What is the purpose of a Will?

Your Last Will and Testament allows you to speak after you have passed away. It does absolutely nothing and has no powers whatsoever all the time you are alive. But as soon as you die your Will has two key functions: it allows you to make key appointments and it allows you to describe the distribution of your assets. These assets include money, possessions, houses, investments, everything that you own. Making a Will is one of the most important responsibilities of every adult, and it should not be put off until a distant day in the future when you are “old”.

You should not think of making a Will as a once-in-a-lifetime event. You should always have a Will in place that reflects your current situation. You should write your first Will as soon as you are an adult, and then update it throughout your life as your circumstances change.

Your Key Appointments

By Making a Will you can make two key appointments.

Your Executor

This is the person you entrust to carry out the instructions in your Will. They have the responsibility to arrange your funeral, gather and secure your assets, and then distribute them according to the instructions in the Will. It is a very important appointment.

You can choose a friend or family member to take on this role, but they must be trustworthy, good with paperwork and have the interpersonal skills to work with the beneficiaries. Usually a Will allows your Executor to employ professional help if they need it, and this can be paid for out of the estate.

If you do not have a friend or family member who can take on this responsibility, you can hire a professional, like a bank or law firm. Be aware that these options can be very expensive and will take money from your estate.

Guardians for Children

If neither parent was available for your minor children, for example you were both involved in a common accident, or if you are a single parent, then somebody will have to take care of your children.

In reality what happens is that if neither parent is available, then a judge at the family courts will appoint a guardian. Hopefully people will come forward and offer themselves as the guardian and the judge will grant guardianship to the person or family that he/she considers to be the most appropriate. As a parent, by making a Will you can make an appointment in your Will and this would be the over-riding factor in the judge’s decision, together with any appointment made in the child’s other parent’s Will. If this person is still willing and able to serve as the guardian, then the judge would most likely grant guardianship to this person.

Of course, circumstances can change between making a Will and the guardianship appointment being made. For example, your guardian may have personal struggles of their own and are no longer fit to look after your children. This is why your guardianship appointment in your Will is not a legally binding appointment.

But unless there is some reason why the person that you have appointed in your Will is unwilling or unable to act, then they will almost certainly be appointed the guardian to your children.

The distribution of your assets

Making a Will allows you to describe the distribution of your assets. This includes gifts to friends, family members as well as charities and other organizations.

The recipients of your assets are called “beneficiaries”. The items going to the beneficiaries are called “bequests”. Everything that you own – your collection of assets, is called your “estate”.

A bequest can be a sum of money “$1,000 to my niece Susan Brown ”, an object “my 1971 Ford Mustang to my brother Gary White”, or a percentage of your estate “one percent of my estate to the Toronto Humane Society”. You can either give a specific bequest like this, or you can simply divide the estate “my entire estate to be divided equally between my 3 daughters”.

The distribution of your assets is made up of a plan, and also an alternate plan, in case your first-choice plan cannot work for whatever reason. Usually your Will would say something like “leave my entire estate to my wife, Sally, if she survives me. If my wife Sally does not survive me, then to divide my entire estate in equal shares between my children”. Your Will should be written in such a way that no matter what happens, there is a plan for your estate.

What happens if you die without making a Will?

You have a distribution plan for your estate whether or not you write a Will. If you write a Last Will and Testament, then the plan is of your making. If you choose not to write a Last Will and Testament, then the plan is determined by the “intestate” laws of your Province or Territory. They are actually different for every Province or Territory.

If you die without making a Will, the first problem is that there is nobody appointed to take charge. Occasionally, it may be obvious who is going to take responsibility for administering the estate, but more often than not, there is general confusion. The lack of an Executor appointment can result in fighting between family members and general chaos. Eventually, the courts will appoint an Estate Administrator, who will then have to secure the assets in the estate. Hopefully, not too much time will have passed that the assets have started to disappear.

The Estate Administrator will then have to distribute the estate according to the laws of your Province or Territory.

If you are single, with no children or grandchildren, your estate will go to your parents. If you have no parents, then your entire estate will be divided between your brothers and sisters. If you have no siblings, then between your nieces and nephews. If you have no nephews and nieces, then your estate will go to your cousins. Only if you have no living relatives does your estate go to the government !!

If you are married with no children, then your estate will eventually all flow to your spouse. But without a Will, the process can be slower, and assets are frozen in the meantime.

