Are you thinking of writing a Will? Have you perhaps heard of terms like “Executor”, “Bequest”, “Living Will” and are now worried that the process of writing your Will may be beyond you? You may be wondering whether it is possible to write a Will without understanding all of these legal expressions. After all, that’s why many people hire a lawyer to prepare the document for them.

You may be surprised to learn that you really don’t need to understand any of these legal words in order to use a service like LegalWills.ca. However, the words may appear in your final Will, and in that context they will make sense to you. We also explain some of the key definitions when you are working through the service. But you may be interested to learn exactly what some of these words actually mean.

Perhaps you wrote your Will with a lawyer. You have had it witnessed and now it’s stored at your lawyer’s office but you still have no idea what it says. Don’t worry, this isn’t an uncommon situation. Many people go through the whole task of writing a Will and signing it when they don’t fully understand what it says.

Unfortunately in today’s legal world, estate attorneys don’t always have sufficient time to go over every detail and word of a Will. This is partly because their time costs money, but also because writing a Will is an everyday common practice to them. Therefore, they often neglect to go over the basics with their clients. An experienced and understanding estate attorney should always be willing to go over every detail of your Will and explain any confusing language so that you feel comfortable when signing it. However, the legal environment can be intimidating and attorneys may assume that you understand the legal terms when in fact you don’t.

At LegalWills.ca we almost fall into the same pattern ourselves when we talk to customers about the “Executor” and the “Beneficiaries”. We forget that some people may be hearing these words for the first time. They are words that are rarely, if ever, used outside of the context of writing a Will.

Why is legal language so complicated?

The language of law is completely unfamiliar to people outside of the legal industry. Reading and understanding the laws in Canada’s legal statues takes time, effort, and sometimes a working knowledge of Latin! The law can also be open to interpretation; one person can take a different meaning to another from exactly the same words.

Some sections of law contain repetition that obscures otherwise straightforward concepts. For example, a section of the B.C. Family Law Act defines what it means to be a child, and have parents.

(1) For all purposes of the law of British Columbia,

(a) a person is the child of his or her parents,

(b) a child’s parent is the person determined under this Part to be the child’s parent, and

(c) the relationship of parent and child and kindred relationships flowing from that relationship must be as determined under this Part.

(Family Law Act, Province of British Columbia)

Part (a) is probably straightforward enough. However, if you wanted to find out if parts (b) and (c) applied to you, your child, or your parents, you may need the help of a lawyer. This is only one example of a relatively easy piece of legislation. But when we add in Latin terms, exceptions and other legal constructs, we can see how complicated the law becomes.

Many people argue that you shouldn’t need to hire a lawyer to find out which laws apply to you. In a democratic society, laws should be written for the people most affected by them, not for lawyers and judges. With this view in mind, there has long been a crying out for plain-language laws in Canada and many other countries. It is also common to hear the term ‘layperson’. This again encourages language to be used in a way that anyone would be able to understand.

As John-Paul Boyd from the Canadian Research Institute for Law and the Family states:

“We live in a system of justice where the courts are open to all. If we live in a system that’s governed by the rule of law, there’s no reason why you should have to hire a lawyer. But when we have legislation written in incomprehensible language… you do wind up having to hire a lawyer, and it seems to me that it’s unfair. If we had laws that were clear and comprehensible, as citizens we would have a better understanding of our individual functions in society, how we relate to other people in society, and how government relates to us.”

In the 1990’s, several politicians and lawyers advocated for so-called “plain language” policies but unfortunately the movement fizzled out. However, many still believe that as we are subject to the law we should all have full access to it and fully understand the law. Only time will tell if the plain language movement picks up again in Canada. But for now, we rely upon the abilities of our attorneys and our own understanding to use and decipher the law.

Understanding Your Will

Your Will (or “Last Will and Testament”) only comes into effect after you pass away. For this reason, it is important to ensure that your wishes are very clear in your Will. Often the only way to do this is to use well established legal terms and to ensure all potential scenarios are covered. This can often make some parts of the Will seem quite long. This also might make your Will look complicated and convoluted. But in the long run, it is best to have a Will that follows the current legal format and language. This way, a Court will be able to interpret the Will if any issues ever arise. Will clauses rely on “precedents”, which are clauses that have been tried and tested over the years, decades, and even centuries.

At LegalWills.ca we try to make the process of writing a Will very accessible, but the final document can still incorporate some tricky clauses. Particularly for example, the powers being granted to the Executor and the clauses that set up Trusts.

To help you get started, we have put together an overview of some basic legal terms and their meanings:

What is Your Estate?

Your Estate is everything that you own and owe at the time of your death. Assets that are held as joint tenants (jointly with another person), such as your home or bank accounts, are not included in your estate. This is because there is a “right of survivorship” with those assets. A right of survivorship means that if one spouse or partner were to pass away, the asset automatically passes to the other spouse or partner. This is done outside the Will and the asset does not form part of your estate.

