What is a Mirror Will?

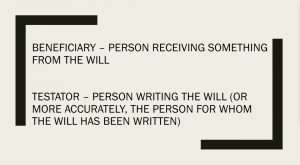

A Mirror Will is actually two Wills, usually created by partners or married couples. The two Wills typically name each partner as the main beneficiary of the other partner’s estate. There may be other specific gifts within the Will, such as gifts to charities, but the two Wills look identical to each other, except that typically, the name of the main beneficiary is the partner of each testator.

Person A leaves everything to Person B. Person B leaves everything to Person A.

Then for the two Wills to be true mirror Wills, each Will describes an identical alternate plan in the event that both partners are involved in a common accident. Often this is that the entire estate is then distributed to the children.

If you walked into a lawyer’s office and simply asked for a Will that left everything to your spouse, and then if your spouse pre-deceased you, to leave everything to your children. Then your spouse asked for a Mirror Will of this Will. They would walk out with the exact same document, but your names would be switched.

For a true Mirror Will, your Executor would be the same in each Will, any specific bequests would be the same, and your alternate distribution plan would be the same.

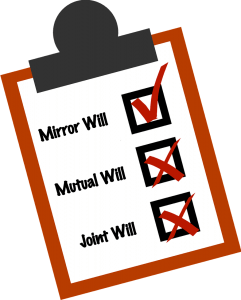

Is a Mirror Will the same as a Mutual Will?

A Mirror Will is not the same as a Mutual Will. There is no legal contract binding the two Mirror Wills, and each Mirror Will can be updated at any time. If one of the partners decided to update their Will at some time in the future, they are absolutely free to do this.

Mutual Wills are two Wills that are written with a legal contract that prevents changes being made to the Wills. Mutual Wills are rarely used, but the intention would be for a couple to both prepare their own Wills, but after the death of one partner, the surviving partner is prohibited from changing their own Will.

Mutual Wills are one approach to preventing a surviving spouse from updating their Will to leave their estate to a new spouse or partner. The Mutual Will addresses the risk of children being disinherited from an estate as the new partner has no biological relationship with the children.

However, a better solution to addressing this concern would be for the surviving spouse to leave a lifetime interest to their new partner, so that on the death of the new partner everything would automatically flow to their children. Lifetime interest trusts are a much more common approach to handling this situation than a mutual Will.

What is a Joint Will?

A Joint Will is a single document that attempts to cover the needs of two partners within one document. At LegalWills.ca it is a very common request from people who feel that their estate is jointly owned, and so they would only need one Will.

Joint Wills used to be popular before the age of computers and printers. It would save the Will writer a great deal of time to write just one document, rather than two very similar documents with just a name change.

They were also popular back in a time when the ownership of property was viewed as the domain of the family’s patriarch. Everybody else in the family including a wife was regarded as a family member without the same ownership rights.

But today, not many Will writers prepare joint Wills. There is no advantage to having one Will cover two different people, even if they are a married couple. But there are significant difficulties that can arise. Supposing one of the partners prepares a new Will revoking all previous Wills. Is the joint Will now cancelled? including the parts pertaining to the other testator?

Joint Wills are confusing and unnecessary, and at LegalWills.ca we do not support the use of Joint Wills.

I think I need a Joint Will for a married couple.

Just because you are a married couple, you still have independent “estates”. Your estate is everything that you own; all of your possessions, bank accounts and property. A married couple effectively own a share of this property each. You should each write your own Will describing what would happen to your share of the joint property.

This means that you can for example leave a bequest to a charity in your Will. You could leave a sum of money to a favourite niece. You can do things in your Will with your share of your jointly owned property. You do not need to have one set of instructions for both of you.

Even if you both had the exact same intentions; to leave everything to each other, and then to leave everything to your children after you both pass away. You would still describe this in a Mirror Will, rather than attempt to describe this in one document covering the two of you.

What are the other different types of Wills?

There are some other Will terms you may have seen. A Reciprocal Will is a pair of documents that name each other as the main beneficiary. Mutual Wills and Mirror Wills are usually Reciprocal Wills.

For sake of completeness, some other Wills should be defined here.

Holographic Will

A Holographic Will is a document written entirely in your own handwriting. It has a unique place in the law, because it doesn’t require witnesses to the signing.

