First a definition;

A stepfamily or blended family is a family where at least one parent has children, from a previous relationship, that are not genetically related to the other parent. Either one or both parents may have children from a previous relationship. Children from a stepfamily may live with one biological parent, or they may live with each biological parent for a period of time.

Sadly, the long form census was scrapped in 2011, so the Census data came to a grinding halt in 2012, but according to Statcan, in 2011 12.6% of all families with children in Canada were stepfamilies ( we heard just yesterday that the long form census is to be reinstated under the new Trudeau government, so we may be able to provide some better data next year).

Statistics Canada defines a stepfamily as one in which at least one child was the biological offspring or adopted child of only one of the spouses prior to the relationship.

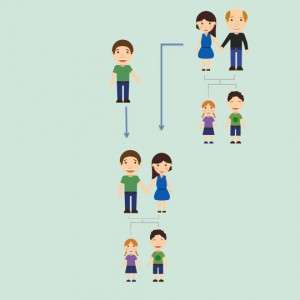

Statcan then classifies blended families as either “simple” or “complex.”

A “simple” stepfamily comprises biological or adopted children from one and only one of the spouses, all of them pre-dating the relationship.

There are three types of “complex” stepfamilies: those with at least one child of each parent and no children of both; at least one child of both parents and at least one from only one parent; and children from both parents and at least one from each.

We will attempt to break down the estate planning implications for each of these and provide suggestions for how to write your Wills.

The simple blended family

The Simple Blended Family

In this situation, let’s imagine that Sue and Brian are married, and have two children, Jenny and Joey.

For whatever reason, Sue and Brian are no longer together and Sue creates a new life with Dan. Dan and Sue now get married and live together with Jenny and Joey (Brian and Sue’s children).

If Sue and Dan have no Wills

If Sue or Dave were to die without a Will, then the family is left with a very complicated situation. Let us assume that Sue and Dave each have an estate worth $500k.

The estates will be divided according to the intestate succession laws which vary from Province to Province.

| Province | Who receives what? |

| British Columbia | If Sue were to die, then Dan will receive $366k, Jenny and Joey will receive $66k each, even if Dan and Sue never remarried but simply lived as common-law. |

| Alberta | Dan will receive $250k, Jenny and Joey will receive $125k each. Brian will receive nothing. |

| Saskatchewan | Dan will receive $233k, Jenny and Joey will receive $133k each. Brian will receive nothing. This would also be the case if Dan and Sue hadn't remarried and simply lived as common-law. |

| Manitoba | Dan will receive $375k, Jenny and Joey will receive $62,500 each. Brian will receive nothing. This would also be the case if Dan and Sue hadn't remarried and simply lived as common-law. |

| Ontario | Dan will receive $300k, Jenny and Joey will receive $100k each. Brian will receive nothing. |

| New Brunswick | Dan will receive all of the house in which they are living, and then $166k. Jenny and Joey will receive $166k each. Bear in mind that if Dan were to die, everything would go to Sue as stepchildren are not included in the distribution of the estate if there is no Will in New Brunswick. |

| Nova Scotia | Dan will receive $200k, Jenny and Joey will receive $150k each. As with New Brunswick, stepchildren are not included in distribution of property without a Will, so if Dan were to die first, Jenny and Joey would receive nothing. |

| Prince Edward Island | Dan, Jenny and Joey would all receive $166k each. If Dan were to die first, then Sue would receive everything. Jenny and Joey would receive nothing from Dan's estate. |

| Newfoundland and Labrador | Jenny and Joey would all receive $166k each. If Dan were to die first, then Sue would receive everything. Jenny and Joey would receive nothing from Dan's estate. |

| Yukon Territory | Dan would receive $217k, Joey and Jenny would receive $142k each. If Dan were to die first, then Sue would receive everything. Jenny and Joey would receive nothing from Dan's estate. |

| Northwest Territories | Dan would receive $200k, Joey and Jenny would receive $150k each. This would also be the case if Dan and Sue hadn't remarried and simply lived as common-law. |

| Nunavut | Dan would receive $200k, Joey and Jenny would receive $150k each. This would also be the case if Dan and Sue hadn't remarried and simply lived as common-law. |

| |

Further complications of dying without Wills

It is possible that you may look at the distribution of your estate and think

“Well, that doesn’t seem too bad, the distribution seems fair, I guess we don’t need Wills”

But things unfortunately are not as simple as it first seems.