Also, some assets allow a beneficiary (see below for more on this term) to be named on them. For example, a registered savings plan or a life insurance policy. These assets therefore pass directly to the beneficiary and are also not included as part of your estate.

Under your Will, all debts and expenses related to your death (the main one being funeral expenses) are paid first out of your estate. You are then able to leave specific gifts to certain people – for example, your wedding ring to your daughter or your record collection to your nephew. Once death expenses and specific gifts are given out, what remains of your estate is called the residue (or “residual estate”). You leave the residue to your nominated beneficiaries. Often the “residual beneficiary” is the main beneficiary of your estate.

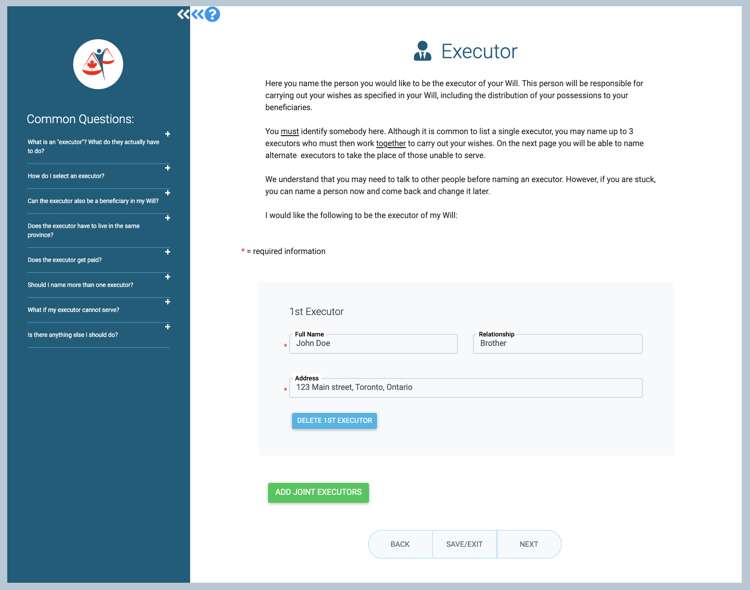

What is an Executor?

An Executor is the person or people you name in your will to administer your estate when you pass away. (Historically, we also used the term Executrix for a female Executor, but this isn’t used so much today). You can appoint more than one person but you should ensure they get along. You are able to nominate a substitute executor as a back-up in case your first chosen executor is unable or unwilling to act.

At LegalWills.ca you can name up to three first choice Executors, and up to three alternates.

Some of the duties of the Executor include the organizing of your funeral, obtaining a copy of the Death Certificate, and applying for Probate (see below for more on this term). The Executor is also responsible for working out what assets are in the estate, paying the debts of the estate, collecting monies from bank accounts and insurance companies, selling properties and assets, and distributing the estate to beneficiaries in accordance with the Will.

Your Executor is able to seek professional help if needed to fulfill their duties. They do not need to have a financial or legal background but it would obviously be an advantage. They just need to be someone you trust to look after your estate.

What is a Beneficiary?

In your Will you nominate your beneficiaries. A Beneficiary is a person or organization who receives a gift or benefit from your estate. If a beneficiary is a minor, their share is held in trust until they turn 18, or you can choose an older age such as 21 or 25 years in your Will. You can even divide the distribution of the estate so that they receive a portion at 21, a portion at 25, and the remainder at 30, for example. The beneficiary can still have access to their inheritance but the executor has control over how the money is spent.

A charity or organization can also be a beneficiary under your Will. A lot of people leave charities a monetary amount. Many also have a clause in their Will that if their partner and all their children have passed away then their estate goes to the nominated charity. The important thing to keep in mind when leaving a gift to a charity is that the exact name is needed. If the correct name is not specified, then the gift might go to the wrong charity or be canceled entirely.

You can nominate anyone as a beneficiary and distribute your assets in any way you like.

What is Probate?

Probate is perhaps the most misunderstood part of the Will process. After you have written your Will, you must keep it in a safe place. It should be somewhere that is known and accessible to your Executor. After you have passed away, your Executor must submit your Will to the probate courts, where it is accepted as your legal Last Will and Testament. Your Executor is then given official authority to act as your estate administrator through a court issued document called a “Grant of Probate”.

There is no way for a bank or financial institution to validate a Will. The bank has no way of knowing whether another Will has been written subsequently, or whether there were any issues with the signing of a particular document. A bank relies on the probate courts validating the Will and issuing the Grant of Probate. If the Executor has the Grant of Probate, the bank knows that they are the official Executor. The bank is safe in the knowledge that they can release the contents of the account to this individual.