Holographic wills are valid in Ontario, Quebec, New Brunswick, Alberta, Manitoba and Saskatchewan. In Prince Edward Island, the court can recognize a holographic will, but is not required to. British Columbia, Newfoundland and Labrador, Nova Scotia, and Nunavut do not recognize holographic wills.

There is an important clarification to be made here. Just because a Province does not accept a holographic Will, it does not mean that the Province does not accept a Will that you have written yourself. Nor does it mean that the Province does not accept a Will that you have written all in your own handwriting. It simply means that it does not accept a Will that has not been signed by two witnesses – a special characteristic of the handwritten, holographic Will.

What does this mean? You should only use a holographic Will to describe the distribution of your estate in the most dire of circumstances. If you are pinned under a rock and you are not confident of your survival, a holographic Will is definitely the best approach. This is why witnesses are not required. Chances are, if you are writing a Will entirely in your own handwriting, there may not be witnesses on hand to add their signature to your document.

But it is not a Will writing strategy under normal circumstances. Even if you manage to prepare your Will on the back of a napkin, and you live in one of the Provinces that accepts a holographic Will, you are not likely to have written a very good Last Will and Testament.

Just to reiterate. This is not a fill in the blanks document. This is a document written entirely in your own handwriting. If you have no legal training, it is not easy to prepare a well drafted Last Will and Testament starting with a blank piece of paper. Even if you have a sample Will to copy.

Nuncupative Will

A Nuncupative Will is another unusual type of Will – also called an “oral Will”. This may be accepted in extreme circumstances for example, for military personnel on a battlefield. In general it is not an approach to estate planning, because every Province requires a Will to be in writing and on paper. Likewise, a video Will, or one saved within an app on a phone would not be accepted by the courts as it would not meet the legal requirements of a Last Will and Testament.

When should I use a Mirror Will?

If you use the concept of a Mirror Will to it’s most literal sense; an exact transposing of one Will to another person’s, then it has limited value. If you blindly hand your Will to a Will writer and request that a second Will be prepared that is an exact Mirror Will then there are few cases where this would be the perfect solution.

It can certainly work if you are married, with children and the children are the biological parents of all children. For the Mirror Will to really work, it would require that your Executor was probably your spouse or an independent third party, and that you had no particular specific bequests including charitable bequests. It would also mean that you had no particular family heirlooms that would pass to a specific individual.

If your Will is “everything to my spouse, if we die at the same time, then everything to our adult children, and if they pre-decease us, then their share would go to their children”. In this situation a Mirror Will can work for you. Even then, it doesn’t allow for much individual expression within the Will.

A “Kind of” a Mirror Will

What is more likely is that much of the information will be passed from one Will to the other, but that there would still be some flexibility in the second Will to not exactly reflect the first Will.

For example, it is common for one of the partners to include a family heirloom, or a charitable bequests, or any prized possession. If you don’t have children, then there is a very good chance that your alternate distribution plans for your estate will be different.

You each may wish to make your partner your main beneficiary, but it you don’t have children, and you are both involved in a common accident, your alternate plan may be for your estate to go to your sister. Your partner may want their share to go to their nephew, or to charity.

This is why we talk about a Mirror Will as a general concept, but not a document that should necessarily be taken literally. Certainly the names of your children may be reflected in your partner’s Will, maybe your Executor appointment, and likely your first choice distribution plan. But beyond that, you should be free to express some individual differences in the second Will.

When should I definitely not use a Mirror Will?

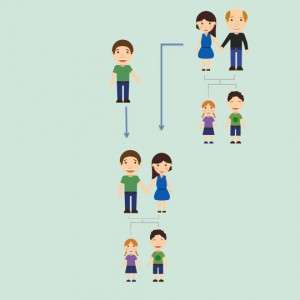

When your distribution plans do not match, then a Mirror Will is not right for you. For example, if both partners are not the biological parents of all of the children; the classic “blended family” or “step-family”.

The Simple Blended Family

In fact, in this situation it rarely makes sense to name your spouse as your main beneficiary without some conditions associated with that bequest.

Imagine that you are in a second marriage, but you have children from a first marriage. Your new spouse is not the biological parent of your children. It is very common in this situation for you to name your spouse as your main beneficiary. You then create an alternate plan in case your spouse were to pre-decease you. The alternate plan leaves your estate in equal shares to your children.

