

Avoid a lengthy probate process

There are misconceptions about the probate process in Canada, fuelled in part by many Internet references based on US law. In Canada, if your Executor needs to gather up assets, then probate will be required (with the exception of the Province of Quebec).

Probate is the process by which your Will is certified as the legal Last Will and Testament, and your Executor is officially granted the authority to act as your estate administrator.

Your Executor cannot simply show up at a bank with a Will asking for the contents of the account to be given to them. The bank has no way of knowing whether the document is the last Will and Testament, whether others were subsequently written, or whether there is a challenge to the document. Banks do not have the framework to validate a Will, and are extremely cautious about emptying an account to somebody other than the account holder.

Banks therefore need a “grant of administration”, a document given to the Executor by the probate courts that certify the document as the last Will and Testament, and officially grant the Executor the powers to administer the estate.

As a result, in Canada, only estates that are passing jointly held assets to the other account holder can avoid probate.

Of course, the probate process is much simpler with a Will. If you have not prepared your Will, the first step in the probate process is proving that there is no Will. This gets your estate administration off to a bad start.

Minimize estate taxes

Having a Will is not a guarantee that your estate will pay less taxes but it does allow you the opportunity to foresee and plan what tax deductions will be made. In Canada, your estate will be taxed as a whole before any distributions are made, however, the value of what you give away to family members or charity will be deducted from the value of your estate. Therefore, you are able to reduce the value of your estate and the estate taxes by giving generously.

By preparing a Last Will and Testament, you can disinherit people

Most people do not know they can disinherit family members out of their Will. It might seem like an odd notion but it is perfectly legal and within your rights to disinherit individuals who may otherwise stand to inherit your estate if you die. Without a will your estate could end up in the wrong hands such as an ex-spouse with whom you have divorced or a distant relative that you have no regard for.

This is particularly important if you a separated without a formal separation agreement. There are a surprising number of people separated from their spouse, but live as a married couple with a new partner without formally divorcing their first partner. Dying without a Will in this situation can be a real mess with your new partner receiving nothing, and your estranged ex receiving the bulk of your estate. At best, the legal fees associated with resolving the estate will eat into most of your assets.

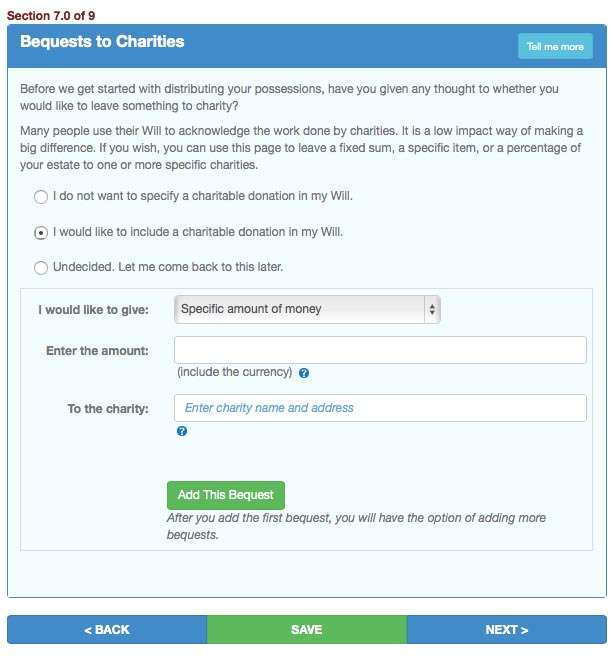

Make gifts and donations

Without a Will no charitable donations or gifts will be made on your behalf. Therefore, if there is a particular organization, group or individual that you wish to bequest money or assets to, your only legal option is to state it in a Will.

It turns out that although 85 percent of people are charitable in their lifetime, only about 5.7 percent of adults over the age of 55 have a charitable estate plan. At LegalWills.ca we try to address this by specifically asking about charitable giving within our Will writing service. We know that Wills created through the Will writing service at LegalWills.ca pledge in the region of $100M a year to charities.

Avoid legal challenges

As previously mentioned, dying without preparing a Last Will and Testament can cause lots of complications for your survivors such as, your estate passing to a legally entitled but unwanted individual or long legal battles created by family feuds. You may not think this applies to you but there have been examples of removed relatives inheriting estates leaving closer relatives disinherited, and numerous cases of families pursuing legal action for promised assets. For the sole benefit of your family leave clear instructions.

It’s never too early to plan

Another good reason for preparing a Last Will and Testament is that it gives you the opportunity to organize your affairs and set life goals. When faced with the daunting prospect of death, many people use the Will writing process as a way to set out priorities, whether that be financial, personal or charitable. It can become good practice to annually update your Will and align your bequests with your life goals.

Because life is short

When an unexpected death or disability occurs it reminds us that a long life is not guaranteed but we can try to make that time of loss easier for our families by having a Will provide for them.

Preparing a Last Will and Testament is no longer expensive or time consuming with online services like the one at LegalWills.ca. It can take as little as 20 minutes and costs less than $40. However, the difficulties created for your loved ones by dying without a Will can be very significant.

You may feel that you have decades left in order to write your Will. But this doesn’t mean you cannot prepare your Will today. Back in the days when it was expensive and inconvenient, people thought of writing a Will as a once-in-a-lifetime task. One that was usually undertaken just before death.

Times have thankfully changed. Preparing a Last Will and Testament is about smart financial planning. Write a Will today, and update it throughout your life as circumstances change. Using our service an annual review and update is free and can take just a few minutes each time.

To get started go to

and click on “Try it Right Now”.

- Probate in Canada – What it is, what it costs, how to reduce fees. - January 6, 2025

- All about Trusts – how to include a Trust in your Will - June 9, 2022

- The Holographic Will – what is it and when should you use one? - May 18, 2022