According to a recent survey conducted by BMO Bank of Montreal, 89 percent of Canadians consider their pets to be a member of their family. It stands to reason then that most people would want to ensure that somebody looks after their pet after they are gone. But hardly any Canadians have set up a pet trust to ensure that their pet receives proper care after they are gone.

If you make no provision for your pet as part of your estate plan, your dog or cat could potentially end up at the humane society. In 2015 82,000 cats and 35,000 dogs were taken into Canadian shelters, of which 48 per cent of dogs and 57 per cent of cats were adopted.

A Pet trust is not just for the wealthy

Whenever there is mention of a pet trust in the news, it is usually because of an extreme bequest, or staggering wealth of the pet owner. We saw is with Leona Helmsley who in 2008 left $12 Million to her pet Maltese.

A couple of years after that, a cat in Italy received an inheritance of $15 Million. But this wealth is peanuts compared to Gunter IV, the German Shepherd, who inherited from his father Gunter III, the beneficiary of the estate of Karlotta Liebenstein, a German countess. Gunter IV is currently worth a cool $450 Million.

But you don’t have to be a millionaire to want to care for your pet. If you have a pet, and you want to make sure that somebody you know will take care of this pet, you can set this up in your Will by including a pet trust.

In Canada, a pet is considered your own property, and so you can leave the pet as a bequest to a beneficiary. Because the pet is property, you cannot leave an inheritance directly to an animal, but you can leave an amount to a beneficiary for the care of that pet. This should be set up in a pet trust.

Informal pet care arrangements

According to the BMO study, Three-quarters of pet owners feel that it is important to make arrangements for the ongoing care of their pet. However, only one-third have made some kind of provision (informal or formal) for their pet, of which a small minority (only seven per cent) have made a formal arrangement in their estate planning documents.

The problem with informal pet care arrangements is that they are loaded with assumptions. You may assume that your sister will take care of your cat, but if you don’t leave your sister appropriate funds, it can be a significant financial burden for somebody to take on. So much so, that when the time comes, your sister may feel that she no longer has the financial means to care for an aging pet. Generally speaking the most significant costs of pet care come in the more senior years – medication and possibly even surgery can be prohibitively expensive for somebody to take on simply as a favour to you.

The BMO survey revealed that of respondents who indicated they had made some kind of arrangement for their pet, only two in five had chosen to provide a monetary legacy, while 54 per cent did not.

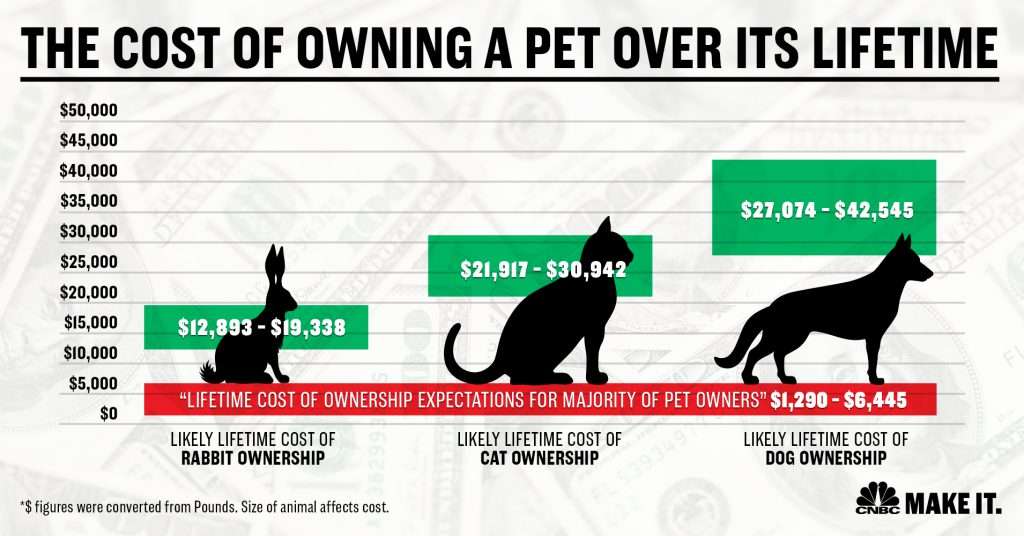

Some simple Will services may allow you to leave a specific sum to a beneficiary and note that the sum should be used for the care of your pet. There are two problems with this. Firstly, you have no idea when the Will is going to come into effect, and so it is impossible to predict how much should be left for the care of your pet. Your pet may be 2 years old when you die, or 15 years old. Do you leave $500, $5,000, $20,000? what is a reasonable? According to the ASPCA, the total first-year cost of owning a dog is $1,270 and for a cat it’s $1,070 (US dollars) and the ongoing annual cost is $700 a year (again, US dollars). When all medical expenses are included, CNBC report the costs to be much higher