What many people misunderstand is that your alternate plan does not describe the flow of your estate. It doesn’t all pass to your spouse, and when your spouse dies, it passes to your children. It only goes to your children if your alternate plan comes into effect; if your spouse pre-deceases you (or is involved in a common accident).

Most commonly, the entire estate passes to the spouse, and then the spouse moves on with their life. They then update their Will, but they do not have any emotional or biological tie to the children or their now deceased partner. So they distribute their estate (which includes their deceased partner’s assets) according to their wishes in their Will.

The end result is that your children end up with nothing.

The solution to this is to leave everything to your spouse as a lifetime interest trust. The assets then flow to your children once your spouse dies, but they can use the assets for the duration of their lifetime. You can create lifetime trusts using our service at LegalWills.ca.

But in any family situation like this; a Mirror Will rarely works.

How much does it cost to prepare a Mirror Will?

The cost of writing a Last Will and Testament varies considerably, and so does the cost to prepare a Mirror Will. If you prepare your Will with an estate planning lawyer, it will cost in the region of $450 to $600 plus a variety of service fees and “disbursements”. If you are able to secure a price up front, your final bill may or may not match that original quote. A Mirror Will is usually charged as a bundle with the second Will costing about a half of the cost of the first. So if a lawyer charges $500 for the first Will, a couple of Mirror Wills would typically cost around $750, as long as the two Wills were almost identical.

Some online services offer a bundle for a couple package. Again, usually at about half as much again for the second Will. At LegalWills.ca our Last Will and Testament service is $39.95, the second, Mirror Will is discounted by 40 percent, and so is priced at $23.97. The total pricing for the two Mirror Wills is $63.92. However, what makes the service at LegalWills.ca unique is that we allow you to export as much or as little data from one Will to the second Will. You receive this discount even if your Wills are nothing alike.

Can I write my own Mirror Will?

The expression “Writing your own Last Will and Testament” comes with many misconceptions. You can write your own Will using a blank piece of paper, or a blank form DIY Will kit from Staples. But in general, this would give you a poorly worded, inadequate Will. When the legal profession warn against the dangers of writing your own Will, they are usually referring to blank kits, or even free downloadable forms. We too advise against using any blank form Will kit. Chances are, you will make a mistake, and leave your loved ones with a mess to sort out.

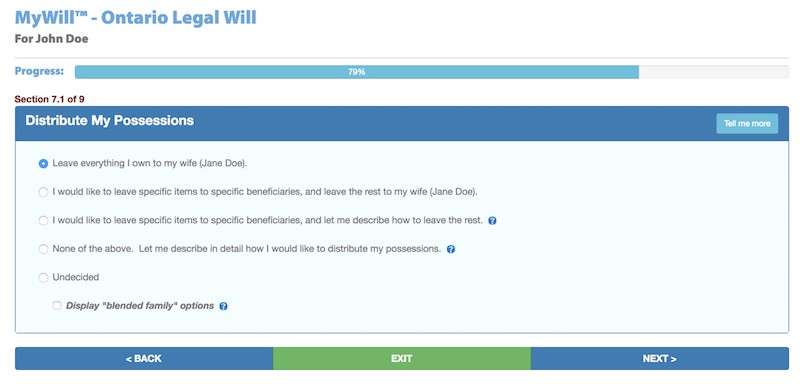

But you can write your own Last Will and Testament using an online interactive service like the one at LegalWills.ca. With our service we guide you through the process of writing a Will in a similar way to online tax preparation software. The service is specific to your Province, takes you through step-by-step, with help for each section. The service even checks for errors so that it only allows you to do what you can legally do in your Province.

You can create a perfectly legal Last Will and Testament using the service at LegalWills.ca and yes, this means that you have technically written your own Will. But using software is not the same as using a blank form Will Kit.

Once you have created the first Will at LegalWills.ca you can create a Mirror Will with just a couple of clicks of a mouse.