If you are married with children, things get complicated and no two Provinces or Territories have the same distribution plan for your estate. The distribution plan for somebody without a Will is almost never the same as a distribution plan written by somebody with a Will. It would be very unusual for any married person with three children aged one, three and five years old, would write a Will with the following distribution plan:

“I leave $200,000 to my spouse, Sarah. The remainder should be divided such that Sarah receives one third, and my three children share the remaining two thirds”

This is what would happen in Ontario if you died without making a Will.

How can you write a Will?

There are, broadly speaking three options for making a Will:

Option 1: Use a blank piece of paper or blank-form Do-It-Yourself Will kit

This is the cheapest approach, often free. But it is actually the most difficult way to prepare a well-drafted Last Will and Testament. Legally, as long as the document states that it is your Last Will and Testament and is signed in the presence of two adult witnesses, then it is an acceptable Last Will and Testament. But this doesn’t necessarily mean it is a good one. Two common mistakes made with blank-form Will kits are:

Mistake 1 – Failing to handle different scenarios

You may have a good plan for your assets if something were to happen to you, but what if your main beneficiary is involved in an accident at the same time. Or your Executor is no longer capable of performing the tasks. Or your chosen guardian has recently had triplets of their own and can no longer add more children to their family. Simple Will kits usually fail to cover the “what if” scenarios.

Mistake 2 – Attempting to list one’s assets

The most common mistake with DIY Will kits is making a Will assuming that it is coming into effect today. You may look around your house and start listing your possessions and deciding who will receive what. Then list your bank accounts so that your Executor knows where to find everything.

You should not include a list of assets in the Will itself. You don’t know when your Will is going to come into effect, and your assets are likely to change over time. This would require you to update your Will every time you opened a new bank account or made a major purchase. Furthermore, once a Will is probated, it becomes a public document that everybody can read. You may not want details of all of your assets made public.

If a particular item has a specific beneficiary that is different to the main beneficiary of your estate, then yes, it must be included. So if everything is going to say, your son , except for a piece of art which is going to your nephew, then the piece of art has to be included in your Will.

It does make sense to list your assets in order to help your Executor administer the estate. They have to gather your assets, and it is helpful to have the accounts documented so that they can be sure that nothing is forgotten. But not in the Will itself.

Option 2: Use the services of a lawyer (or Notary in BC or Quebec)

This has always been the traditional approach for making a Will. If you work with a lawyer to prepare your Will, you have the option of asking for legal advice. If you have a particular situation that needs consultation with an expert in the law, then this is a great approach. For example, if you had a child with special needs receiving government benefits and you would not want an inheritance to impact these benefits, there is a particular trust called a Henson Trust that can be created. It is a sophisticated legal tool that should not be prepared by somebody with no legal training. However, most people when preparing their Will may not need this type of legal advice, so working with a lawyer may mean that they are overpaying for services that they are not using.

Also, be aware that a family lawyer is not an estate planning or tax expert. If you need advice on structuring your estate to minimize taxes, then you may need to work with a team of advisors. If your estate is very large, then you may need to work with an accountant as well as a family lawyer.

Although working with a team of professional advisors may provide the best answers, it can be expensive, and it is certainly not the most convenient approach. Making an appointment with a lawyer, particularly for working professionals, it often cited as the main barrier to making a Will.

Option 3: Use an online interactive service

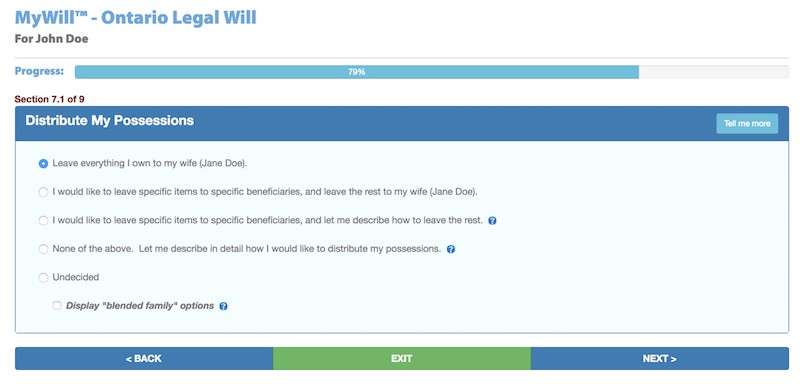

Thankfully there is a middle ground that allows you to prepare a professional quality Last Will and Testament with the price and convenience of a Will kit. This is the online interactive Will service.

