At LegalWills.ca we claim that you can create a well-drafted Canadian Will in as little as 20 minutes. Clearly, there are some important decisions to be made, and it’s not something that should be written hastily, but if you have a straightforward situation and you know how you want your estate to be distributed, it really shouldn’t take you very long to prepare your Will.

To illustrate this, in the following video I create my Canadian Will, or more specifically my Ontario legal Will, in about 5 minutes.

Video transcript

The first thing I’m going to do is enter some basic personal information; my name, town where I am living, and the most important thing is the Province, and the Province is going to determine the legal jurisdiction for which the Canadian Will is going to be written. For the purposes of this demo, I’m going to be creating an Ontario Legal Will.

Enter family status and information

I’m going to set up the account for myself., and include my gender here, and now I’m going to give my marital status. For the purposes of this, I am married and I’m going to have two young children and that means I’m going to have to create a trust and guardians for those children.

I’m going to enter in some basic information about my spouse including my wife’s name, and move onto the next page where I’m going to identify my children.

For this demo, I’m going to have one young daughter, and when I say young, I mean she’s under the age of 18, which means she cannot inherit directly. I am therefore going to have to create a Minor Trust for her. I’m now going to add one young son. This is obviously a very common scenario where you would have a spouse and two young children, and this is exactly the type of demographic that absolutely should create a Will.

I’ve now defined my family, I don’t have any deceased family members, and for now, I’m not going to include any other people in my Will, I can always add those later if I want to.

Name guardians for children

The next thing I’m going to do is identify some guardians for my minor children., so I have a son and a daughter who I need to nominate a guardian for. Here I’m going to name the person, it’s going to be my sister, and I’m going to name an alternate just in case this first choice person cannot serve as the guardian. As is typical, I’m going to name the same person as the guardian for my two young children.

Choosing an Executor

Now I need an Executor. The Executor is the person with the responsibility to carry out the instructions in the Will. I’m going to name the Executor, their relationship to me, and their address. I can name up to three co-executors, for the purposes of the demo I’m naming just one. I’m now going to name an alternate just in case that first choice is unable or unwilling to serve. – you should always have a back-up Executor. Again, I can name up to three alternates.

Distribute my estate

Now I’m moving into how to distribute my possessions. The first thing I can do is a bequest to charity. We prompt people explicitly if they would like to include a charitable bequest, so I’m going to quickly include a $1,000 bequest to United Way in Ottawa. If I add that, it is going to be included in my Will.

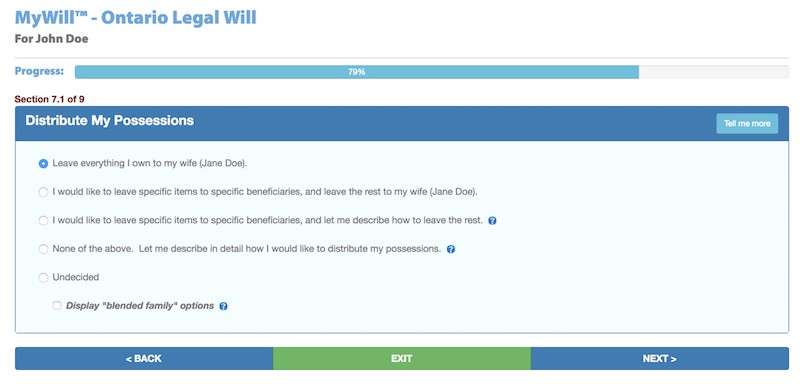

Now I’m going to get onto the main distribution of my possessions.

As is typical, I’m going to leave everything to my wife. But if something were to happen to the two of us – we were both involved in a common accident, then I’m going to divide everything equally between my two children. So I’m going to leave them half each. Remember though, they are young children.

Creating an alternate distribution plan

I can now decide what’s going to happen if either one of those children pre-deceases me. So what I’m going to do here is name an alternate beneficiary for one child. I’m going to name this person, my cousin, to receive everything that the first child would have received had it not been for the fact that they pre-deceased me.

That’s child one of two, and now I’m going to move into the second child. And decide what is going to happen to that second child’s share if they were to pre-decease me.

You see the three options here – I can leave everything to the other child and that’s what I’m going to do in this case. And if both children were to pre-decease me, then again, it would all go to my cousin.

Creating Trusts for children

Now I need to set up Trusts. Remember, they are young children so they cannot receive their inheritance directly. I am setting up a trust so that they will receive their inheritance when they are 30. The first child will receive half of it when they are 21, the second child, again, at 30 years old will receive the bulk of their inheritance, but in this case, they will receive one third of it when they are 21, and one third of it at 25. The remaining third they will receive when they are 30.

It is now asking me if I have any particular debts that I wish to forgive., and for this demo I will say “no”.

I’m now going to quickly setup the account and pay for the Canadian Will service. The Canadian Will service is $34.95, plus applicable taxes.

I have to set up some security questions just in case I forget my User ID and password. Once you have set up the account, you have up to one year to make any changes and get the Will looking exactly the way you want it.

Rather than stepping through the credit card payment process, I have just entered a discount code there, and now I have the Will service enabled on my account, and the account is all set up.

Drafting my Canadian Will

I can go back to my member home page and now I’ll be able to view my Will.

Here’s all my account services; the Living Will, Power of Attorney, Expat Will, and a number of other different services but I’m going to go back to the Ontario Will service to download and print my Ontario Will.

And here….is my Canadian Last Will and Testament which pops up as a PDF and as you can see there are eight pages.

Here’s the $1,000 bequest to United Way, here’s the bequest to the two children, here’s the trust for one of the children, and the trust for the other child. Then there are a number of clauses that give powers to the Executor. Towards the end here is the guardians for my children.

And on the last page is where I sign it in the presence of two witnesses to create my Canadian legal Will. And there you have it, a completely legal Canadian Last Will and Testament in five minutes.

Tim Hewson is one of the founders of LegalWills.ca.

He has over 20 years of experience helping people to write their Will and other estate planning documents. He has been interviewed by many of the major news media outlets including CTV, Global News, The Toronto Star, and other leading Canadian publications. He has also contributed to a number of financial planning books.

Throughout his career, Tim has written extensively on the subject of Will writing and estate planning.

Latest posts by Tim Hewson

(see all)Like this:

Like Loading...

Related