Clearly Jenny and Joey are minor children so they cannot inherit anything directly. Their inheritance will go into Trust to be handled by a trustee to be received when they become adults. There are at least two problems with this;

Jenny and Joey will probably be going to live with Brian, after all, he’s the biological father. Sue’s Will would have given her an opportunity to name a guardian, but even with this, there is a good chance that if Brian is willing and capable, then he will take over the parenting duties. Obviously, this may come as a shock and disappointment to Dan.

The courts will then appoint a trustee for the children’s inheritance. Somebody will be looking after the money that will be going to the children, and it may be Brian, it may be Dan, the courts will decide. If Dan and Sue had written their Wills, Sue could have named the trustee.

The children will receive their significant inheritance as soon as they become adults.

In Alberta, Manitoba, Ontario, Prince Edward Island, Quebec, and Saskatchewan they will receive this money at 18. In British Columbia, New Brunswick, Newfoundland, Northwest Territories, Nova Scotia, Nunavut, and Yukon, they will have to wait until they are 19.

So for example, in PEI, Sue’s 18 year old son would be the very happy recipient of $166,000 !

In addition the splitting the estate is not always a straightforward task. Supposing Sue’s $500k estate is primarily made up of her share of the family property. If the property is owned as “tenants-in-common” with Dan, then the children will own a percentage of that home, and they may want their share of the property right now.

This means that Dan is forced to either pay to the children their share of the property, or if he is unable to do this, the family home will have to be sold.

Finally, Dan is still receiving a significant part of Sue’s estate that Sue may have intended to go to her children. Supposing a few years later Dan remarries. There’s a good chance that Dan’s entire estate (including his inheritance from Sue) is going to pass to his new wife (are you following? it can get complicated). It means that Dan’s new wife will effectively be the beneficiary of a significant portion of Jenny and Joey’s inheritance.

I think it’s fair to say that the fallout of Sue dying without a Will does not reflect her true intentions.

The importance of Wills for simple blended families

There are some very important elements of writing a Will that help organize the distribution of the estate.

Setting up a life interest in an estate

You may conclude that the answer to avoiding this mess is to simply create a Will where everything is passed to the children and not the second spouse. Unfortunately, in many Provinces the spouse has a claim on the estate, and the Will would likely be re-written to provide for some inheritance to the spouse.

These laws are in place because without them, the children would be able to displace the step-parent from their house. In this story, it wouldn’t be fair on Dan if everything went to Jenny and Joey who then left to live with Brian.

If you are attempting to prepare your own Will you typically have three options, each of which has serious negative consequences.

- Leave everything to your second spouse: The hope would be that eventually when the second spouse passes away, they will then leave the entire estate to your children. This is a huge assumption and there may be many family dynamics at play in the years that follow your death. There is a good chance that your children would receive nothing of your estate.

- Leave everything to your children: This ensures that your children receive their inheritance, but leaves the second spouse with nothing. There may be a challenge to the Will, and if there is no challenge, the second spouse may be forced to sell the family home.

- Divide everything between your children and your spouse: This may seem fairer but actually exposes your family to the problems of both option 1 and option 2.

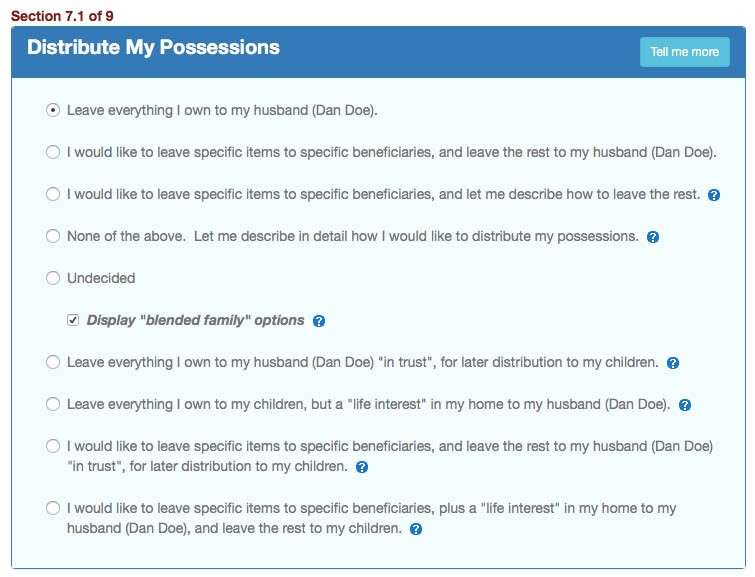

Fortunately, at LegalWills.ca our Wills allow life interests to be created specifically for Blended family situations.