Step 1 – write your Will

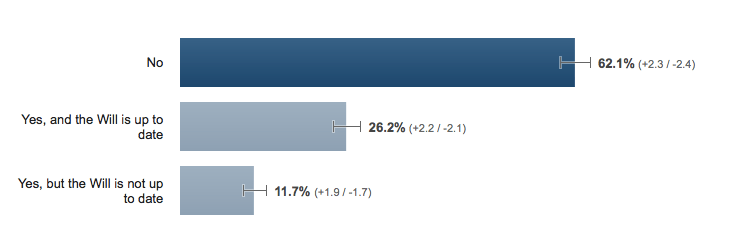

The first step in preparing a pet trust is to write your Will. As we previously reported, most Canadians do not have a Will, and of those that do, many are not kept up to date.

Adult Canadians asked “do you have a Will?”

So if you want to formally make sure that your pet is taken care of after you are gone, you need to be better than the 73 percent of Canadian adults who do not have an up-to-date Will. The statistic is amazing because every adult needs a Will. Unfortunately, the traditional approaches to Will writing have been expensive and inconvenient, so it leaves the vast majority of people without any form of plan.

Approaches to Will Writing

There are essentially three different ways to write your Will in Canada.

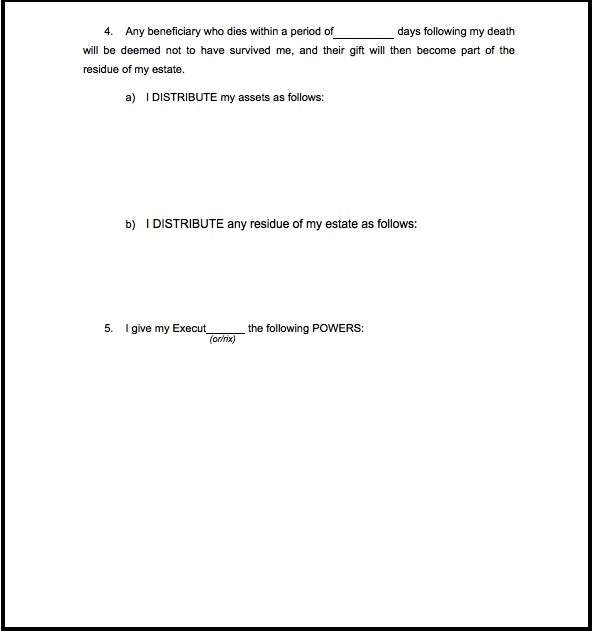

1. Use a blank sheet of paper, or a blank form Will kit

This is generally the cheapest way to prepare a Will, but ironically, the most difficult approach. It is almost impossible to prepare a well drafted Last Will and Testament using a blank sheet of paper, or even using a blank form kit that you can buy from Staples. DIY Will kits almost require you to have a legal background and some training in estate planning to effectively prepare a Will.

The dangerous thing about these Will kits is that after completing one, you think you have written a good Will. It is only after you have passed away, and your loved ones try to probate the document, does it become apparent that it just doesn’t work.

This is an example of a blank form Will kit which we purchased. Section 5 invites you to describe the powers that you are giving to your Executor. It is almost impossible for somebody with no legal training to complete this section. Even if you were to find sample clauses somewhere on the Internet, you would have to be certain that the clauses are up-to-date, applicable to your jurisdiction and also applicable to your personal situation.

Blank form Will kits have provided wonderful ammunition to legal professionals who warn against “writing your own Will”. However, there are other options for writing your own Will which are far superior to a blank form Will kit (see below).

2. Using an estate planning lawyer or legal professional

The traditional approach to Will writing has been to work with a lawyer. You are likely to get a well written Will if you work with a lawyer, but the process is expensive and inconvenient. Particularly when you need to make minor changes to the document. Over time, your circumstances will change. Perhaps the people named in your Will might have a change of circumstance.

For example, if your alternate Executor has been taken ill, or moved overseas, this person may no longer be the most appropriate choice. However, if you have written your Will with a lawyer, you may not take the time to book another appointment to make what appears to be a minor adjustment to the Will. We have also heard of lawyers charging over $100 per change made to an existing Will.