There is no way to avoid probate in Canada unless assets are all going to a joint asset holder. For example, if a bank account is in a married couple’s joint names, and one of the partners has died. The bank is not taking any risk in putting that account into the surviving partner’s sole name. But if the contents of a bank account are passing to another person, or being given to the Executor, the bank will need to see the Grant of Probate.

There are fees associated with Probate that are typically on a sliding scale depending on the size of the estate (except in Quebec where it is a flat rate). We have a probate calculator on the website at LegalWills.ca.

More General Will Terms

Bequeath or Devise

Many Wills describe the distribution of the estate with the words “I give, bequeath and devise” which in layperson’s terms means “I give, give, and give”. Traditionally the word devise was associated with real estate, and the word bequest (which you bequeath) was a personal item. But today, there is no real difference, and so this language is somewhat redundant.

Bond

If your Executor lives out of Province, the probate courts may be concerned with the Executor collecting all of the assets, and then disappearing. It is therefore possible that the courts may ask your Executor to “post a bond” or put down money as security. This provides some protection for the beneficiaries that the assets will not simply disappear.

Guardian

One important part of a Will is the naming of a guardian for minor children. If you have young children, and no parent is available (for example if you are a single parent, or both parents are involved in a common accident), the courts will appoint somebody to raise your children on your behalf. If you have named a guardian in the Will, the judge will take this as guidance when they appoint the guardian for your children. If this person is still willing and able to serve as the guardian, the judge will most likely pass the responsibility of raising the children onto the guardian named in your Will.

If you do not name a guardian in your Will, then the judge will have to use other information as guidance for making the appointment. Their final decision may not match your preferred choice.

Intestate

If you die without a legal Will in place, you will have died “intestate“ and this causes a lot of problems for your family and loved ones. Your Will performs a number of critical functions. Firstly, it puts somebody in charge – your Executor. Without a Will, the courts will eventually appoint an Executor on your behalf.

Your Will also appoints guardians for your children if applicable. If you die “intestate” a judge will appoint the guardians for your children on your behalf.

Your Will also describes the distribution of your “estate” made up of all of your “assets”. This is your real estate, cars, possessions, money, and even digital assets. Without a Will in place, your assets will be divided according to the “intestate distribution” rules for your Province (no two Provinces are the same). For example, if you are married with children, only two Canadian Provinces have your entire estate passing to your spouse.

This also means that you will not be able to pass on treasured family heirlooms in a meaningful way, nor will you be able to make charitable bequests.

Revoke a Will

The word “revoke” is not one that we use in common everyday language, but it simply means “to cancel”. All of the Wills written at LegalWills.ca start with the phrase “I hereby revoke all previous Wills”. This means that as soon as you sign and date the new document in the presence of two witnesses, who in turn sign the document, any previous Will is automatically cancelled. You can only have one Last Will and Testament. All previous Wills are superseded by the most recently signed document (assuming that it has been signed correctly).

Trust

A Trust is an asset that is managed by somebody on behalf of somebody else. In your Will you can create a number of different types of “testamentary trusts” (meaning, the trust was set up in the Will). In the Wills created at LegalWills.ca, we support three types of trust:

- A trust for a minor beneficiary

- A lifetime interest trust

- A pet trust

A trust for a minor beneficiary means that you can leave a bequest to a young child “in trust”. Their inheritance will be managed by a “trustee” until they reach the age that you have specified in the Will.

The lifetime interest trust is usually used in blended family situations. It allows you to leave an asset to your children, but gives your spouse access to that asset e.g. the family home, for the rest of their life. When your spouse dies, it then automatically goes to your children.

The pet trust allows you to name a guardian for your pets, and sets aside a sum of money for the care of that pet.

A note on Quebec

There are some variations on these terms in Quebec. Typically an Executor is called a Liquidator. A Guardian is a Tutor, a Beneficiary is a Legatee. The service at LegalWills.ca has been completely re-written for Quebec, so it is compliant with Quebec law. If you are in Quebec and use the service at LegalWills.ca, you will create a legal Will for Quebec, using the appropriate terms in the Will.

Write your Will today

Writing your Will using a service like LegalWills.ca is not a complicated process. It is certainly no more complicated than using tax software to file your taxes. The questions are simple, questions like: Are you married? Do you have children? Who would you like to be the Executor? At the end, our software will compile your document and insert the legal language required of a Will in Canada. The whole process takes about 20 minutes, and costs $49.95.

If you are not sure about preparing your Will, give it a try. Just to to www.legalwills.ca and click on Start your Will.

- Probate in Canada – What it is, what it costs, how to reduce fees. - January 6, 2025

- All about Trusts – how to include a Trust in your Will - June 9, 2022

- The Holographic Will – what is it and when should you use one? - May 18, 2022