These options offer the flexibility demanded by a blended family.

The first blended option is leaving everything to the second spouse as a life trust, and when the second spouse dies, the funds then are passed to the children. All the time Dan is alive he can live off the proceeds of the trust fund, but the contents of the trust are own by the children. They just cannot access it until Dan has died.

The second option allows for Dan to have use of the family home for the rest of his life, and when he dies, the family home then is passed to the children. The Will includes details describing who has the responsibility for care and maintenance of the home and outlines what Dan can and cannot do while residing in the home.

The final two options provide for additional flexibility where you may want to include some other bequests to other beneficiaries but still create these life trusts. Maybe a charitable bequest or two.

Naming an Executor

Another important role of Wills is the naming of your Executor; the person with the responsibility to carry out the instructions in the Will. This person will have to deal with some challenging family dynamics while having the acumen to handle the financial demands including the payment of debts and taxes. In addition, they will have to organize your funeral arrangements.

In a blended family situation, it would be better for you to make that appointment rather than a judge in a court. Bear in mind that cordial family relationships will almost certainly be strained when large sums of money are involved, and parents, step-parents with adopted parents will be vying to establish their positions in the family hierarchy. There will be a lot of emotional stress after your passing and this invariably puts a strain on blended families rather than pulling everybody closer together.

If your children and first and second spouse do not get along well, you must be very careful with your Executor appointment. Although you can select more than one person to work together, it may be preferable to name just one Executor. Multiple Executors from blended families often have a difficult time working together and this can bring the estate administration to a grinding halt.

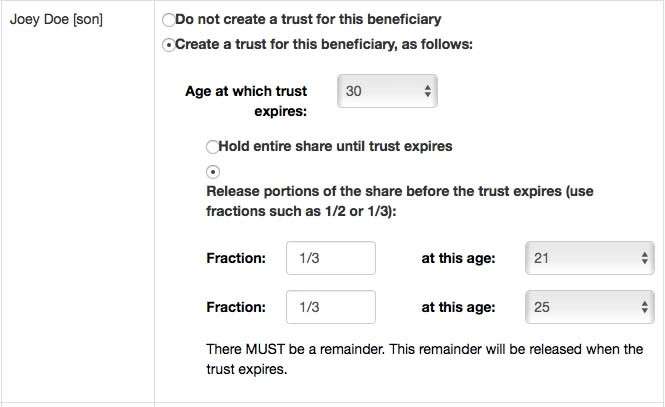

Setting up a trust for a minor beneficiary

Wills also allow for the creation of trusts for minor beneficiaries. Remember Joey with his new $160k purchase? I think most people would agree that 18 is too young to inherit a large sum of money, just at a time when a young person may be heading off to Frosh Week at University!

Using the service at LegalWills.ca you can create a trust that not only delays the inheritance, but can also be used to phase the release of the trust funds.

This page within the LegalWills.ca website has set the trust up so that Joey receives one third of his inheritance at 21, one third at 25 and the remainder at 30. Without a Will, this would not be possible.

Other documents in the estate plan

So far we have only discussed the importance of your Wills, but there are three other critical documents in an estate plan that become vital in blended family situations.

The Financial Power of Attorney

If you are ever in a situation where you are unable to take care of your own finances; you are seriously hospitalized, or you lose mental capacity, then you can give somebody else the power to handle your finances. This means that bills can still be paid, and even potentially a house can be bought or sold.

If we go back to Sue’s family situation; supposing Sue sadly developed Alzheimer’s and started losing her capacity. She was even put into a retirement or senior’s residence. She may own half of her house with Dan, but there is nothing that anybody would be able to do to sell her house. Dan may want to sell it, but Sue would have to sign the papers, and maybe Jenny and Joey don’t want the house to be sold. What does Brian think of all of this?