As a result, people who write their Will with an estate planning lawyer are much less likely to keep their document up-to-date.

3. Online Will writing services

An increasingly popular approach to writing a Will is to use an online Will writing service like the one at LegalWills.ca. There are a number of key benefits:

Firstly, compared to a blank form Will kit, the online services are usually specific to your jurisdiction. Will kits are usually generic and do not take into account Provincial laws, whereas online services typically ask for your Province of residence, and then tailor the service to local laws. In addition, online services are always kept up to date to reflect changes in the law, but blank form kits can quickly become outdated.

Most importantly, when comparing to a Will kit, the online services check for errors, only allow you to do what you are legally permitted to do, and guide you through the process of preparing your Will, rather like tax preparation software. You are far more likely to create a well-drafted Last Will and Testament using an online service like the one at LegalWills.ca than you are with a blank form DIY Will kit.

There are also significant advantages of using an online Will writing service over working with an estate planning lawyer. The first obvious one is price. At LegalWills.ca you can create your Will for $39.95. This is typically about 95 percent cheaper than a lawyer, who typically charge in the region of $600-$800 for a Will.

But online services are also much more convenient, allow you to make unlimited changes and updates, educate you on the process, and then offer a number of added value services.

For example, at LegalWills.ca you can prepare a handbook for your Executor known as MyLifeLocker, that allows you to document all of your accounts, important contacts, financial dealings, utilities and even online accounts. You can then set your Executor up as a “keyholder” giving them access to all of the information that they need at the appropriate time, and not before.

LegalWills.ca also allows you to upload files to a digital vault, write messages to loved ones, and describe your funeral wishes. All to be made available after you have passed away and not before.

Writing a Will at LegalWills.ca

As you step through the service at www.legalwills.ca you will firstly provide some information about yourself and your family. You will identify which Province you are living in, and describe your marital status and whether you have children. In addition, you will need to make key appointments like your Executor and if applicable guardians for your children.

You will then get to the distribution of your estate (everything that you own)

There are key components to the distribution of your estate. You can make charitable bequests if you wish. This is called “planned giving” whereby a charity can receive a sum of money, a percentage of your estate, or even a specific item like your car or contents of your house.

You can also leave specific bequests to individuals. Again, this could be a sum of money, a percentage of your estate, or a specific item.

Unique to the service at LegalWills.ca is the option to set up a pet trust. No other Will kit or online service in Canada effectively offers this option.

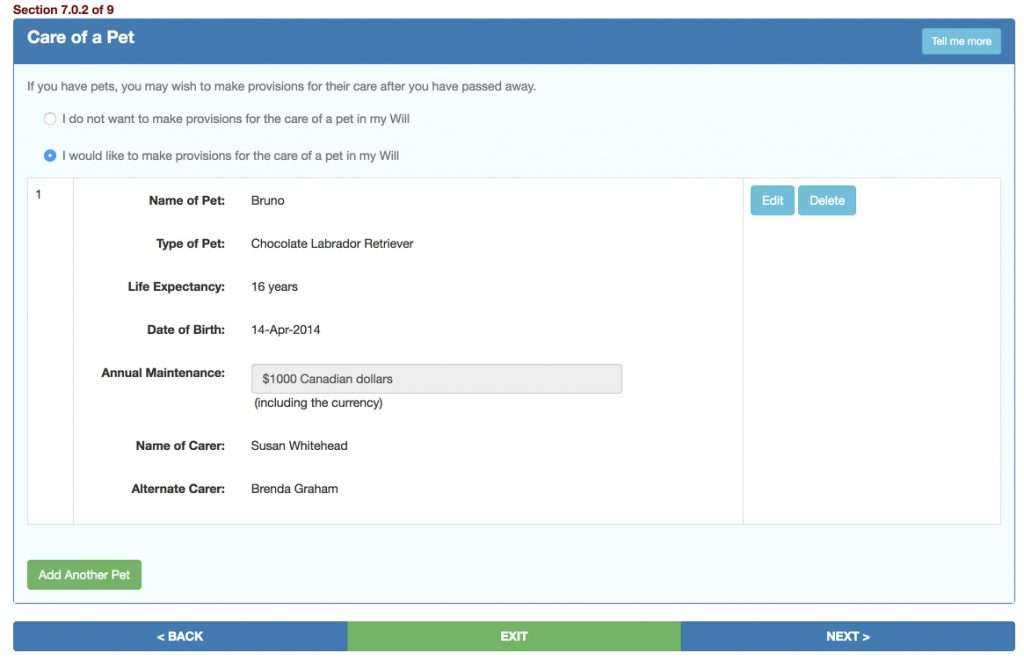

How to write a pet trust at LegalWills.ca

The process for creating a pet trust at LegalWills.ca couldn’t be simpler. Firstly, you provide the name of your pet, and explain the type of pet. Just so there’s no confusion as to which pet you are referring to.