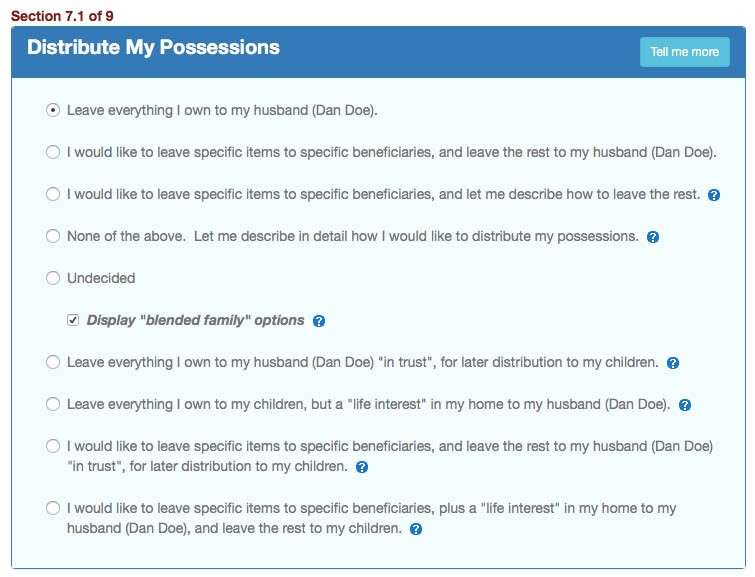

How can I create a Mirror Will at LegalWills.ca?

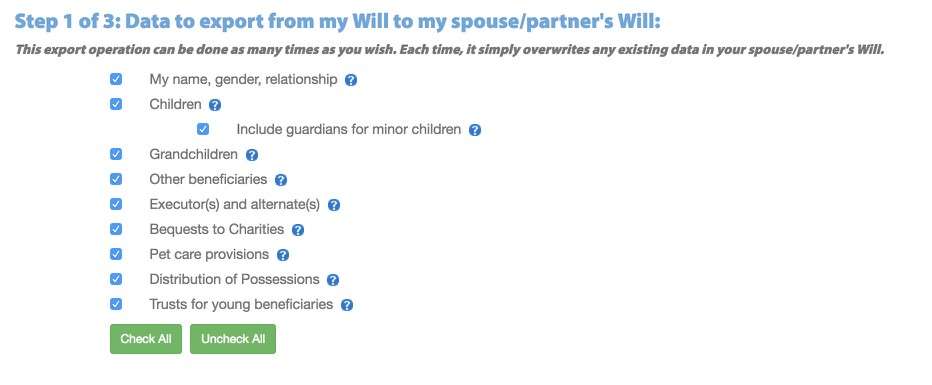

LegalWills.ca is unique in the industry in having a tool that significantly streamlines the process for preparing a second Mirror Will. In addition, the service is unique in allowing you to export as much or as little of your Will as you wish, into the second account.

The first step is to prepare your own Will at LegalWills.ca, and then creating your own User ID and password. In purchasing the Will service, you automatically get a one year account, and so you can continue to make as many changes to your Will for one year, to get it exactly how you need it.

Once you have completed your Will, you can download and print the document and then sign it in the presence of any two adult witnesses to create your legal Last Will and Testament.

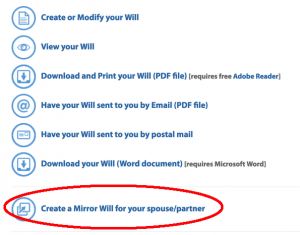

Then log back into your account, click on MyWill, and then “Create a Mirror Will for your spouse/partner”.

This will guide you through the process of exporting data from one account to another.

You can then select which elements from your Will you wish to move into the second account.

You can then either set up the second account, or if you already have the spousal account, you can just enter the information for an existing account.

This means that you can for example, move the names and birthdates of your grandchildren to your spouse’s Will, but you can each make your own charitable bequests if you wish.

The second account is then set up with the required information already entered into the service.

We claim that you can prepare a Will in 20 minutes using the service at LegalWills.ca. But using our Mirror Will tool, you can create a second Will in half that time!

How do I get started?

The first step to preparing your Will, and your Mirror Will is to step through our online Will writing service. From here you will be guided through the nine sections to prepare your Will. If you have any questions about our service, our blog, or about Wills in general, please contact us using the contact us form. We do not charge for support and are happy to help whenever we can.

Tim Hewson is one of the founders of LegalWills.ca.

He has over 20 years of experience helping people to write their Will and other estate planning documents. He has been interviewed by many of the major news media outlets including CTV, Global News, The Toronto Star, and other leading Canadian publications. He has also contributed to a number of financial planning books.

Throughout his career, Tim has written extensively on the subject of Will writing and estate planning.

Latest posts by Tim Hewson

(see all)Like this:

Like Loading...

Related