Much like the interactive services for preparing your taxes, these services guide you through the process for making a Will. They are specific to your Province or Territory, and check for errors. For example, if you have young children, you are prompted to name guardians for the children, and set up trusts. After answering all of the questions, the service compiles a document that can then be downloaded and printed.

The document should then be signed in the presence of two adult witnesses to turn it into a legal Last Will and Testament.

If you need to update the document to reflect any changes in your personal situation, you can simply login to your account, make the change and then download the new Will. All from the comfort of your home.

Over the last 15 years these online services have become more robust and sophisticated, so they no longer only cover the simplest of situations. Some, like the service at LegalWills.ca, include pet trusts, lifetime interest trusts, coverage of foreign assets and more.

Do you need a lawyer to write a Will?

Lawyers are available if you need legal advice. There is absolutely nothing in any legal statute that requires you to use the services of a lawyer to prepare a Will. Everybody has a right to prepare their own Will, and many do not have financial or geographic access to a lawyer.

At a minimum, a Will must state that it is your Will, be signed and dated, and be signed by two attending witnesses. Those witnesses can be any two adults who are not beneficiaries in the Will (or in some jurisdictions, they cannot be the spouse of a beneficiary). In general, we recommend that the witnesses have absolutely nothing to do with the contents of the Will.

A lawyer can help you if you need legal advice. But most people do not need legal advice when writing a Will, particularly if you are using software.

To make your document a legal Last Will and Testament you should firstly download and print it. It must then be signed in the presence of two adult witnesses who are not beneficiaries in the Will. These can be any two adults; friends, neighbours or co-workers, as long as they have nothing to gain from the contents of the Will.

Once it is signed and witnessed, it becomes a legal Last Will and Testament. There is no requirement to have the document notarized, stamped, or signed by a lawyer. Nor does the document need to be registered.

You simply store the document somewhere safe, in a place that is known and accessible to your Executor. After you have passed away, your Executor should take the document to your local probate court, where it is accepted as your Will, and filed with the courts.

Your Executor is then given a “Grant of Administration” that they can use when gathering your assets. A bank will ask to see the Grant of Administration before releasing funds to the Executor.

What other documents do you need?

The complete Estate Plan

Everybody needs a Will. At some point, you will die, and by making a Will you leave your family and loved ones with clear instructions on what should happen next. There are some other documents that we consider to be a part of a complete Estate Plan. All of these documents can be created at LegalWills.ca.

Funeral wishes

There is a common misconception that your funeral wishes belong in your Will, but in fact, there are very good reasons why you should write your funeral wishes in a separate document, and simply store this with your Will.

These are just a few of the reasons why your funeral wishes should be documented separately:

1. Your Will is a legal document that must go through the formal probate process before it is accepted as your Will. There may be multiple versions of your Will, and the probate courts officially certify one Last Will and Testament. By the time this is done, your funeral would likely have already taken place.

2. Your funeral wishes are usually very personal and may speak about the music that you want played, the general tone of the ceremony and other quirky wishes. They don’t really belong in a legal Last Will and Testament. Furthermore, once your Will is probated, it is a public document, and can be read by anybody. Some of your personal funeral wishes may not be for the general public.

3. Your funeral wishes are not legally binding. They are an expression of your wishes, but they do not have the same legal rigour as a Last Will and Testament. Your funeral wishes do not have to be signed in the presence of two witnesses, and can be updated at any time, and you can even make handwritten updates. You cannot do this to a Last Will and Testament.

Inventory of Assets

Most Wills have a “residual clause” that describes a distribution plan for everything that is left after debts, taxes, funeral expenses and specific gifts. But this clause typically says something like “my entire estate to be divided between my children”.

Your Executor is then tasked with gathering that entire estate. How will they know the extent of your assets? Including potentially digital assets like online accounts? It is important that you prepare an inventory of assets that can be stored with your Will.

At the end of December 2017, the Bank of Canada announced that there were approximately 1.9 million unclaimed bank accounts, worth some $742 million. Many of these were for people who died, but their Executor wasn’t aware of the account.

Financial Power of Attorney

The preceding documents are all useful once you have died. But what if you were incapable of handling your own affairs, but you were still alive? This could mean that you were in a coma, or you developed a mental illness or cognitive impairment. Your financial Power of Attorney allows you to name a person to take responsibility for your finances if you were ever to lose capacity. A Power of Attorney is immediately cancelled as soon as you pass away.

This can be very useful if you have bills to pay, including medical bills, or costs associated with a nursing home.