You then make a reasonable estimate of how old this pet could become. Not sure? there are plenty of online resources for calculating a pet’s life expectancy. This life expectancy is going to form part of the calculation to determine the size of the trust.

You then provide the date of birth of the pet. If you are not sure of the exact date, you can provide a rough estimate or simply your best guess at the year in which the pet was born.

You then decide how much of your estate you wish to put aside for the annual maintenance of your pet. Again, there are some great online resources for this.

Finally, you name the person who you wish to care for your pet, and also name a backup in case your first choice is unwilling or unable to serve.

What does a pet trust look like?

Your pet trust will appear in your Will, and take the form of a legal clause something like this:

Gift for Care of Animal

This gift shall carry a sum of money as a bequest payable to Susan Whitehead PROVIDED THAT Susan Whitehead looks after my Chocolate Labrador Retriever, named Bruno, free of tax for Bruno’s upkeep and maintenance (hereinafter called “Bruno’s fund”). If this person is unable or unwilling to act for any reason, then Bruno’s fund should be paid to Brenda Graham PROVIDED THAT Brenda Graham serves in place of Susan Whitehead. The amount of Bruno’s fund is to be calculated on the basis of Bruno’s age at the date of my death, on the assumption that Bruno’s life expectancy is 16 years of age and that the average annual cost of Bruno’s upkeep and maintenance is $1000 Canadian dollars. Bruno’s fund will therefore be an amount calculated by multiplying the sum of $1000 Canadian dollars by the number of full years and full months between the date of my death and April 14, 2030. In the event that Bruno has died at the date of my death then this gift shall fail.

Pet Trust FAQ

Can I leave anything directly to my pet?

Under Canadian law, a pet is considered a piece of property and as a result you cannot leave part of your estate to a pet. However, what you can do is leave a sum of money to a specific person, and stipulate that this money must be used for the care of that pet. You can also ask that person to become the guardian or carer of that pet.

How do I choose a caregiver?

First, decide whether you want all of your pets to go to one person, or whether different pets should go to different people. If possible, keep pets who have bonded with one another together. When selecting caregivers, consider partners, adult children, parents, brothers, sisters, and friends who have met your pet and have successfully cared for pets themselves. Also name an alternate caregiver, in case your first choice becomes unable or unwilling to take your pet. Be sure to discuss your expectations with potential caregivers so that they understand the large responsibility of caring for your pet. Remember, the new owner will have full discretion over the animal’s care, including veterinary treatment and euthanasia, so make sure you choose a person you trust implicitly and who will do what is in the best interests of your pet.

How much money should I leave for the care of my pet?

This is a very personal decision and is based on the type of lifestyle you expect the carer to offer to your pet and also your anticipation of any bills, including veterinarian bills. Some people leave substantial legacies to their pets, but you should also consider your pet legacies in the context of any money you have left to family and loved ones. You could think about the annual costs that you currently incur for the care of your pet and use this as a guideline. Remember that costs are typically higher for aging pets compared to costs when they are younger. So make sure that you have provided enough to cover medical expenses as they age.

Can’t I just leave a sum of money to a person for the care of my pet?

If you leave a sum of money to an individual for the care of your pet, there would be no control over how that money is spent. The person who receives the money could spend it all on themselves and not care for the pet at all. By setting up a pet provision within your Will, you can ensure that the money is only used for the benefit of the pet. You can certainly leave a separate bequest to the carer, but this is done as an entirely separate legacy.

But you need to write your Will

The very first step in making provision for your pet through a pet trust is to write a Will. The whole process takes about 20 minutes, and costs $39.95. We would encourage you to get started at

www.legalwills.ca/mywill

By clicking on Try it Right Now.

Please let us know if you have any questions by adding a comment below.

Tim Hewson is one of the founders of LegalWills.ca.

He has over 20 years of experience helping people to write their Will and other estate planning documents. He has been interviewed by many of the major news media outlets including CTV, Global News, The Toronto Star, and other leading Canadian publications. He has also contributed to a number of financial planning books.

Throughout his career, Tim has written extensively on the subject of Will writing and estate planning.

Latest posts by Tim Hewson

(see all)Like this:

Like Loading...

Related