By preparing a Financial Power of Attorney and granting Dan with the powers to handle Sue’s financial affairs, much family discord can be avoided. Bear in mind that this document can only be completed while you have full mental capacity. At LegalWills.ca we frequently hear the question;

My mother has lost mental capacity, can we prepare a financial Power of Attorney for her?

Sadly, at that point, it is too late. When you prepare your Wills, you should also prepare your financial Power of Attorney.

The Living Will and Healthcare Power of Attorney

The most recent, high profile ramifications of not having a Living Will were seen with Bobbi Kristina Brown (Whitney Houston’s daughter). Clearly, there is a celebrity lifestyle at play that may not be relevant to your situation, but the family were left with very difficult medical decisions made all the more difficult due to a complex family structure.

Your Living Will (or personal healthcare directive, or Advance Directives) allows you to express the type of care you wish to receive if you are ever in an irreversible terminal condition. Your Healthcare Power of Attorney allows you to name a single person with decision making powers who speaks on your behalf.

In a blended family, when different people have different interests at heart, a single decision make can be an invaluable appointment.

LifeLocker

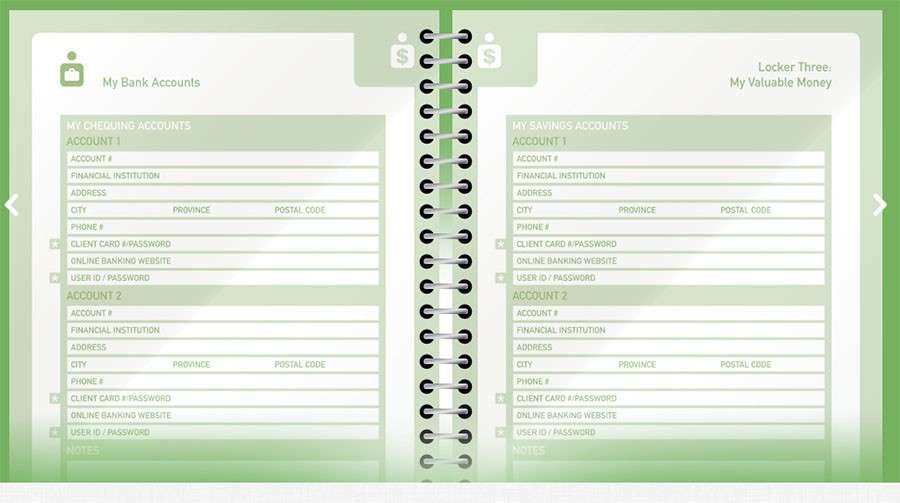

At LegalWills.ca we allow you to create a LifeLocker that lists all of your assets and important personal contacts. It serves as an important resource for your Executor who has the responsibility to gather your assets and distribute them according to the instructions in the Will.

Your LifeLocker will ensure that none of your assets go undiscovered, including digital assets. Your online accounts will need to be managed and possibly closed down. You may have other online accounts and assets like photo storage, blog revenues, domain names, genealogy sites or other online investments that need to be secured by your Executor.

By creating a LifeLocker you can ensure that there are no bank accounts, or sums of money that are lost. You can then grant access to your LifeLocker to named, trusted “keyholders™” who can access the information at the appropriate time.

Wills for Blended families conclusion

We have covered only the simplest Blended Family structure in this article. We have not discussed the added complications of a true Brady Bunch family (sorry, you may have been mis-led by the banner image at the top). When both parents bring children into the same family with estranged spouses, the writing of a Last Will and Testament is even more critical.

We will cover complex Blended families in a follow-up blog article.

Needless to say. If you are living in a family situation where biological or adopted children are from one and only one of the spouses, then write your Will. The whole process will take about 20 minutes, cost about $40 and save months or years of distress for your family.

Tim Hewson is one of the founders of LegalWills.ca.

He has over 20 years of experience helping people to write their Will and other estate planning documents. He has been interviewed by many of the major news media outlets including CTV, Global News, The Toronto Star, and other leading Canadian publications. He has also contributed to a number of financial planning books.

Throughout his career, Tim has written extensively on the subject of Will writing and estate planning.

Latest posts by Tim Hewson

(see all)Like this:

Like Loading...

Related