Critically, this document has to be written while you are mentally competent, to come into effect if you lose competence. In many cases the document may never be used. But if you ever lose capacity to handle your own financial affairs, it is too late at this point (or at least, much more difficult) for somebody to be appointed Power of Attorney over your affairs.

Living Will (Healthcare Power of Attorney and Advance Directives)

The final document is the appointment of somebody to make medical decisions on your behalf; a Healthcare Power of Attorney. This document is often accompanied by an expression of your wishes for end-of-life care, called an “Advance Directive”. Together these documents are sometimes referred to as your “Living Will”.

The service at LegalWills.ca

Hopefully by now you have an understanding of the importance of making a Will, and the different approaches to preparing a Will.

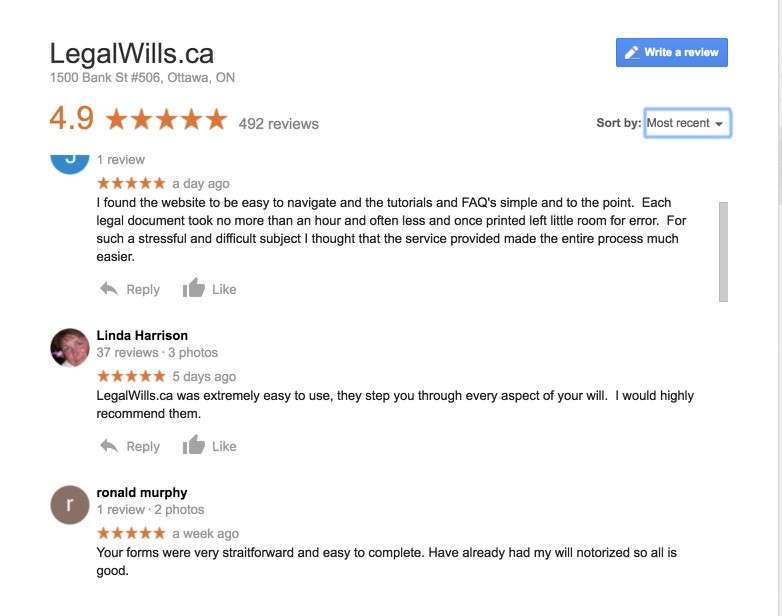

LegalWills.ca is Canada’s leading online Will service provider. We have been in business since 2001 and have helped thousands of Canadians prepare their estate planning documents. Many of our Wills have gone through the probate process, and we have never once heard of an issue with one of our Wills. We have an A+ rating with the Better Business Bureau and over 500 five-star reviews on Google.

Our Will writing service is made up of nine sections which guide you through the process of preparing a Will. We will ask you about your key appointments, your family situation, allow you to set up trusts, make charitable bequests, and even make provisions for the care of pets. The whole process for preparing a Will takes about 20 minutes.

A word on Joint Wills

Although it is legally possible to create a joint Will with one document serving two people, it is not supported at LegalWills.ca.

Joint Wills used to be created with the intention of saving the time and expense involved in creating two separate Wills. Most lawyers practicing today, however, avoid creating joint Wills because of the awkwardness and difficulties that can arise in interpreting their terms, as it can leave the surviving partner bound by terms that make no sense once the first partner has passed away.

Using the service at LegalWills.ca we encourage each partner to prepare their own Will individually. You would name each other as your main beneficiary, and then have an alternate plan in case you were both involved in a common accident. This is called a Mirror Will and LegalWills.ca has a special tool for preparing a Mirror Will, so that information does not have to be re-typed into two different accounts.

The opinions expressed herein by “LegalWills.ca” are designed to provide educational information only and are not intended to, nor do they, offer legal advice. Opinions expressed within this document are not intended to, nor does it, create an attorney-client relationship, nor does it constitute legal advice to any person reviewing such information. No communication with “LegalWills.ca”, on its own, will generate an attorney-client relationship, nor will it be considered an attorney-client privileged communication. You further agree that you will obtain your own attorney’s advice and counsel for any information that has been published herein by “LegalWills.ca”.

Tim Hewson is one of the founders of LegalWills.ca.

He has over 20 years of experience helping people to write their Will and other estate planning documents. He has been interviewed by many of the major news media outlets including CTV, Global News, The Toronto Star, and other leading Canadian publications. He has also contributed to a number of financial planning books.

Throughout his career, Tim has written extensively on the subject of Will writing and estate planning.

Latest posts by Tim Hewson

(see all)Like this:

Like Loading...

Related